Bitcoin (BTC) Blinks With Weak Hand Capitulation, Holds Steady Amid Market Fall: Analytics Firm Santiment

A leading digital asset analysis company says a reliable technical indicator suggests that weak hands have already left the crypto markets.

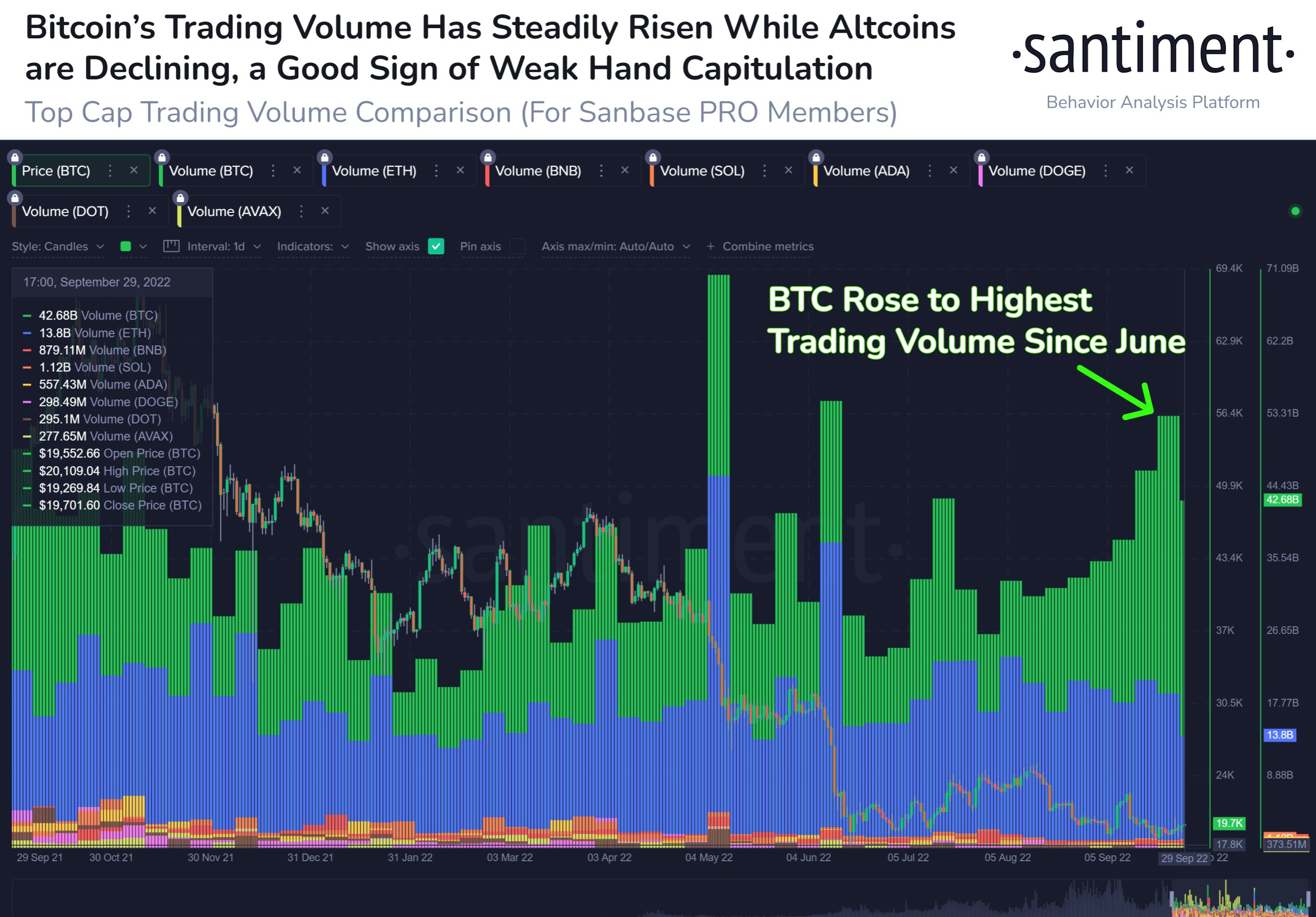

Santiment says it is keeping a close eye on Bitcoin’s (BTC) volume, which the firm says has been in an uptrend since June when the crypto king pushed its current bear market low.

According to the research firm, the increase in Bitcoin’s volume at the expense of trading activity in altcoins indicates that crypto-tourists have been washed out of the markets.

“Bitcoin’s trading volume has risen steadily since mid-June, while other top cap assets are declining. Trader interest is beginning to return to relative safe haven assets like BTC, while the rest of the markets have less trading interest.”

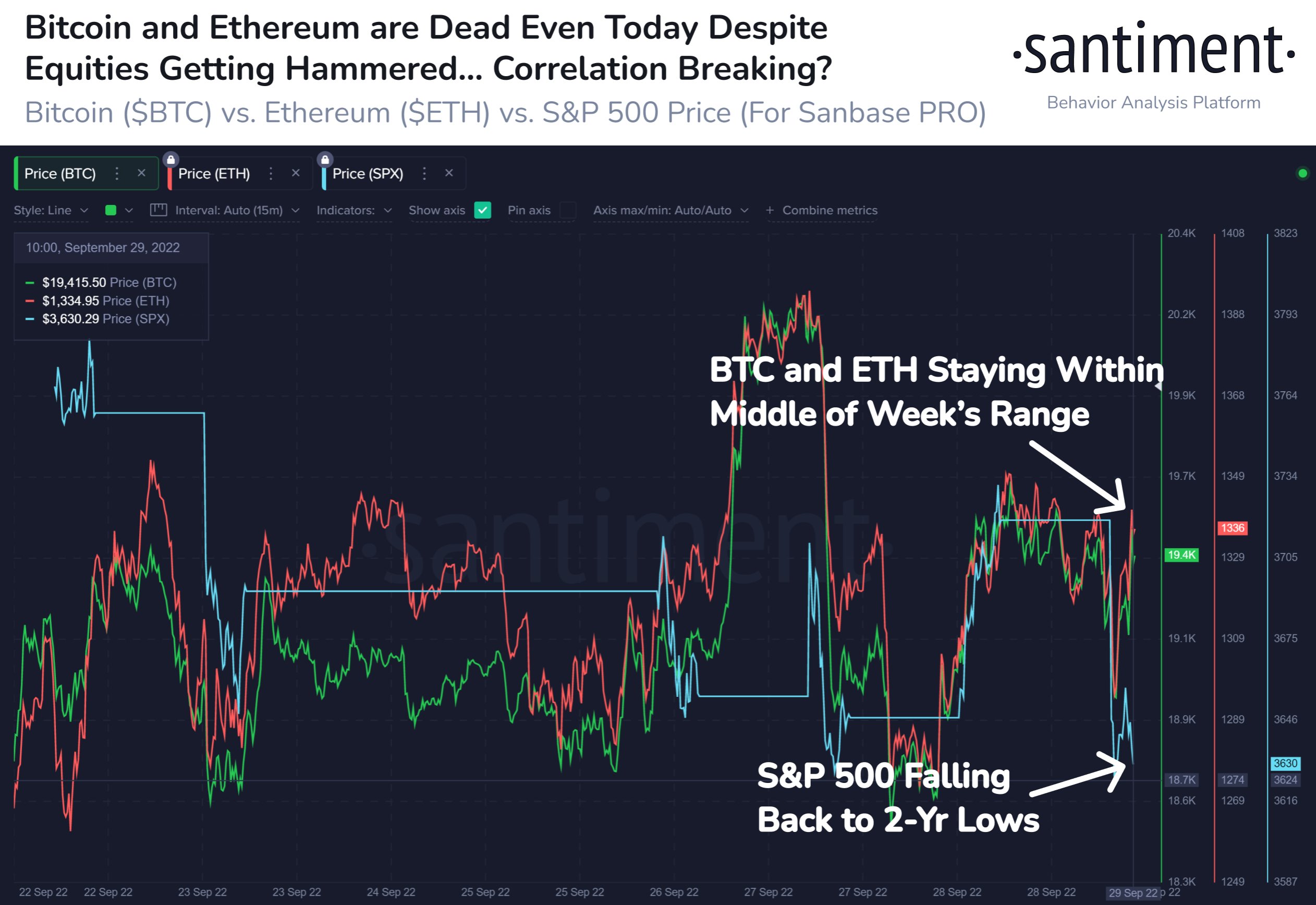

Santiment also highlights that BTC’s increasing volume comes as Bitcoin continues to show strength in the face of heavy selling in the stock market.

“Bitcoin has stayed around $19,000 and Ethereum at $1,340 today. But the story is the fact that they are doing so without the support of the S&P 500, which is down 2.4%. If the correlation is decreasing between crypto and stocks, this is very encouraging.”

Popular crypto strategist Rager also notes the difference in the short-term price action of Bitcoin and the S&P 500 (SPX). Rage tracks Bitcoin will rally when the stock market shows signs of life.

“If you want to be encouraged, just compare the SPX and BTC charts.

Since September 22, the stock index has declined, while Bitcoin, although choppy, has held a relatively sideways position.

You better believe Bitcoin will have a strong reaction when the stock market reverses.”

At the time of writing, BTC is trading hands at $19,333, up over 4% over the past seven days, while the S&P 500 is down more than 2% over the same time frame.

Don’t Miss a Beat – Subscribe to get crypto email alerts delivered straight to your inbox

Check price action

Follow us on TwitterFacebook and Telegram

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Daily Hodl are not investment advice. Investors should do their due diligence before making high-risk investments in Bitcoin, cryptocurrency or digital assets. Please note that your transfers and trades are at your own risk and any losses you incur are your responsibility. The Daily Hodl does not recommend the purchase or sale of cryptocurrencies or digital assets, nor is The Daily Hodl an investment advisor. Please note that The Daily Hodl participates in affiliate marketing.

Featured image: Shutterstock/vvaldmann/Andy Chipus