Bitcoin balances on exchanges rise, BTC price shows weakness

Bitcoin has failed to break above key resistance levels around $23,000. As a consequence, the cryptocurrency has moved sideways over the past two days, while preserving some of the gains of the past week.

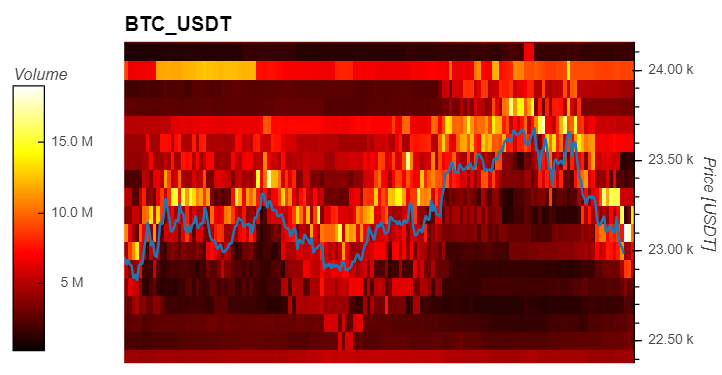

The decline in bullish momentum coincides with an increase in ask (sell orders) liquidity for BTC’s price above current levels and an increase in BTC’s supply influx on crypto exchange platforms. In short time frames, there are over $70 million in sell orders for Bitcoin from $23,000 to $24,000.

Related Reading | The Crypto Market Is Getting Better: ApeCoin And Curve DAO Shows Gains

These levels seem to continue to act as resistance as the price of Bitcoin continues to push upwards. BTC’s price has reached the immediate zone of $23,100, but data from Material Indicators records $18 million in sell orders at this level alone.

As shown below, BTC’s price is seeing less liquidity below today’s levels with large liquidity gaps at key levels. This could suggest high volatility to the downside if BTC continues to lose momentum and cannot break above $24,000 in the near term.

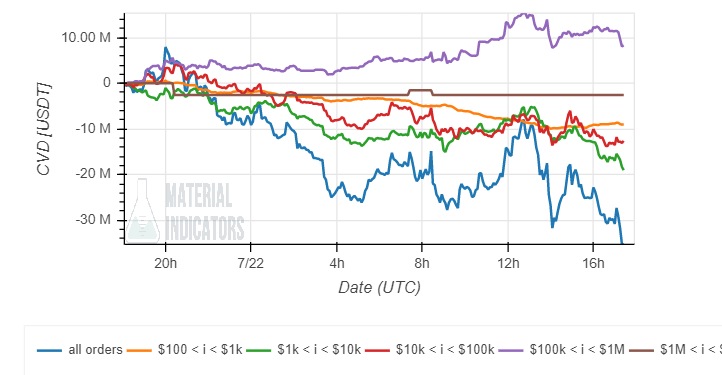

In addition, Material Indicators is recording an increase in selling pressure from investors with sell orders above $100,000. These investors accumulated BTC in the past week and exerted a lot of influence on the price action.

As the chart below shows, these investors (in purple below) have started to sell into the current price action. In these timeframes, it seems premature to conclude whether this trend will continue and whether it will have a negative impact on BTC’s price.

Analyst Ali Martinez agreed with the data shown above. Via Twitter, Martinez showed data on the increase in selling pressure from BTC whales and miners with a decrease in the number of addresses with over 1,000 BTC and a 1% decrease in Bitcoin held by addresses linked to miners.

Bitcoin supply on exchanges rises, hints of further weakness?

Additional data provided by Ali Martinez records an increase in Bitcoin held by crypto exchange platforms. This metric is considered bearish as these BTCs are often unloaded into the market.

Related Reading | Ethereum is showing signs of exhaustion, but can it still touch $1700?

Since July 12, the analyst said, there has been a peak of 27,000 BTC or $621 million sent to these venues. Martinez commented the following about these calculations:

The increase in open interest combined with a slowdown in network growth and increasing selling pressure from whales and miners suggests that the recent Bitcoin price action is leverage-driven. This network dynamic increases the likelihood of a steep correction.