Bitcoin [BTC] Yes, the supply of exchanges is at a 4-year low, but there is more

During intraday trading on October 18, the leading coin was Bitcoin [BTC]registered an increase in activity across various exchanges, data from Sentiment knew.

According to the blockchain analytics platform, BTC saw a significant increase in the number of coins taken by exchanges and a continued decline in the asset’s supply on exchanges.

On October 18th, with a daily amount of 40,572 BTC, the royal coin recorded its largest net flow of coins away from exchanges since June 18th. In addition, the leading coin’s supply on exchanges fell to a 4-year low of 8.48% on the same day.

👌 #Bitcoin saw a massive wave of coins moving off the exchanges yesterday, the largest daily amount (40,572 $BTC) in 4 months. The supply of coins on exchanges is down to 8.48%. When the supply of exchanges decreases, it reduces the chances of future sales. pic.twitter.com/OKtdS6RUJY

— Santiment (@santimentfeed) 19 October 2022

Generally, a decrease in an asset’s supply on exchanges indicates a drop in selling pressure. Also confirmed by Santiment, “as the supply of exchanges decreases, it reduces the chances of a future sale.”

What do other metrics tell us about the possible price direction of the leading asset in the near term?

Know this and know peace

More often than not, the intensity of the whaling determines the direction an asset price will go. As for BTC, holders of various amounts of the coin have increased their holdings in recent months, Santiment data showed.

Since April, the number of whales holding 10 to 100 BTC has increased by 3%. For holders of 100 to 1,000 BTC and 10,000 to 100,000 BTC, the numbers have also increased by 0.2% and 16% respectively in the same period.

A continued rise in these indices can help push up the price of the leading coin.

Source: Sentiment

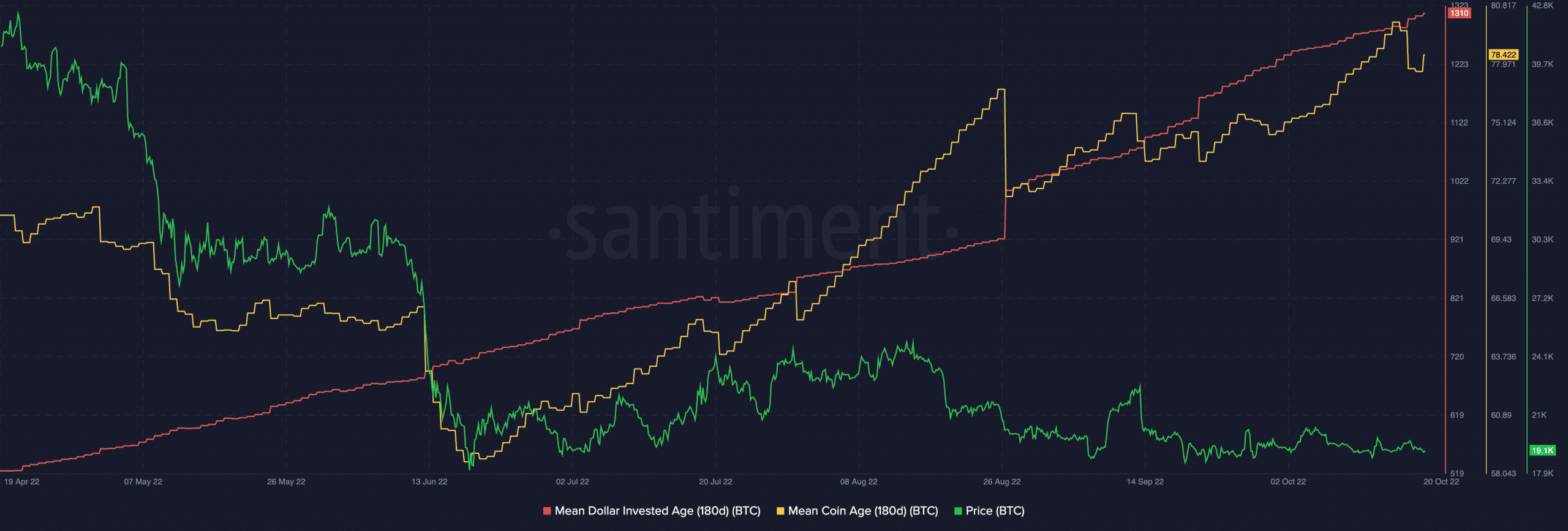

For a sustainable price increase to happen, the BTC lying dormant in wallet addresses needs to see some action. A look at the asset’s average coin age calculation showed that older coins have not been able to change hands for some time.

On a 180-day moving average, BTC’s average coin age was in an uptrend at 78.422. To see any major growth in price, this calculation must take a downward trend, as this will mean increased movement of BTC between addresses.

This position was confirmed by a 180-day moving average assessment of BTC’s Mean Dollar Invested Age (MDIA). At the time of writing, this was also in an uptrend at 1310.

A continuous upward movement indicates some stagnation on the BTC network; Therefore, any major price movement can be difficult.

Source: Sentiment

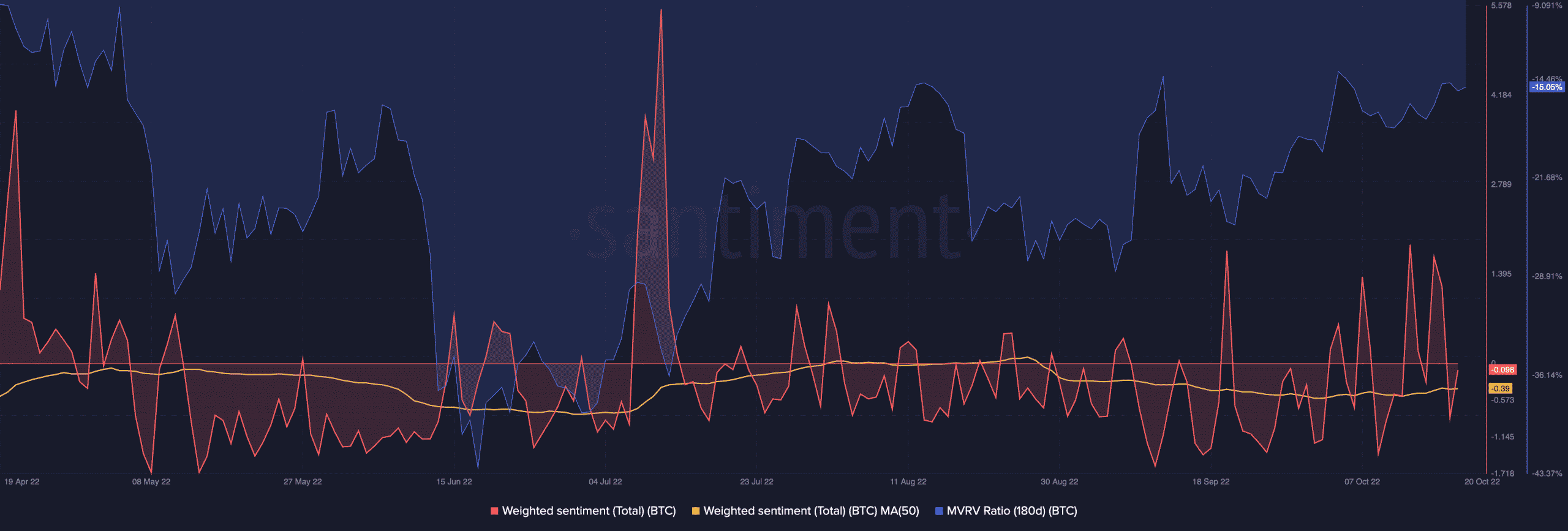

It is also relevant to point out that due to the persistent decline in BTC’s price in recent months, several holders have counted losses on their investments, data from Santiment showed.

An assessment of BTC’s MVRV on a 180-day moving average confirmed this. At press time, the metric was at -15.5%.

Before you make your next trade, note that a negative bias against the asset has persisted over the past few months and may have something to say about where the price goes next.

Source: Sentiment