Bitcoin (BTC): Lower price likely due to damage from Fed rate hikes

main pictures

The question

Is the bottom in? Is it safe to start buying Bitcoin (BTC-USD) now?

I see a lot of analyst speculation on whether the “Enron and Lehman Brothers” era of crypto is over with Alameda / FTX (FTT-USD) debacle, or the series of failures and bankruptcies will continue.

But even if the crypto contagion is limited and the market stabilizes, there is a greater looming threat from the traditional financial markets. If we see another financial crisis in the next year, all liquid assets – including Bitcoin – will quickly sell out, just like the pandemic panic event of March 2020.

First, is Bitcoin going to die?

I’ve been a Bitcoin fan since 2013. It’s a brilliant collection of cutting-edge technology that enables secure payment transfers without the need for an intermediary. From its origins as a white paper concept, and through many major price crashes and recoveries, Bitcoin has been a fascinating story.

Fun fact: my first Bitcoin article for this publication was submitted in March 2014, but was rejected because at the time it was a niche topic and there was no noticeable effect on any traditional stocks. This was well before Grayscale launched their Bitcoin Trust product (OTC:GBTC) in 2015.

We are seeing a lot of negative press with critics again making claims that Bitcoin will go to zero. This is nothing new. Mainstream media has declared Bitcoin dead 466 times between 2009 and 2022, including 21 times in 2022 alone. On average, this happens about 36 times each year.

The European Central Bank recently felt the need to write its own obituary of Bitcoin, dismissing any price stabilization as a “last gasp before the road to irrelevance” and publishing the misinformation that it is “rarely used for legitimate transactions.” Jake Chervinsky, General Counsel, Compound Labs, has responded to similar claims by Treasury Secretary Janet Yellen:

“It is disappointing to hear Dr. Yellen repeat the erroneous view that crypto is used mainly for illegal activities. Her statement is demonstrably false… That said, it is important to remember that crypto is a relatively small problem compared to everything else Treasury is responsible for, so she probably hasn’t spent time considering it deeply yet.”

Financial processing has always required a clearinghouse, a trusted third-party centralized system to verify transaction validity. Banks clear checks, credit card companies approve, clear and settle transactions. But Bitcoin allows direct payment securely on a peer-to-peer basis, without the need for an intermediary. For the first time in human history, this protocol enabled a method of decentralized, distributed trust.

Central banks like the ECB want to maintain the status quo using gatekeeping technology and innovation. They believe they are the anointed elite to run financial systems and nothing should exist outside of their authorization and control. Bitcoin threatens this. This was described in my previous article, The Financial Elite: Bitcoin Bad, CBDCs Good, Stablecoins Meh.

But governments and central banks can make it difficult to own Bitcoin through heavy-handed regulation or outright bans. But when China banned mining last year, operators simply migrated to friendlier countries. Unless all governments simultaneously criminalize it, an event with a very low probability, it will certainly live on.

The current crypto environment

In the early days of Bitcoin and Ethereum (ETH-USD), there was no way to leverage digital assets. Over time this changed until the industry was full of CeFi lenders re-hypothecating customer deposits and making incredibly poor risk management decisions. An example of this is Voyager Digital (OTCPK:VYGVQ), which offered a $650 million unsecured loan to Three Arrows Capital, apparently with little or no due diligence on their operations. As it turns out, Three Arrows was upside down on investments including GBTC.

In this way, the crypto industry imitated TradFi and produced its own version of the Great Financial Crisis of 2007-2008. But instead of the collapse of the housing bubble as a catalyst, crypto dry tinder was provided by the price decline of GBTC and the fire started with the crash of the algorithmic stablecoin Terra (UST-USD) and its companion token (LUNC-USD). I wrote more about it in my article, USD Coin Stablecoin Interest Update: CeFi Implosion.

Many crypto institutions were likely insolvent by early 2022, but continued to gamble in the misplaced hope that they could recoup their losses. This led to the further questionable decision to park funds on Anchor Protocol because it promised 19.5% returns for Terra stablecoin deposits. When UST and LUNA crashed in May, institutions not only lost much-needed interest payments, but were left with huge holes in their balance sheets.

Bottom line, the companies now filing for bankruptcy – Three Arrows, Voyager, BlockFi and Celsius (CEL-USD) – are all guilty of failing to assess the risk of counterparties such as FTX and Alameda. This is not a problem with Bitcoin, it is a case of the worst aspects of the TradFi system infecting the marketplace. As Senator Pat Toomey has said, “The Code committed no crime” (I can’t provide the reference as SA doesn’t allow YouTube links, but check out his podcast with Bankless). BTC is not responsible for poor risk management and fraud. As painful as these washouts have been, Bitcoin’s value proposition has not been broken, and the industry will ultimately be stronger going forward.

How to avoid future scams and scams

FTX’s Sam Bankman-Fried was almost universally hailed as a genius. Zhu Su and Kyle Davies of Three Arrows Capital were considered the smartest people in any room. They all used their reputations to avoid difficult inquiries into the company’s balance sheets.

Alex Mashinsky often declared that customers’ money was safer with Celsius than with traditional banks. In contrast, Vermont officials recently claimed that Celsius had been insolvent since early 2019.

Some industry experts and analysts saw the suspicious actions of these actors, but unfortunately, few said anything about it. Many podcasters and You Tubers were paid to promote Celsius, Voyager, BlockFi and FTX. Other prominent voices in the industry who secretly suspected the worst were cowed into silence by the implied threat of being blackballed.

This begs the question, where can we find honest comments going forward? Who will alert us to the next set of scams? Here are the best sources for unvarnished interrogation of the industry that I have found.

Cory Klippsten is the CEO of Bitcoin-centric firm Swan.com and was a staunch critic of both LUNA and Celsius before their collapse.

Dirty Bubble Media is the alias of a researcher who predicted the problems with both Celsius and FTX. Be aware that he is extremely critical of all things crypto, so be prepared to have your basic assumptions challenged.

Stephen Findeisen, aka Coffeezilla, is a YouTuber who exposes crypto scams. Lately he has been very active investigating FTX and Sam Bankman-Fried.

Finally, FatManTerra is a researcher primarily known for documenting events with Terra. He also calls out other bad actors in the room.

Any other sources you’ve found valuable in separating the wheat from the chaff in crypto? Let me know in the comments.

The macroeconomic environment

While the crypto contagion is not contained and the fate of Genesis Global and Gemini is yet to be determined, there is another large set of potential challenges. Make no mistake, Bitcoin is still very much tied to the macroeconomic conditions. If the market panics again like it did in early 2020, all liquid assets including Bitcoin could quickly sell out.

March 2020 Bitcoin Crash (Coingecko)

The next 12 months could be precarious as the Federal Reserve slams on the brakes by raising interest rates for the sixth time in a row this year. The Fed looks set to continue this policy until inflation demonstrably slows or something breaks. Which market vulnerabilities can be exposed?

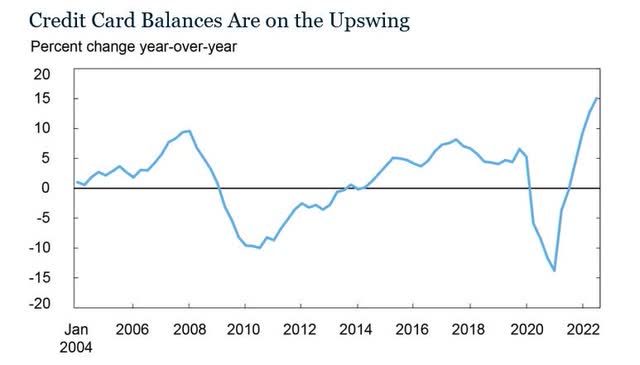

There are some troubling economic indicators starting to emerge. In the most recent quarter ending in September, total consumer credit card balances rose 15%, the largest year-over-year increase in more than 20 years.

New York Fed Consumer Credit Panel / Equifax

As inflation increases the cost of basic goods and services, more Americans are forced to use credit cards only for necessities. Even worse, when interest rates go up, so do credit card rates. A credit card at a retailer recently notified me that the APR increased to 29.99%! About 12% of consumers missed a credit card payment this year.

Although 37% say they forgot to make a payment, others cited the following reasons for not paying:

Had to pay for food or groceries (31%) Had to pay utility bills (29%) Had to prioritize other forms of debt (26%) Had to pay for an emergency (26%) Had to pay rent or mortgage (25%) Didn’t have enough income to to make the payment (24%)

Total household debt has reached $16.51 trillion in the third quarter of 2022, as reported by the Federal Reserve Bank of New York.

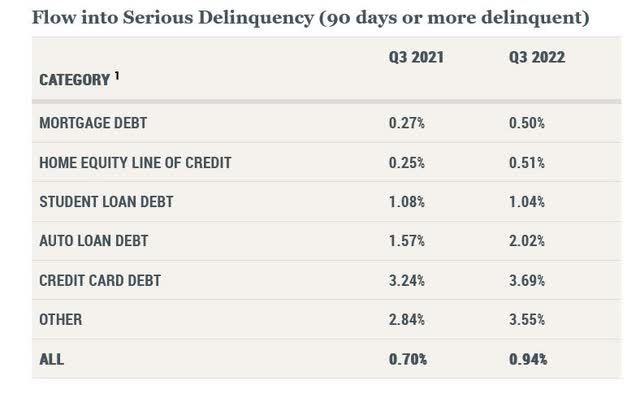

Federal Reserve Bank of New York’s Center for Microeconomic Data

All categories showed increases except student loan debt; Probably due to released debt from some loan forgiveness programs.

Federal Reserve Bank of New York’s Center for Microeconomic Data

Serious delays ticked up across the board except for student loans, which are still on repayment pause. But what happens when households with already stretched budgets have to start paying these loans again?

US Bureau of Economic Analysis

The personal savings rate, which looked good during the pandemic, has fallen off a cliff in the past year. Reducing savings and increasing debt is a problematic combination.

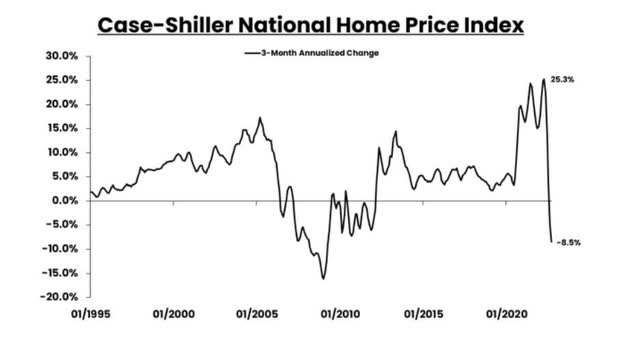

The housing market deserves an article of its own, but suffice it to say that the price bubble is starting to burst. For the quarter that ended in September, house prices fell at an 8.5% annual rate. New mortgage applications are also down 46% since this time last year.

Case-Shiller, EPB Research

Conclusion

So what will break the economy? Where is the hidden fragility? Black Swan events are impossible to predict, but in retrospect we can piece together what led to the great financial crisis of 2007-08. The pattern is familiar, excessive risk-taking by global financial institutions and the bursting of the US housing bubble.

The crypto industry was also absolutely guilty of excessive and horrible risk taking. That combined with the decline in the GBTC premium and the demise of the Terra LUNA ecosystem led to the overall institutional failures. The collapse of FTX and Alameda could lead to even more bankruptcies.

The problem with both crypto and TradFi is that risky investments and fraud are often hidden in good times. As Warren Buffett famously said, “Only when the tide goes out do you discover who has been swimming naked.” We need to challenge our assumptions and listen to those who raise concerns.

For me Bitcoin is a long term blue chip crypto asset to hold. However, over the next 12 months, the cautious investor needs to be alert and prepared for a further leg down due to selling pressure from the traditional financial crisis currently under investigation behind the scenes. So have we seen the bottom for Bitcoin yet? In my opinion, there is good reason to believe that we have not.