Bitcoin [BTC] bounces above the 50-day MA, but what can LTH expect?

- An increase in BTC demand in the spot market was observed in the last 24 hours at press time.

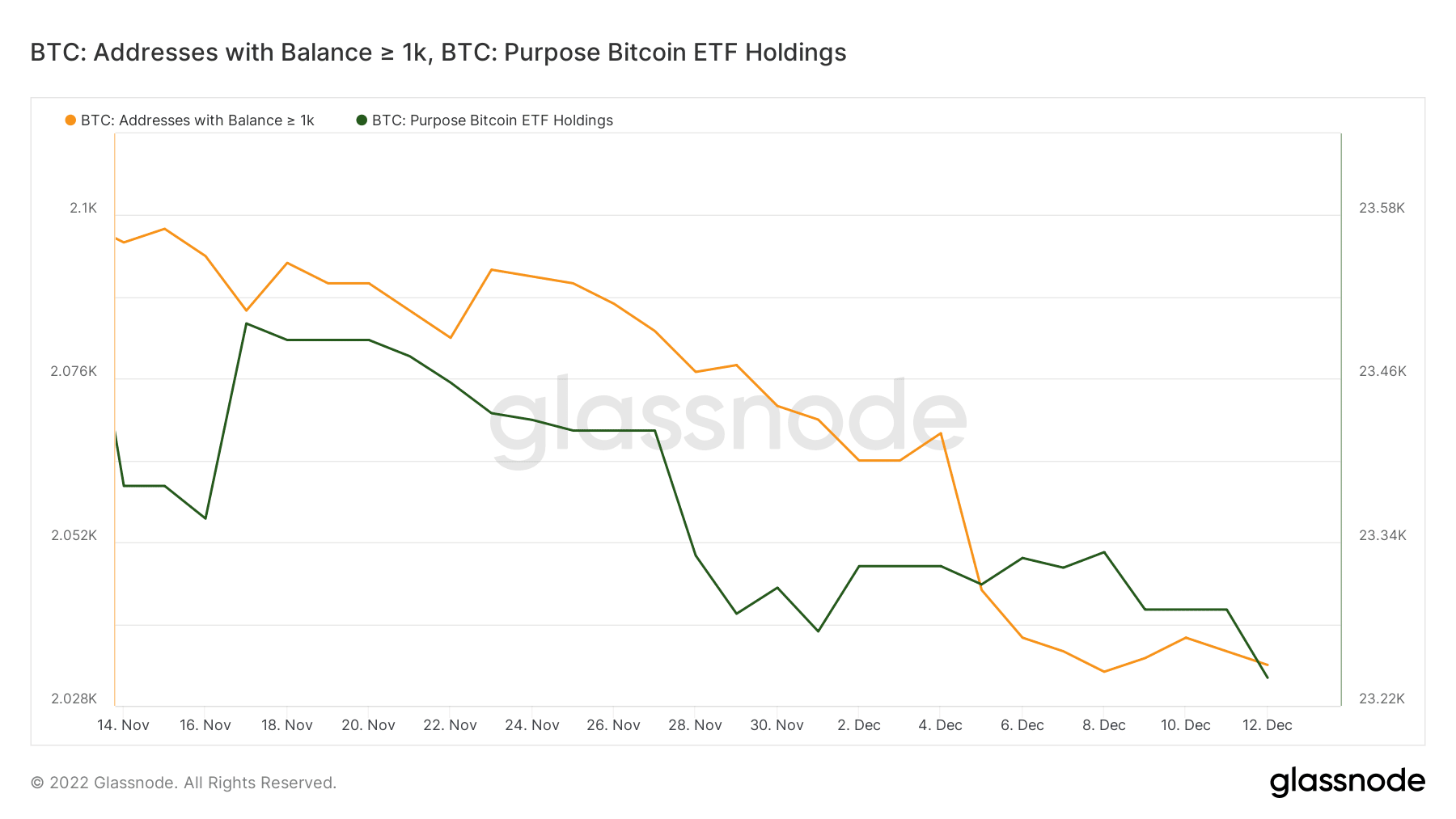

- Addresses with balances greater than 1000 BTC have not yet started to accumulate.

An interesting thing just happened with Bitcoin’s price action. It managed to rally 5% in the last hours before this press, pushing briefly above its 50-day moving average. This move happened right after the release of US CPI data, and here’s why.

Read Bitcoins [BTC] Price prediction 2023-2024

The reason for Bitcoin’s rally over the past 24 hours is the same reason why it has been on a bearish path for most of 2022. Inflation has been on the rise and the Federal Reserve has been raising interest rates in an attempt to curb it. Higher prices have resulted in a tough investment environment and liquidation of investment funds.

CPI: 7.15 vs. 7.3 Exp.

This is the first part of what we expected this week.

Tomorrow Powell increases by 0.5% instead of 0.75%!— Ran Neuner (@cryptomanran) 13 December 2022

The latest consumer price index (CPI) data came in at 7.15. This is lower than the consensus estimate of 7.3, and thus the final figure has exceeded investors’ expectations.

More importantly, it means inflation is finally coming down. This result means that the FED’s fight against inflation is yielding positive results. It also means that the investment landscape is improving, which is why the CPI report encouraged some accumulation.

Should investors expect more upside?

All eyes are now on the Federal Reserve which is expected to make an interest rate decision in the next few hours. There may be more hope for Bitcoin bulls if the FED raises rates by 50 BPS, instead of 70 BPS.

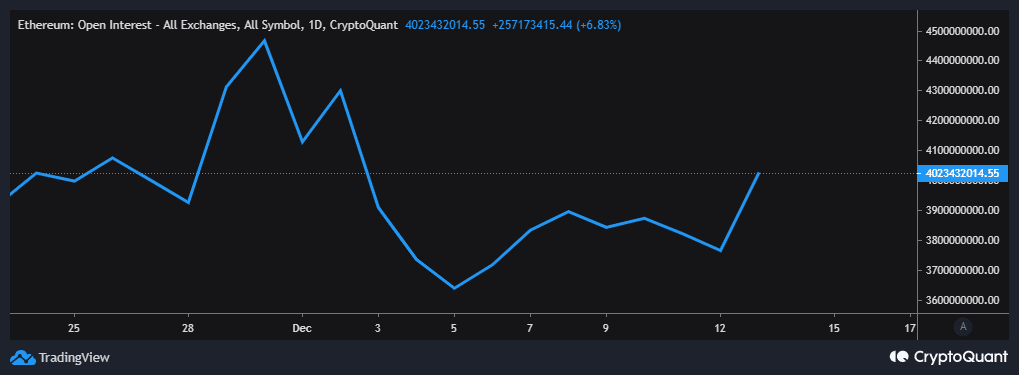

Meanwhile, on-chain metrics are already looking pretty favorable. The last 24 hours were marked by an increase in Bitcoin’s open interest, suggesting that demand for BTC in the derivatives market has increased.

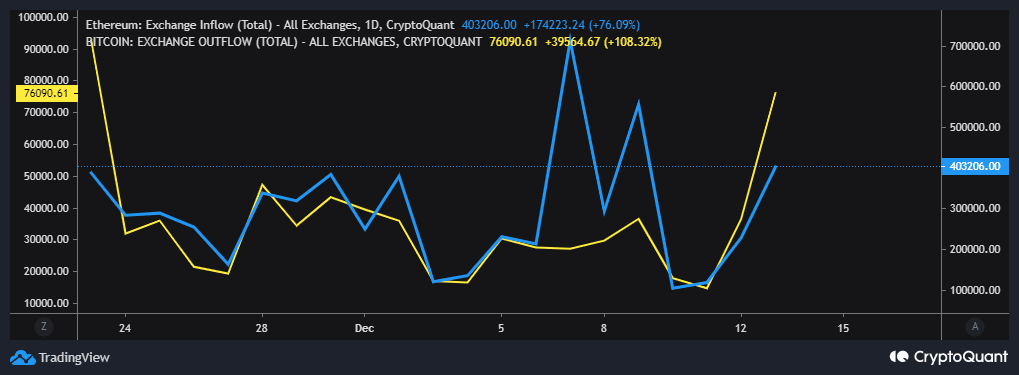

An increase in demand for Bitcoin in the spot market was also observed in the last 24 hours at press time. This is reflected in Bitcoin exchange which was almost double the exchange supply at the time of writing.

Source: CryptoQuant

But we need to evaluate whales and institutional demand to determine if Bitcoin can maintain the same momentum.

The Purpose Bitcoin ETF holdings continued to trim their balances and had not yet begun to accumulate. This is despite an improved BTC outlook over the past 24 hours. The calculation represents institutional demand which currently suggests that it is not quite there.

As for whale demand, addresses with balances greater than 1000 BTC have also not started to accumulate. This could be a sign that the recent upside will be limited as institutional and whale demand is absent.

The next 24 hours should be quite interesting due to the upcoming rate revision.