Bitcoin ATMs: Unbanked vs Cashless Countries Crypto Adoption Rates

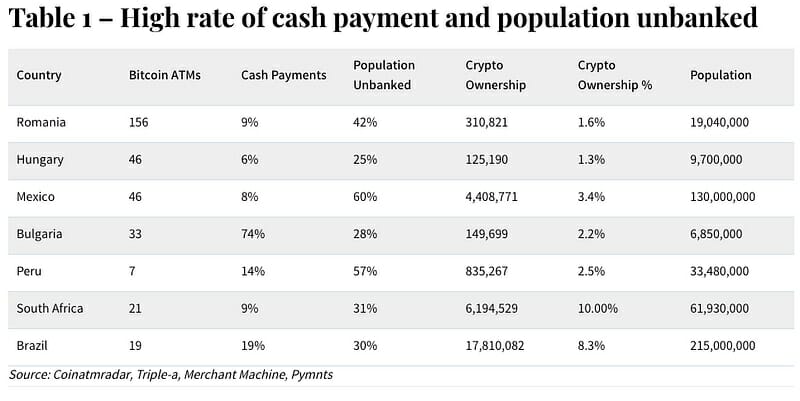

A recently published study by Tradingbrowser.com highlights the explosive growth of cryptocurrency in highly unbanked countries where Bitcoin ATMs are installed.

The data shows that countries with the highest share of unbanked populations also have the highest share of cryptocurrency adoption.

Q4 2022 hedge fund letters, conferences and more

Gates Capital Management is reducing risk after rare down years [Exclusive]

Gates Capital Management’s ECF Value Funds have a stellar track record. The funds (full name Excess Cash Flow Value Funds), which invest in an event-driven equity and credit strategy, have produced an annual return of 12.6% over the past 26 years. The funds gained a total of 7.7% in the second half of 2022, surpassing the 3.4% return for Read more

The rise of Bitcoin ATMs

Here is a snapshot from the report:

- Countries with high unbanked rates also have higher cryptocurrency adoption rates due to high cash payments and Bitcoin ATMs. If the forecast of installed Bitcoin ATMs continues, these unbanked countries could see exponential growth in adoption.

- The most surprising and significant driver of the high adoption rates in highly unbanked nations is the alternative financial solution that Bitcoin ATMs and blockchain offer.

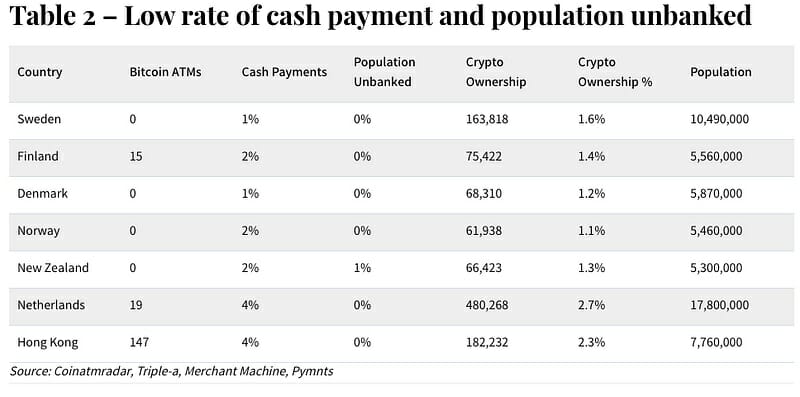

- Cashless countries such as Sweden, Denmark, Norway and New Zealand have a record low percentage of cash payments, and almost 100% of the population is connected to a bank account. These countries have no installed Bitcoin ATMs and have lower cryptocurrency ownership rates than developing countries.

A spokesperson for Tradingbrowser.com shared a comment:

“Cryptocurrency adoption is a rapidly evolving phenomenon with significant implications for the future of finance and commerce. The data presented in the article and tables provide insight into the diverse and complex factors driving adoption rates worldwide.

The emergence of Bitcoin ATMs and cash payments as key drivers of adoption is a testament to the need for accessible and user-friendly infrastructure that can facilitate seamless integration of cryptocurrency into everyday transactions.

It is worth noting that the high proportion of unbanked populations in certain countries is a major contributing factor to cryptocurrency adoption rates. This highlights the need for innovative and inclusive financial services that can cater to underserved populations and give them greater financial autonomy and flexibility.”