Bitcoin Benefits From Banking Sector Fallout (BTC-USD)

Vitaly Sova

Main task and background

The purpose of this article is to discuss the broader market and its implications for Bitcoin (BTC-USD) and other cryptocurrencies by extension. This is timely because, as readers are probably aware, this has been a challenge a few weeks for the wider market. The biggest concern comes from SVB’s failure and subsequent risk of contagion to other banks and the global banking sector. Yet, over the same time period, the price of Bitcoin has risen:

1-week move (Bitcoin) (Coinbase)

Looks great right? Probably time to jump right in and ride this wave?

Well, before you do, consider that a 1-week snapshot doesn’t tell the whole story. While this price action is undoubtedly great for owners of the asset, consider its performance over the past year. Not too pretty:

1 Year Draw (Bitcoin) (Coinbase)

This can be difficult to understand. It certainly is for me, to a certain extent. So for this review I decided to dig into what’s going on with the market, how BTC is reacting, and why I don’t see the recent gains as sustainable. I see an argument for further gains here, but only for those who are truly risk-averse and willing to take some profit when it appears. Longer term, I think sentiment will balance out as sentiment and confidence in the US banking system is likely to rise again over time.

Bank failures and then federal aid catalysts for gains

For starters, I’ll focus on the biggest story for the market — crypto, stocks, bonds, or otherwise — right now. There is certainly the failure of Silicon Valley Bank and Signature Bank, followed by the general sell-off of the banking sector for fear that more banks may follow suit. This negatively affected crypto in the beginning as well, as these banks were lenders to the industry.

However, I see the general fear among consumers and the decline in trust in banks as a whole as a potential cause Why BTC has rallied. This may sound counterintuitive, but that’s what I meant by the title of my article. When people lose faith in “the system” – by which I mean the US banking and financial system – it can provide justification for owning non-traditional assets such as cryptocurrencies (Bitcoin or otherwise).

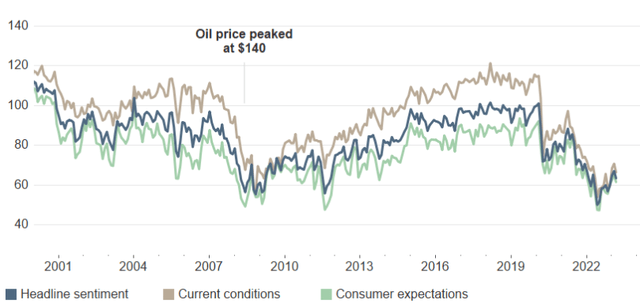

To understand how real this decline in sentiment is, let’s look at the University of Michigan’s Consumer Confidence Index. While this doesn’t just consider banking, it speaks to the general mood of the public that has been hammered by these bank failures:

Consumer Sentiment Levels (Monthly) (U of Michigan)

What I’m getting at here is that as the public begins to lose faith in the banks and the regulatory environment as a whole, it begins to lend credence to the currency skeptics that crypto relies on. My point is that when consumers get anxious it can work in two ways. One is that they flee to safety, a normal action in my mind.

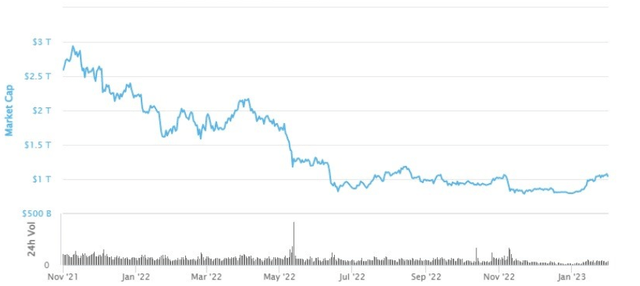

But over the past few years, there has been another option for people who have lost faith in the USD and other popular currencies. They can go into the idea of deregulation and generally unregulated currencies like Bitcoin and others. It is a way of expressing distrust and rebelling against the current “system” and continues to grow in popularity and become more mainstream. Despite the risky nature of this sector, we have actually seen some signs of stabilization. The total market capitalization of the crypto market, while down in recent years, has stabilized over the past nine months:

Total cryptocurrency market value (World Bank)

This could be another reason why investors are flocking back to crypto. Although still a highly volatile asset, it is becoming more stable and well known in relative terms. Can it be compared to shares, bonds or traditional currencies? Of course not. But it becomes more legitimate, so that helps underline the rush of confidence in it when good news comes out.

Part of the good news actually stemmed from the bank failures themselves. The ultimate push by regulators and the US government to protect investor deposits at these failed institutions helped restore confidence in assets under custody more broadly. While I personally don’t see the optimism on behalf of crypto investors as entirely justified, it is there nonetheless. The bottom line here is that if investors feel that their money is safe – whether it’s in savings accounts, investment accounts or crypto accounts – then asset prices will be supported and likely to rise.

My concern: Bank failures are not that rare

So I posted why investor interest in BTC is starting to increase. But are these reasons justified? Personally, I don’t think so, and won’t use the recent momentum as a reason to buy.

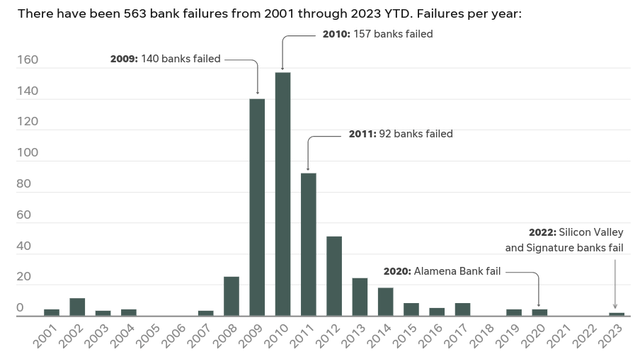

The logic here is simple. Bank failures are not really that rare. This is not to minimize the challenges the sector faces in the short term. A bank failure is never “good”, and the risk management failures and subsequent government response are not encouraging signs. So their public anxiety and anger as a result has many benefits.

But the point I’m making is that this isn’t something that’s going to have long-term consequences because it’s not a one-off event. Banks have failed before, and will fail again. The economy has survived these before, thanks in part to FDIC insurance programs that prevent a bad situation from getting out of hand (usually). For context, consider that while bank failures have been fairly rare in recent years, they have not been the case for extended periods of time:

Bank failure over time (FDIC)

The conclusion I draw here is not to make any dramatic portfolio changes as a result of SVB, Signature Bank, or even if another bank goes under. If crypto was right for you before, it probably still is now. But the opposite is also true. The market will recover from this crisis as it has in the past. Using this cycle as a reason to dive into an asset like Bitcoin is probably bad. That’s my two cents at least.

If you’re worried about bank failure, Bitcoin probably isn’t the answer

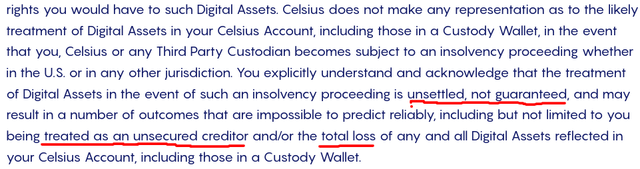

To expand on the above point, I think the idea that crypto balances are “safer” is false anyway. For support, let’s look at Celsius’ own terms of service, which is a now bankrupt crypto lending company. The security of customers’ digital assets did not appear to be a primary concern for them:

Celsius’ Terms of Use (Celsius)

in this regard, we see that the crypto industry has a general lack of security that we expect (and demand) from bank and savings accounts. Investor protection is lacking due to lack of regulation or supervisory body. Does this mean your money is just going to be stolen overnight? Probably not. But that limits the options you have if there are problems. Celsius’ own website called the deposits “unsettled” and “not guaranteed”. If this doesn’t scream “red flag”, I don’t know what does.

The takeaway for me is that it is a mistake to shift to this sector or take a less traditional approach due to temporary uncertainty in the US banking sector. I would caution readers against taking too much risk in this climate, you may end up getting more than you bargained for with a new approach.

What Can Push BTC Higher?

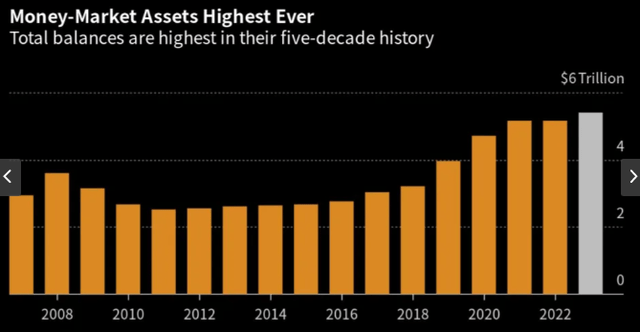

I have taken a rather negative tone regarding Bitcoin’s rise in this review. But I’m not a complete bear here for a couple of reasons. One, momentum in crypto can often be hard to squash immediately, so the good times may roll on from here for a while. Second, investors and households currently have a lot of cash (and cash equivalents) on hand. In fact, the money market balance is currently at its highest in history, as shown below:

Money market balance sheets (total) (Bloomberg)

This does not automatically translate into a bull or bear case for Bitcoin specifically. But it does mean that there is money out there that can be put to work at a moment’s notice. It would be naive of me to think that some of this liquidity will not find its way into Bitcoin, especially since the recent gains must be exciting for many people – myself included. Any asset class that outperforms stocks and bonds on the order of Bitcoin has at least some consideration in the short-term warrants.

What I see here is a relatively bullish case for most risk assets. Now that the stock has sold off, there is a much stronger case for buying back in than there was a month ago. With all that cash on the sidelines, I see some risk taking as a likely outcome, and Bitcoin is one place that could happen. It won’t be for me personally, but this is a trend that won’t go away, even I can recognize it!

Banking Worries Fuel Prospects for Less Hawkish Fed

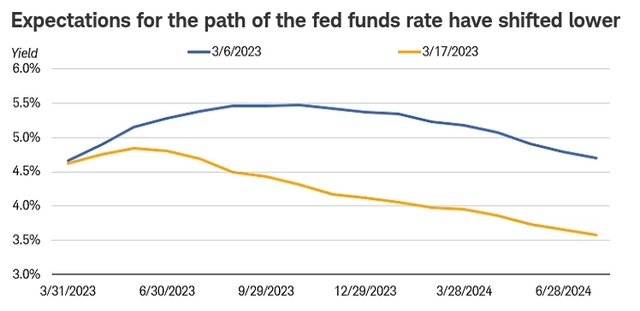

My final thought touches on another output from the banking sector fallout in recent weeks. This is the belief that the Fed is going to back off on its rate hike plans and may even start cutting interest rates at the turn of the year. The reasoning is that the banking sector has pressured the market and created a bit of panic, so the time is ripe to ease off the gas. Whether or not that will happen is up in the air, but the futures market certainly thinks it will:

Fund rate expectations (Charles Schwab)

This speaks to an important fundamental for BTC’s recent rally. The resulting higher interest rates from the Fed over the past year have meant that safe assets such as Treasuries, bonds and dividend-growing stocks have become more attractive because their yields have increased (new debt issuance led to higher yields and dividend growers saw yields increase. if all other things are like). This meant that a more risk-off mode has followed, hurting BTC.

Now the opposite may be true. What has declined due to Fed rate hikes could result in a recovery as the Fed halts its current path, or even reverses it. That includes bitcoin. So, again, there is a clear path forward here under the right circumstances, but readers need to be very careful how they approach it. A lot can “go wrong” with this task.

The bottom line

Bitcoin has been on the run lately and it certainly piques my interest. But at this point I have to pass because I think the euphoric feeling is going to level off once the negative bank headlines are replaced. That’s not to say I won’t get in at some point – it’s an area I dabbled in in the past. I bought in first in the mid 40k range and saw my position climb to the mid 60k mark. Unfortunately, I didn’t lock in profits then and ended up existing when the price went back to my cost basis. So I am one of the few crypto writers who will admit that they do not earn anything in this sector. Still, I will be vindicated given the drop in prices that has resulted since then.

Looking ahead, I may reconsider whether the sector is receiving an unjustified jolt. But I don’t believe in the long-term story of crypto at this point with enough conviction to stuff a whole bunch of cash into it just because the stock markets are rattled. I will consider any asset that can make me money at any time, but I don’t like the risk-reward trade-off now. As a result, I caution readers to take BTC’s recent rally with a grain of salt, and be selective with new positions going forward.