Bitcoin (BTC) price starts massive rally

After a strong bullish week, the Bitcoin (BTC) price has cleared a crucial resistance level that could trigger another rally.

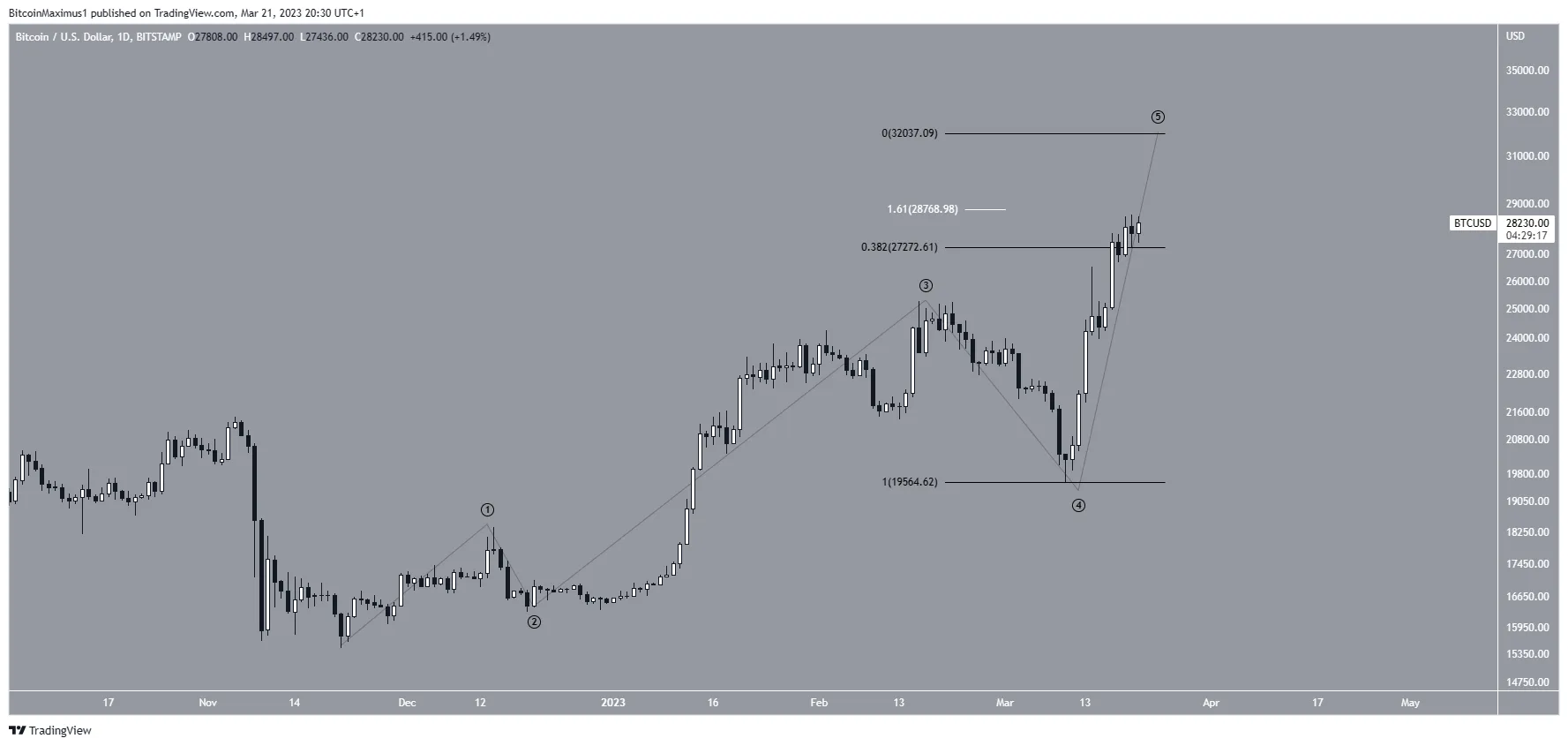

The daily chart for BTC shows that the price has increased since March 10, when it reached a low of $19,569 (green icon). The increase since then has been parabolic, leading to a new annual high of $28,567. The high was made exactly at the 1.61 external Fib of the last drop, which is an appropriate level for a top.

However, the daily RSI remains bullish, showing no signs of weakness. The indicator broke out from its bearish divergence trendline and is still rising.

Top of movement or beginning of massive rally?

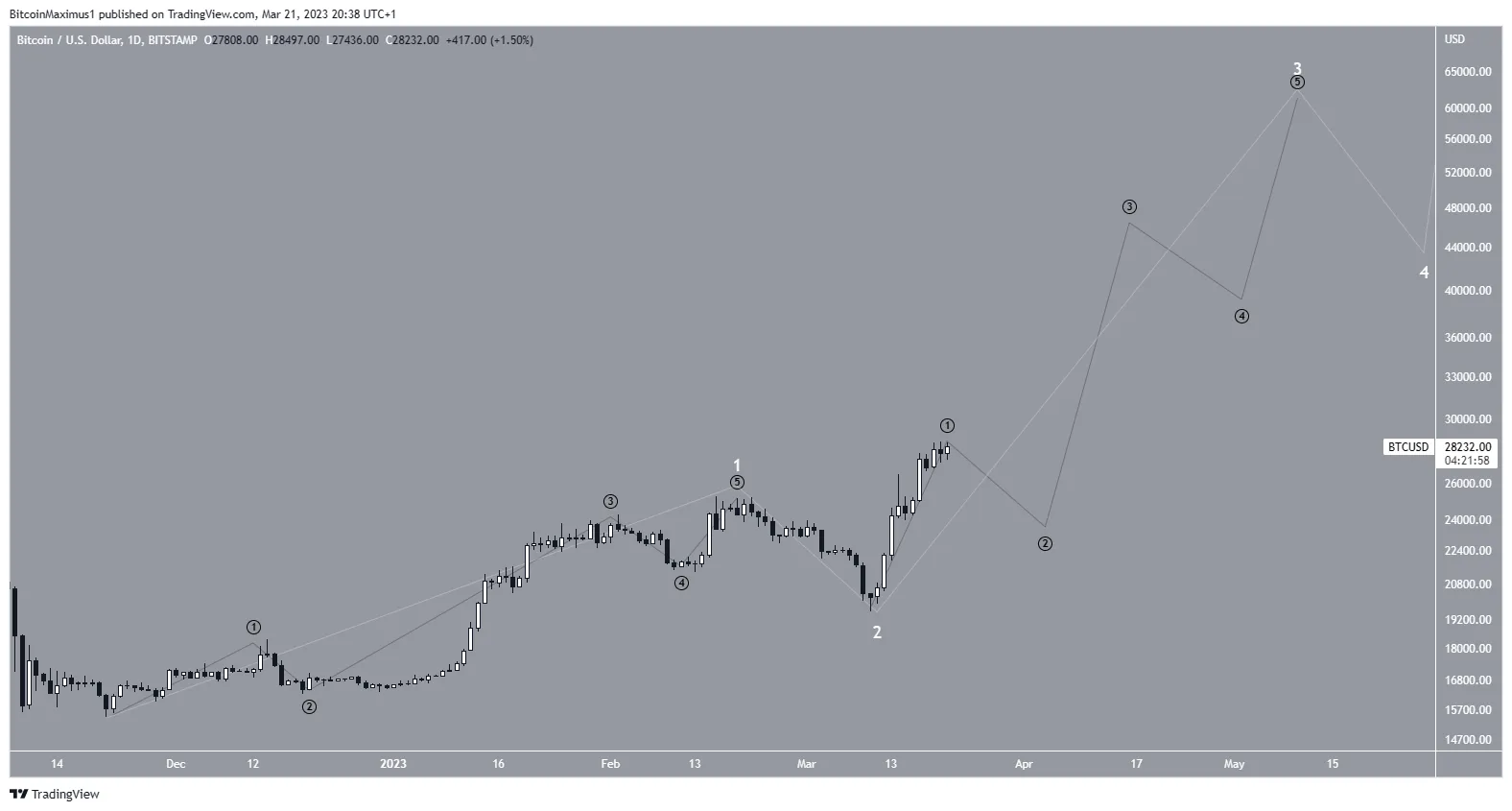

There are two potential wave counts for the future Bitcoin trend. The first suggests that the price is in the fifth and final wave of an increase. In addition to the previously outlined 1.61 external Fib level (white), the next key resistance is at $32,000, giving wave five the same length as waves 1 and 3 combined. If this is the correct count, a significant drop will occur afterwards.

The second count is much more bullish. It indicates that the price has just begun a long-term wave three (white), which could take BTC towards a new all-time high. The number of sub-waves is given in black and suggests that the price is approaching the top of sub-wave 1.

Since the BTC price is likely to peak soon, the shape of the decline will be crucial in determining the future trend.

Bitcoin (BTC) Weekly outlook is decidedly positive

The weekly time frame Bitcoin price chart shows that the price had fallen below a descending resistance line since reaching an all-time high of $69,000 in November 2021. The downward movement culminated with a low of $15,476 in November of the following year.

The price action since then has been decidedly bullish, boding well for the future outlook for peer-to-peer blockchain technology.

First, BTC price retook the $18,700 support area and then broke out from the descending resistance line.

During the week of March 6-13, BTC price created a very long lower wick, validating the line as support (green icon). It followed up with a bullish engulfing candlestick that caused a breakout above the $24,700 resistance area. The candlestick represented a weekly gain of 26%, the highest gain since December 2020 (red icon). The area is now expected to provide support.

The weekly RSI readings are also bullish. The indicator broke out from its bearish divergence trend line (black line) and moved above 50. This came after a long period of bullish divergence.

As a result, the weekly readings from both the price action and technical indicators are decidedly bullish.

If the rise continues, the next resistance area will be at $35,680, created by the 0.382 Fib retracement resistance level (white). On the other hand, a close below $24,700 could catalyze a drop to $18,700.

To conclude, the most likely Bitcoin price forecast is a rise towards at least $35,800 and possibly higher. A weekly close below $24,700 would invalidate this bearish outlook. If that happens, it could catalyze a drop towards $18,700.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for missing facts or inaccurate information. You comply and understand that you should use this information at your own risk. Cryptocurrencies are highly volatile financial assets, so do your research and make your own financial decisions.