Bitcoin Bearish Signal: Long-Term Holder Selling Ramps Up

On-chain data shows that long-term Bitcoin holders have just increased selling as the binary CDD calculation increases.

Bitcoin binary coin days broken have observed an increase

As pointed out by an analyst in a CryptoQuant post, long-term holders may use the recent surge as an opportunity to distribute their coins.

A “coin day” is said to be the amount that 1 BTC accumulates while sitting still for 1 day. Thus, the total number of coin days in the market refers to the total time the Bitcoin supply has been dormant.

Every time a coin moves on the chain, the coin days associated with it reset to zero. “Coin days destroyed” is an indicator that measures just this, for the entire market on a given day.

Whenever the value of this metric increases, it means that a large amount of dormant supply, likely belonging to long-term holders or “hodlers”, has just been sold or moved.

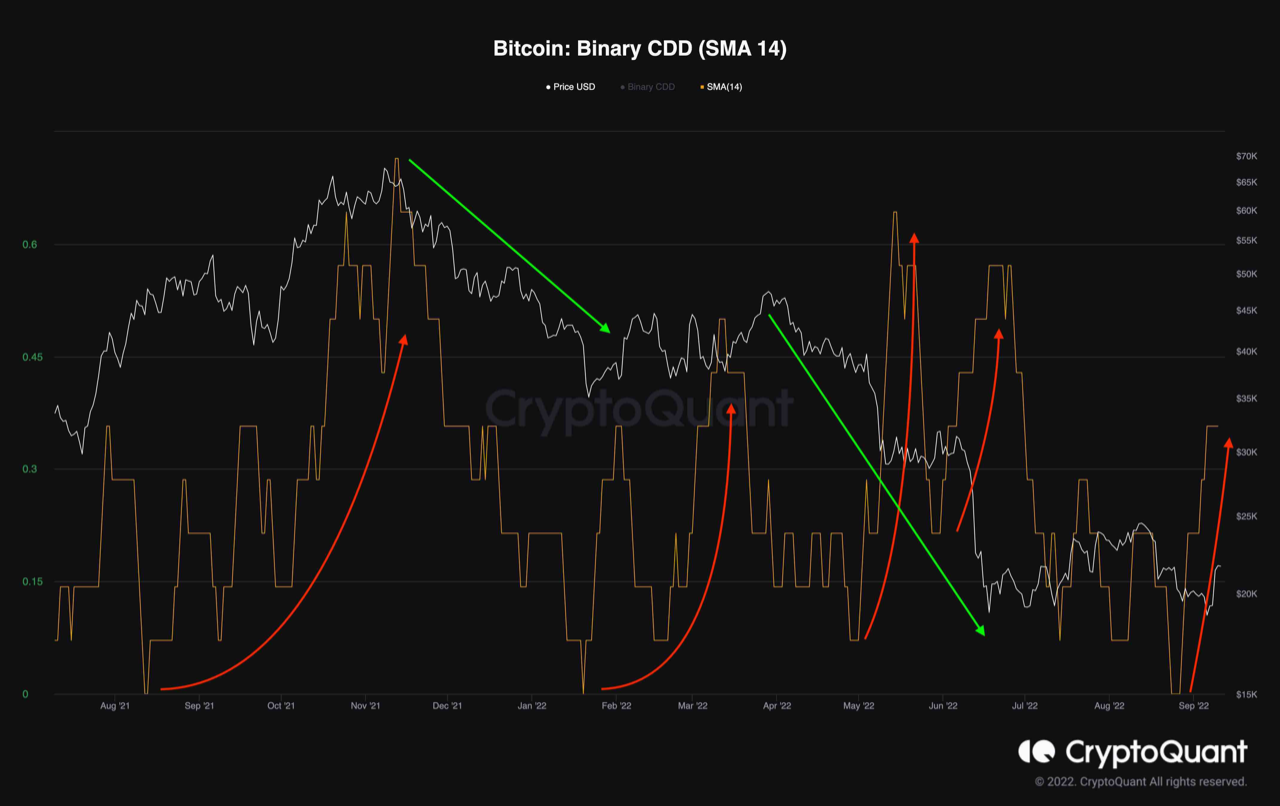

One way to interpret the data associated with this indicator is through the “binary CDD” calculation. Here’s a chart showing the trend in that over the past year:

Looks like the value of this metric has spiked up in recent days | Source: CryptoQuant

What the binary CDD tells us is whether Bitcoin long-term owners are making more moves than average or not right now.

When the indicator’s value moves towards 1, it means that the LTHs are possibly putting selling pressure on the market at the moment. On the other hand, values pointing towards 0 suggest that LTHs are not moving that many coins at the moment.

Now, as you can see in the graph above, when the binary CDD metric has seen rising values over the past year, the price of the crypto has generally seen a sharp decline.

Recently, the indicator has once again seen an increase in value while the price of Bitcoin has also risen.

This could indicate that LTHs are using this increase in price as an opportunity to reap some profit by selling off some of their coins.

If the recent trend is anything to go by, this top in the binary CDD could prove bearish for the value of Bitcoin.

BTC price

At the time of writing, Bitcoin’s price is hovering around $21.7k, up 9% in the last week. Over the past month, the crypto has lost 9% in value.

The chart below shows the BTC price trend over the past five days.

The value of the crypto seems to have observed upwards momentum during the last few days | Source: BTCUSD on TradingView

Featured image from Kanchanara on Unsplash.com, charts from TradingView.com, CryptoQuant.com