Bitcoin: Bear Market in the Rearview Mirror or Initial Decline? (BTC-USD)

Olemedia

As Bitcoin (BTC-USD) comes off its second-worst year in its 14-year history, it’s worth looking back to see some of the challenges the first and biggest cryptocurrency has overcome. And, despite enormous volatility along the way, Bitcoin has shown incredible resilience and has a setup for potential big wins over the next 18 months.

– In 2014, Mt. Gox hack, where the exchange lost hundreds of thousands of Bitcoin.

– 2018 was Bitcoin’s biggest annual loss, with -73%.

– 2022 brought Terra Luna crash, Celsius crash and FTX collapse.

In addition, Bitcoin has gone through several rounds of different regulations, including some outright bans from different countries. Yet here we are in 2023, and the price is up 70% year-to-date (at the time of this writing), and up 81% from its November low.

Given the “events” of 2022, it has been concerns about the Terra, Celsius and FTX failures, but Bitcoin has managed to survive and maintain its position as the leading digital currency. While these failures have demonstrated some of the risks of the larger crypto space, what is also evident is Bitcoin’s strength and stability in the face of adversity.

Finally, while there is speculation as to how much of an effect this may have on the price of Bitcoin in the short term, a growing number of investors shaken by recent bank liquidity problems are taking note of the self-custody options available to holders of Bitcoin.

In my last Seeking Alpha Bitcoin article from early 2022, the takeaway was that Bitcoin should work to form a lasting bottom in 2022, with a forecast favoring $24k containing some selling. The last part of that forecast was proven wrong last June, when the price broke key support. From the article, the question (and answer) was asked:

“What if $24k doesn’t cut it?

Although this is not expected, it has become important to provide coverage on this prospect, given Bitcoin’s detour to the least bullish of our previous expectations.

First, a break below $24k does not constitute an invalidation of the primary Elliott Wave pattern that has price nearing the bottom in wave 4 of (3). A brief rise through $24k would not compromise the larger pattern, as long as the price recovers quickly and resoundingly. However, a sustained break below $24k has strong implications for long-term forecasts. Such a prospect would “downgrade” our expectations of a closing diagonal pattern stemming from the December 2018 lows.

Although recent developments in the latter half of 2022 have reduced my overall confidence in reaching $100,000 before a more prolonged bear market (more than has already occurred), I remain cautiously bullish in the medium term.

Let’s take an Elliott Wave view of the current pattern to help gather closer-term expectations for Bitcoin, as well as key supports needed to sustain a short-term bullish view and resistances that need to be surpassed to shake off reasonable bearish- prospects in the medium term.

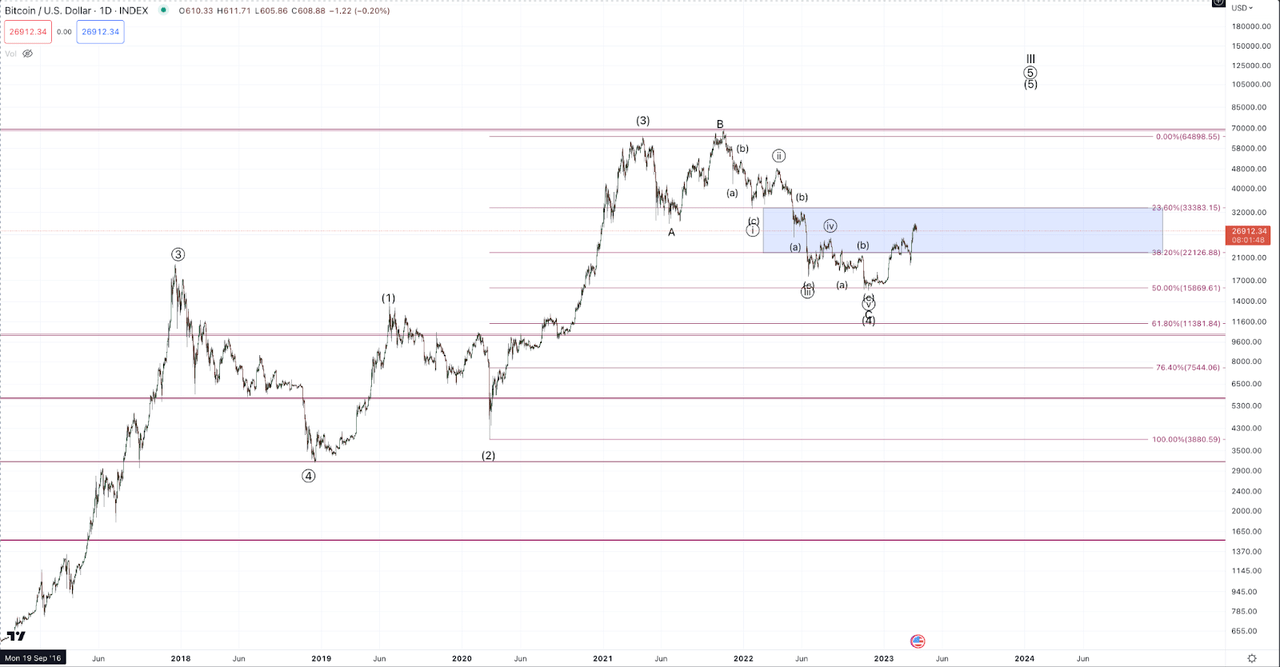

First, considering the pattern from the 2018 low, Bitcoin has formed an upward 3-wave.

Rally, marked (1)-(2)-(3).

Jason Appel (Crypto Waves)

In Elliott Wave we observe that typically, in strong trends, the price will form a 5-wave rally, ideally as an “impulse”. A simple description of an impulse is a five-wave trend pattern that develops with an initial micro-degree five-wave rally and subsequent three-wave pullback or consolidation, referred to as waves 1 and 2, followed by a major breakout of strong unidirectional price action in a micro five-wave, wave 3, followed by of a consolidation of the breakout, wave 4. After the completion of wave 3, the wave 4 consolidation cannot overlap into the price action of wave 1. Finally, assuming the price has the necessary support for a wave 4 the last wave up, which minimally should make new highs above the wave 3 high and maximally, in case of blow-off tops, rise epically above the wave 3 high in climactic fashion.

Coming back to the Bitcoin chart: The price has formed what appears to be a potentially impulsive pattern, with 3 complete waves from the 2018 lows to the 2021 highs. As such, our expectations have been for Bitcoin to rise significantly in its 5th wave, assuming wave 4 support holds. The “standard” support range for wave 4 in an impulse is 38.2%-23.6% retracement for the third wave. In terms of price, this support region was $22.1k-$33.4k. In addition to these levels, we consider other important Fibonacci ratios between the different sub-waves and look for confluences in levels. $24k was an area of particular confluence. After the first fall of the wave (4) to the June 2021 lows, the 23.6% pullback held for all intents and purposes, followed by price breaking slightly with the highest expectations in April 2021 was for a test of the lower end of the standard support region, which ideally would have provided a successful test of $24k to form a wave (4) bottom. While it is valid to consider the fall in the June 2021 low all (4) and the higher high in November all (5), it was too shortened and anemic to consider it the 5th wave as the most likely interpretation.

As mentioned earlier, $24k didn’t last. Often when the 38.2% retracement is resoundingly broken, it is an early signal of concern that the price will not follow through on impulsive expectations. The next key support below is the 50% retracement of the wave (3). When price retraces 50% of wave (3), it is not an invalidation of the larger impulsive expectations, but any meaningful or sustained break below 50% tips odds from continuing to favor impulsive upside continuation.

The 50% retracement, on a logarithmic scale, measured from the March 2020 low to the April 2021 high (the length of wave (3)) was $15,869. This level is not to be considered a hard invalidation point. Rather, it is a kind of pivot. The longer and deeper the price moved below it, the more likely the impulse would fail. Although Bitcoin did break below a couple of times, the breaks were very minimal in terms of price and time. And based on the subsequent activity since the low in November, we can say that for all intents and purposes, the 50% retracement has held.

To summarize, Bitcoin has 3 up from the 2018 low, and the 2022 decline, amid the Terra and Celsius crashes, and the fraud revelations and rapid collapse of FTX, took the price right to the acceptable edge of support for a fourth wave . In a way, it is remarkable that Bitcoin has maintained its bullish setup amid all the bearish developments. In another, it has raised concerns about the thesis that BTC will reach above $100ki the current long-term cycle from the 2018 lows.

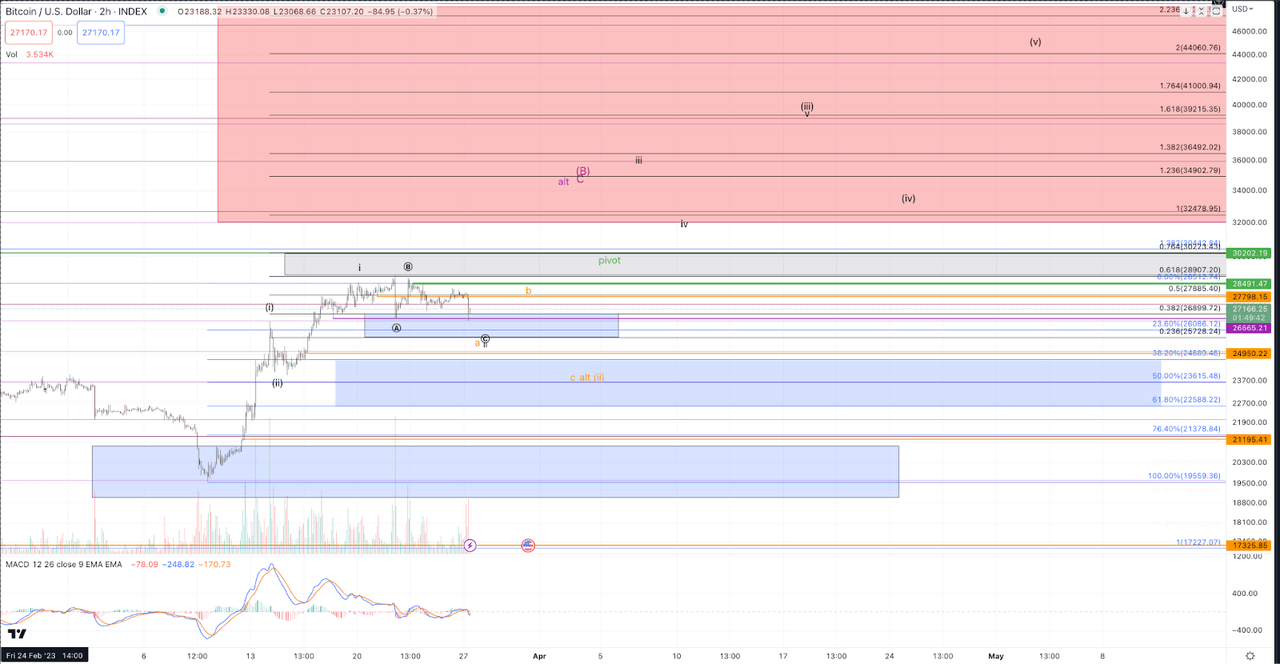

In the latest activity since the November low, we note that the price has formed what counts best as a micro 5 wave up in mid-February, followed by a quick test of Fibonacci support into mid-March, followed by of an immediate micro 5 up, exceeding the February high and the August high, a key downside resistance that effectively breaks the downtrend.

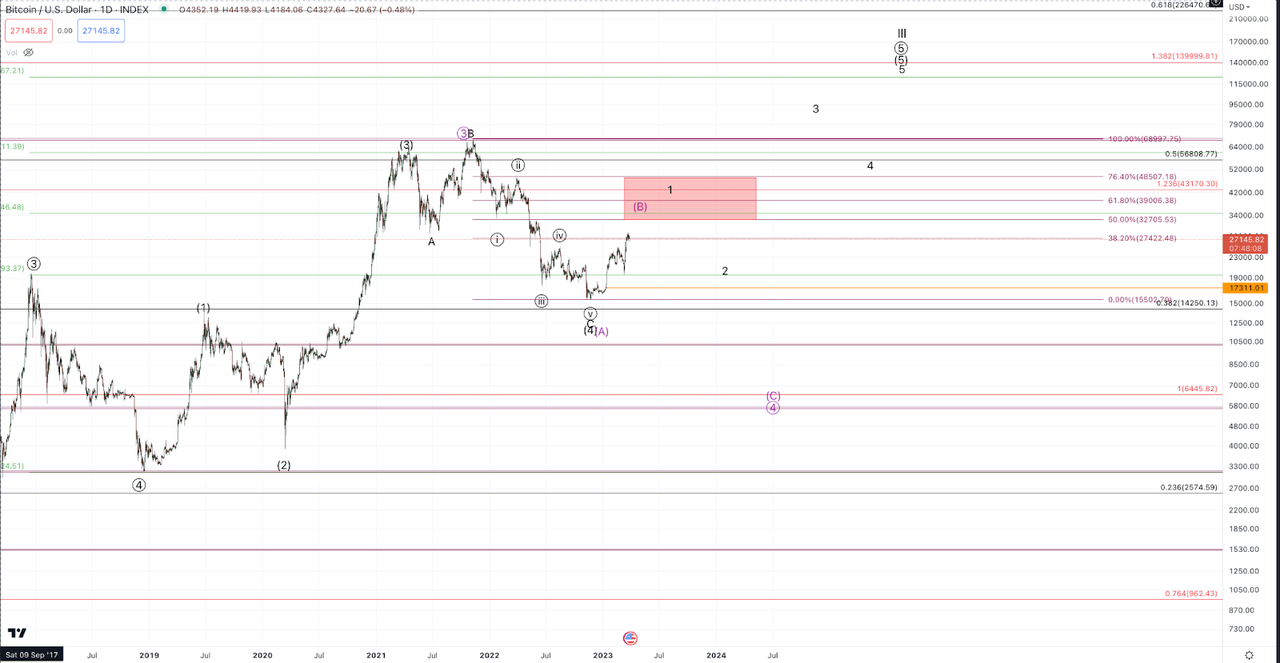

With all that has happened, while I can’t rule out a lower low (which will be discussed), the primary interpretation of this action from November is some sort of initiation move. In the accompanying chart (immediately below), this number favors black.

Jason Appel (Crypto Waves)

The alternative perspective shown in the purple count suggests that the rally from the November low is a corrective – rather than an initiating – move to start a pattern up to new all-time highs. In this case, the Fibonacci resistance is evaluated from the retracement of the move down from the wave (3) high and down to the November 2022 low $32.5k-$48.5k. Ultimately, BTC will have to exceed this region to “prove” itself. And while BTC has yet to reach this region, it is doing everything necessary to make a resistance test quite likely.

To a lesser extent (see chart directly below), BTC has what counts best as a very bullish (i)-(ii), i-ii setup from the March 2023 low. This heralds a major breakout as BTC breaks above last week’s highs. The minimum target for this microbreakout is the $32.5k region, although $35k+ is preferred. Once BTC breaks above $32k, holding above this week’s high will be necessary for us to maintain a reasonable bullish bias. And if price were to alternatively break out and then come back strongly through $28.9k, that would shift the odds in favor of the bearish purple count where price could top out in a corrective move, setting up another decline to below $10k levels.

Jason Appel (Crypto Waves)

In the favored black count, the preferred path for BTC over the coming weeks is a series of breakouts and consolidations above support to eventually take the price above $40k before the next key inflection point.

Before the expected breakout the two key support areas are $25.7k-$26.9k and below $25k the lower support region for the expected breakout to $32k+ is $22.5k-$24.7k. Right now, based on the consolidation just below last week’s high, the upper support region is favored to hold. That said, should this week begin with some selling pressure, a test of lower support is pretty good for the current setup as long as $21k holds. Below there, the odds of immediate upside continuation greatly decrease.

On a sentimental note, the kind of disinterest that is pervasive throughout the market is typical of this early stage of a major 5th wave. We have seen this several times in the Elliott Wave study across different markets. Will it be different this time? Is it true that the herd has lost interest in BTC in the next few years? Possibly. However, given the guidelines and parameters that this technical approach gives us, I am keen to play the long side given the phenomenal implied risk-to-reward bias offered in the current stance. My larger degree target for BTC to complete this 5th wave is $108k-$140k.