Bitcoin becomes this cohort’s target after capitulating for the sixth time in history

- Trading at $19,200, Bitcoin has been untouched for more than a month straight, minimizing profit windows.

- Net unrealized loss to relative profit ratio shows that BTC is still in capitulation thanks to lack of recovery.

- Long-term owners can use this opportunity to accumulate Bitcoin as this is the ideal time.

Bitcoin, which once reigned at $67,000, is struggling to successfully close above $20,000 today. The fall in the crypto market has left investors longing for an exit, but the bearishness of global markets is also keeping the crypto market subdued.

After the failed recovery back in September, Bitcoin is back at lows that could support a bullish bias.

Bitcoin capitulates again

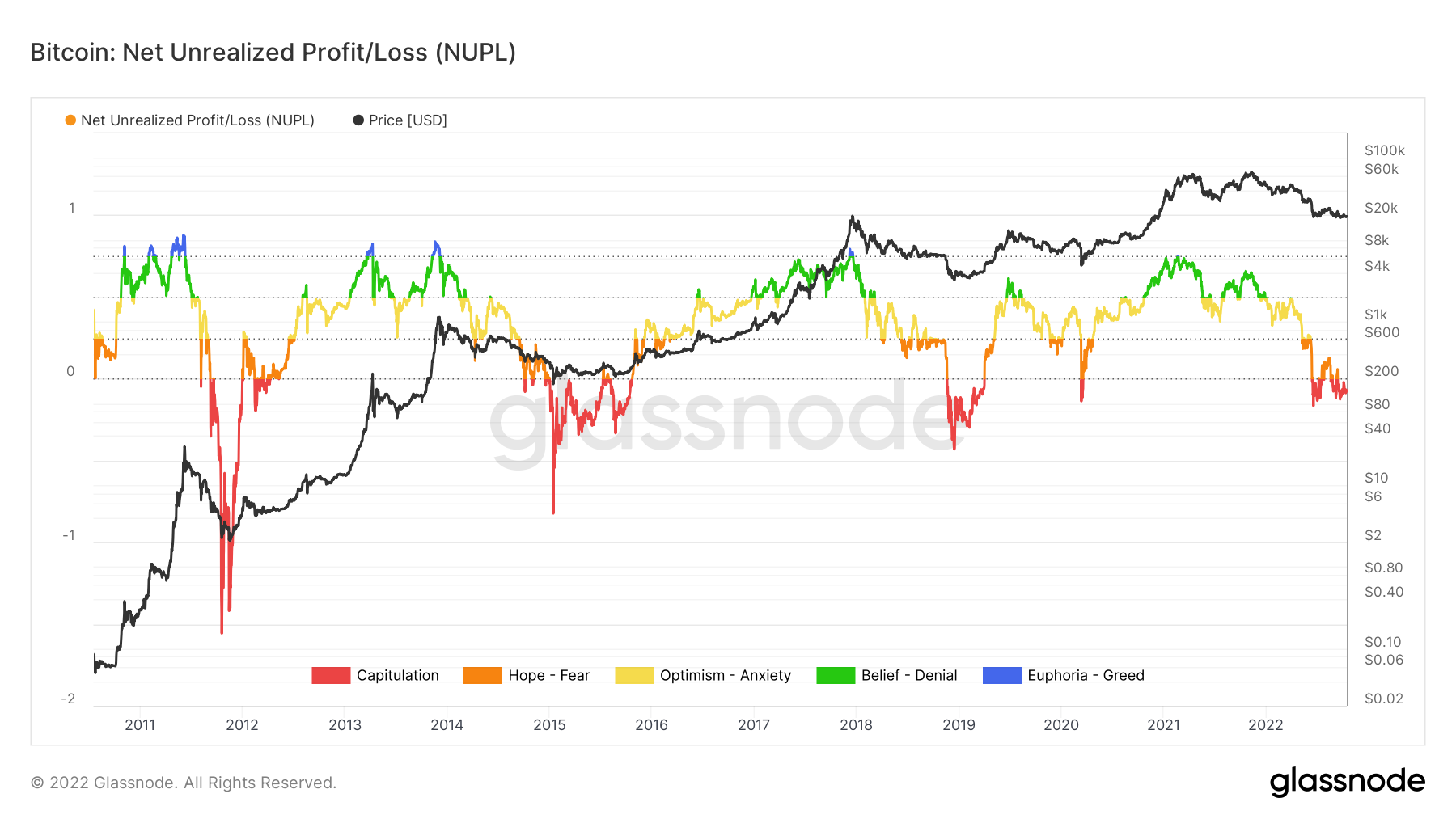

According to the Net Unrealized Profit/Loss (NUPL) ratio, Bitcoin is cushy in the capitulation zone, which it entered for the second time just this year. The crash in June was the first time BTC visited these lows, and it recently rebounded in August after BTC fell from $23,000 to $19,000.

This year is shaping up to be one of the most disappointing years for the crypto market in terms of profits. Not only is this Bitcoin’s second capitulation this year, but the sixth in its entire 12-year history.

Bitcoin NUPL

Bitcoin NUPL

Usually this low is a sign of a trend reversal, but it is no longer a certainty given Bitcoin’s increasing correlation with the broader markets. As of last month, the correlation split between BTC’s price and the S&P 500 index stood at 0.59, and the same with the NASDAQ reached 0.62.

Furthermore, trading at $19,200 at the time of writing, BTC has seen no change in price in over a month due to the lack of bullish signals. BTC is just above the critical support line at $18,600, and remains below the 50-day Simple Moving Average (SMA) as well as the 100-day SMA.

Bitcoin 24 Hour Price Chart

Bitcoin 24 Hour Price Chart

There are signals like this that show how much longer investors have to wait to recoup their profits.

Long-term holders back on it

The one cohort that can certainly make the most of this situation is the long-term holders (LTH). According to Reverse Risk, this cohort is just below the ideal accumulation zone that has been the indicator’s home for almost the entire year.

Bitcoin reverse risk

Bitcoin reverse risk

During periods of high confidence and low price, BTC presents an attractive risk/reward to invest, which LTH can take advantage of, provided there is potential for recovery. As mentioned above, this may take time, but since the average time a Bitcoin is held by LTHs is three years, they may just end up accumulating.