Bitcoin Bull Market on hold due to crypto correction

Capital flowing into Bitcoin markets has moved a large amount of it back to unrealized profits. Additionally, chain signals are similar to those present in the early stages of a bull market.

In its Week on Chain report on April 24, research firm Glassnode expressed more confidence in a return to bullish market sentiment.

Bitcoin prices are currently correcting from the 2023 high of just below $31,000 on April 14th. However, the asset still has a gain of 66% since the beginning of the year.

“The overall market has safely moved out of an unrealized loss regime and into an unrealized profit regime,” the firm noted.

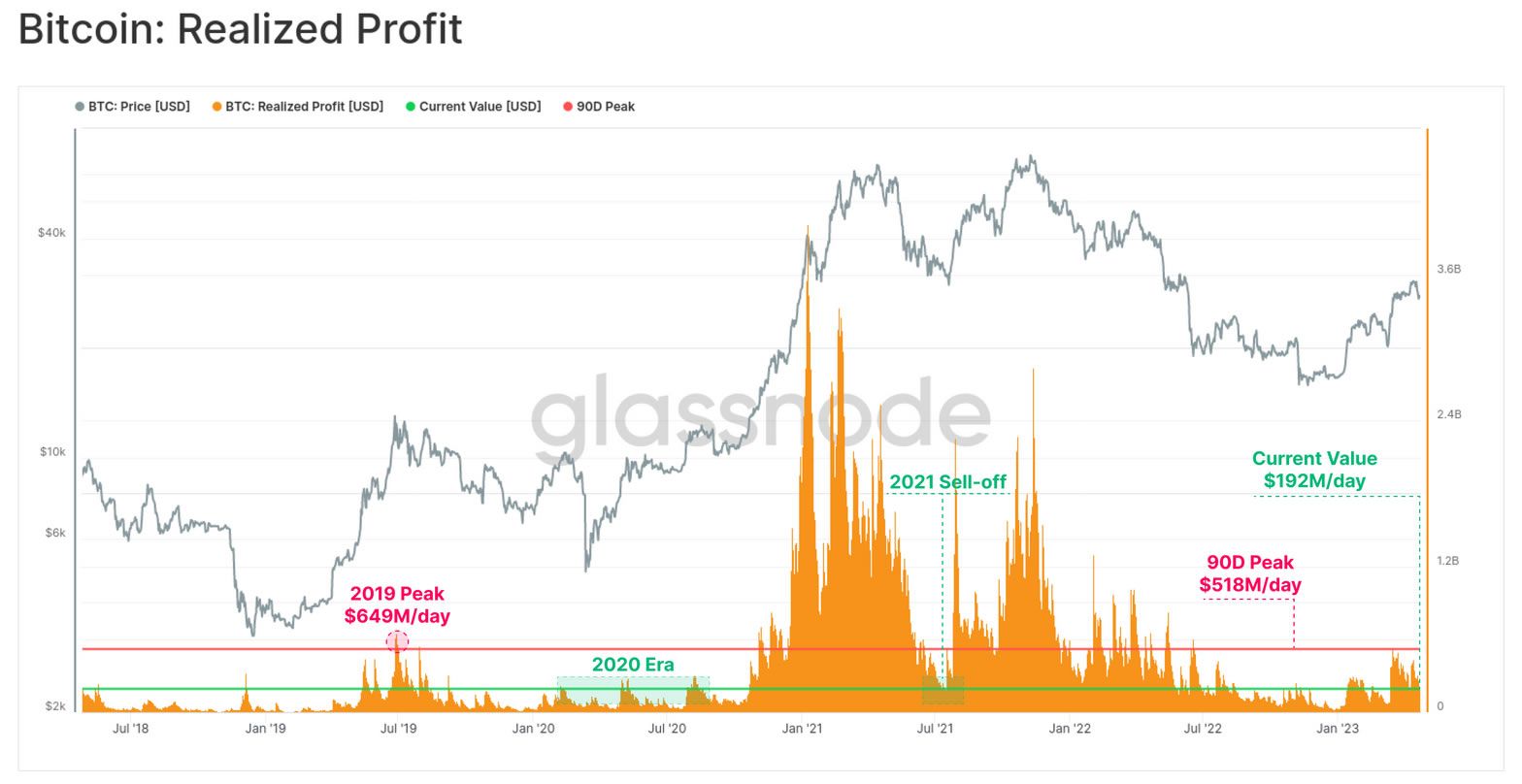

It also noted that the size of USD-denominated profits taken this year remains well below the cycle highs of 2021. It is of the same scale as that observed in 2019 when BTC rose from $4,000 to $14,000.

Realized Bitcoin increases

Furthermore, the report noted that overall losses remain fairly low relative to all major sell-off events throughout 2021 and 2022. The March 2020 Covid crash, Bitcoin miner migration, the Terra/Luna collapse, and the FTX implosion were all major realized loss inducers events.

2023 hasn’t seen anything close to that scale despite the US regulatory war on crypto.

“This suggests that a degree of selling exhaustion has been reached on a macro scale, at least from the lens of large-scale holders locking in significant losses,”

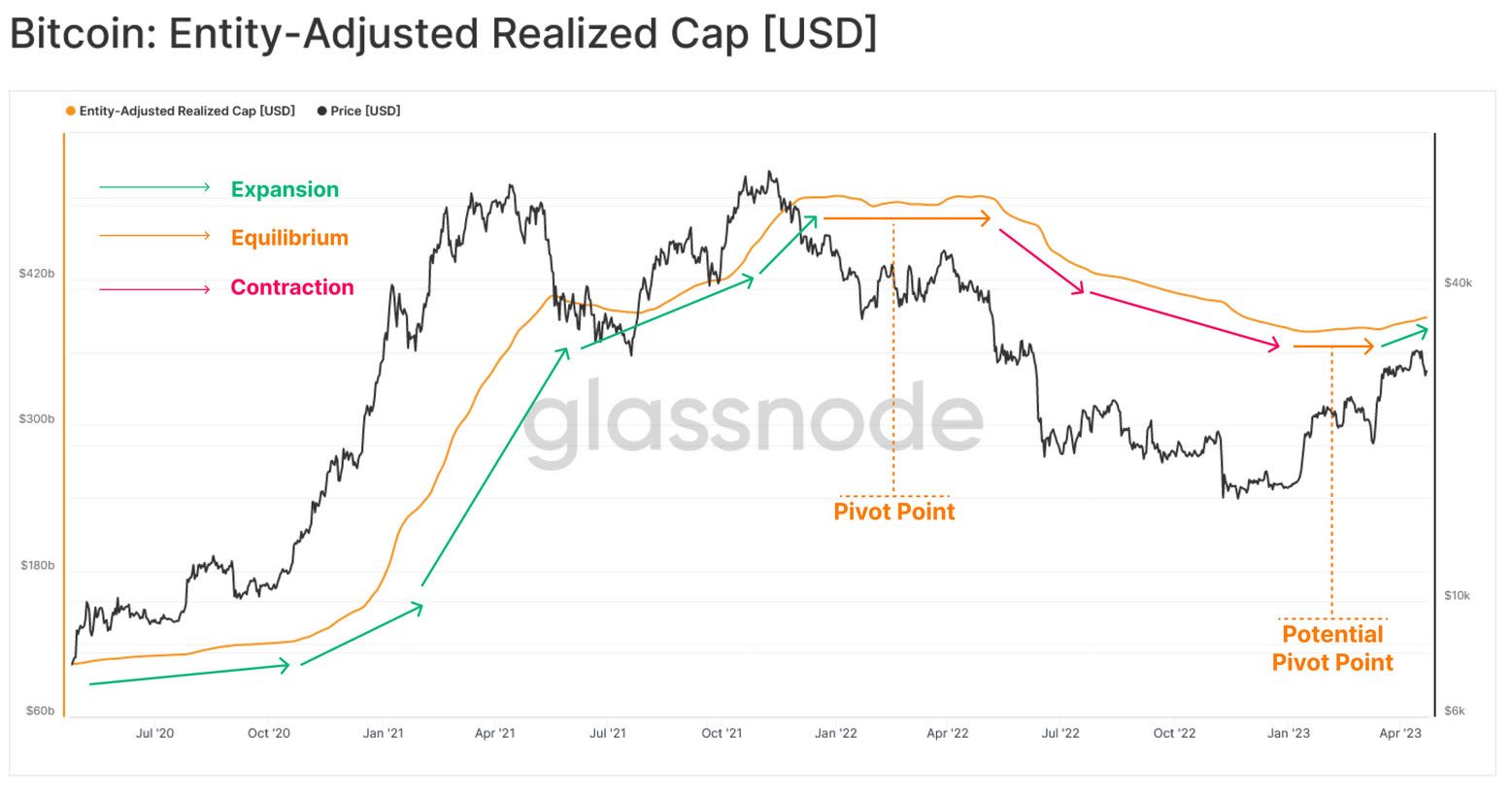

Realized limit values are the cumulative sum of all realized gain and loss events. This has stabilized from the massive outflows in 2022 and has gone through a potential turning point, according to Glassnode.

In the wake of solid Bitcoin price performance this year, a very large cross-section of the market is seeing its holdings recover above their acquisition price. This “creates a more favorable and profitable environment,” the report concluded.

BTC Bulls are not ready to run yet

However, an inevitable market correction has begun and prices are on the retreat again. Glassnode stated that this suggests that there is still indecision among investors in digital assets, so a bull market may take a while yet.

“With accumulation and distribution behavior across multiple wallet cohorts mixed at the moment, the market appears less decisive than it has been in the first quarter of the year.”

Bitcoin is currently trading down 1% on the day. As a result, the asset changed hands for $27,443 at the time of writing.

Furthermore, it has entered a short-term range-bound channel for the past three days at this price level where there is support.

The next leg down finds more support around $25,000 if the correction deepens.

Disclaimer

In line with Trust Project guidelines, this price analysis article is intended for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, objective reporting, but market conditions are subject to change without notice. Always do your own research and consult with a professional before making any financial decisions.