Bitcoin (BTC) set to outperform gold, according to top Bloomberg analyst – here’s why

Bitcoin (BTC) is likely poised to outperform gold, according to Bloomberg Chief Commodity Strategist Mike McGlone.

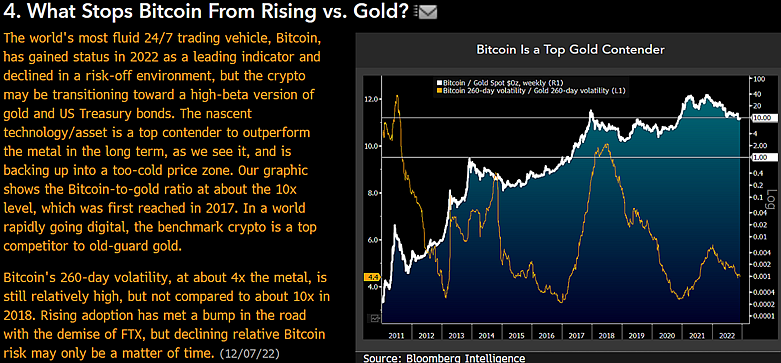

The popular analyst says the flagship cryptocurrency is currently four times more volatile than the yellow metal, which is minimal compared to where it was in 2018.

According to McGlone, Bitcoin is a “top competitor” to gold and could move to a higher beta version of it and bonds.

“What’s Stopping Bitcoin from Rising vs. Gold? The world’s most liquid 24/7 trading vehicle, Bitcoin, has gained status in 2022 as a leading indicator and fell in a risk-off environment, but the crypto may move to a high-beta version of gold and the US Treasury.”

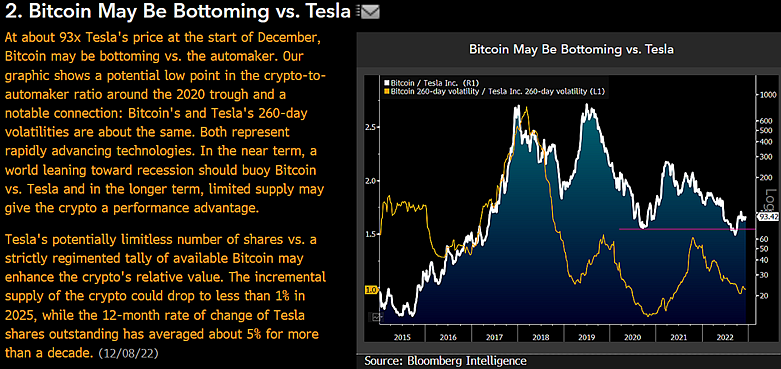

The strategist also compares BTC to Tesla shares, as the two assets are often grouped together by analysts as similar plays on innovative technology.

According to McGlone, Bitcoin’s price relative to TSLA may be about to form a bottom.

“Bitcoin could be the bottom vs. Tesla – At roughly 93 times Tesla’s price in early December, Bitcoin may be bottoming out against the automaker. The graphic shows a potentially low ratio of crypto-to-automakers around the bottom in 2020 and a remarkable correlation: risk measures about the same.”

The closely followed commodity strategist has previously called for next year to be Bitcoin and the crypto market’s time to shine after over a year of straight downtrends.

“The most aggressive Fed tightening in 40 years is a good reason for the macroeconomic ebbing tide, but 2023 may be about which assets come out ahead as central banks swing. If they don’t turn to easing, the world could tip deeper into recession, with consequences for all risk assets. Our base case is for a prolonged period of deflation, with the crypto market, as measured by the Bloomberg Galaxy Crypto Index, coming out ahead.”

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/Alberto Andrei Rosu/PurpleRender