Bitcoin and Ethereum Split (ETH-USD)

Dennis Diatel photography

Produced by Ryan Wilday with Avi Gilburt and Jason Appel.

Incessant decline

In my article “Red Flag In Crypto Miners”, in addition to expressing caution regarding the long-term outlook for Bitcoin (BTC-USD) mining, I stated how critical $16K is to my Bitcoin prospects. Although we have already witnessed a one-year, 73% decline in Bitcoin prices from the 2021 high to the June low, breaking and sustaining below $16K could usher in a deeper bear market.

Weak reversal

So far, Bitcoin has held above its June low of $17,100. On August 14, it traded at $25,185, about 47% off its June low. But does this strong move indicate that the bottom is holding? Unfortunately, I cannot say that this is the case, as the entire move from the June low is corrective in structure. Furthermore, if a low is going to hold, we do not want the price to break below the 0.764 order for the move from the low. That level is $19,100 and it was breached on September 6. And at the time of writing, Bitcoin is still lower on the hourly chart.

This means that the June low is very likely to be broken and the critical $16K level is at risk.

Aether strength

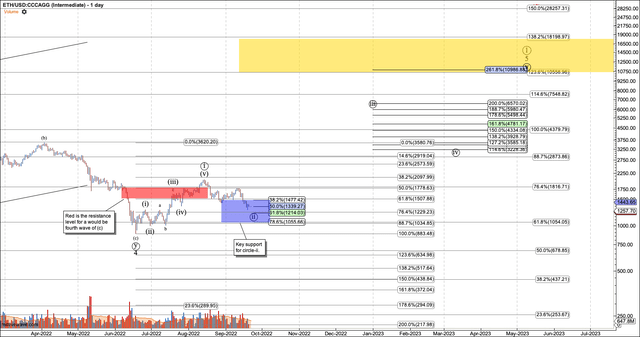

While Bitcoin and Ether are normally highly correlated, Ethereum (ETH-USD) has fared much better. After falling to $879 in June, it rebounded to $2026, or a 131% discount. More importantly, the rally to $2026 is too high to be a fourth wave of the C wave that started down from Ether’s all-time highs. A high fourth wave should have held below $1780. And finally, the structure outside the June low can be called a leading diagonal. All of this means that the June low is likely to hold.

This structure gives us support for a wave 2 off the June low of $1000. As long as that level is not breached, both the long-term chart and the move from the June low suggest that $10,500 is in the cards.

Daily chart for Ethereum (Produced by the author using Motivewave software.)

Ether’s Frothy Bulls

If you know the crypto space well, you know that it can be tribal. Many crypto investors focus on a favorite project, leaving diversification to more mature investors. They show their support by using social media to cheer on their favorite project and beat the rest. No tribal war in crypto is fiercer than the one between the Bitcoin Maximists, or maxis, as they are called, and the Ether Maxis.

Ethereum went through what was called “the Merge” on September 15th. This was an upgrade of the blockchain from Proof of work (POW), to proof of stake (POS). This change has been heralded by Ether Maxis as making Ethereum superior to Bitcoin because proof of stake consensus requires less energy. And other changes enabled in the merger make the supply of Ethereum more deflationary.

The tension surrounding this upgrade may be the reason for the strong pressure from the June low. But as always, euphoria leads to frothy markets, and instead of pushing higher, Ether has so far fallen over 20% since the merger triggered. Ether maxi social media announced its arrival, but it triggered a fall

Ryan Sean Adams co-hosts the Bankless Podcast, a pod that can be called very pro-Ethereum (Twitter)

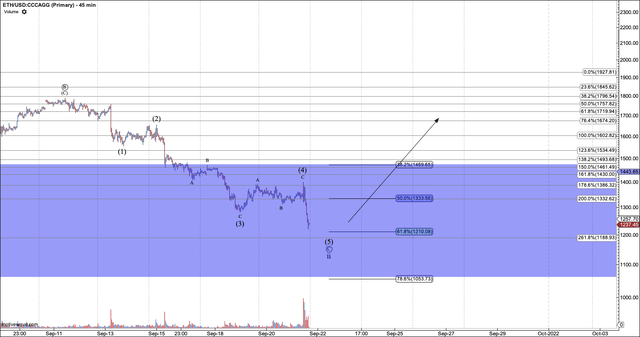

We saw the potential for the B-wave top forming on my chart below a week before it finally did, as the Ether bulls looked up with excitement. Now that the smoke has cleared, we are starting to rally in our support zone, which ranges from the current price down to $1000.

Ethereum 45 min. Diagram (Produced by the author using Motivewave software.)

As I have stated emphatically before, there is never a guarantee that our support zones will hold. But by patiently waiting for the right structure, we can take a trade with a solid risk-to-reward ratio. And we can size our position so that breaking support causes us little pain. If we start to see the market react to the support region, we can build a winning trade.

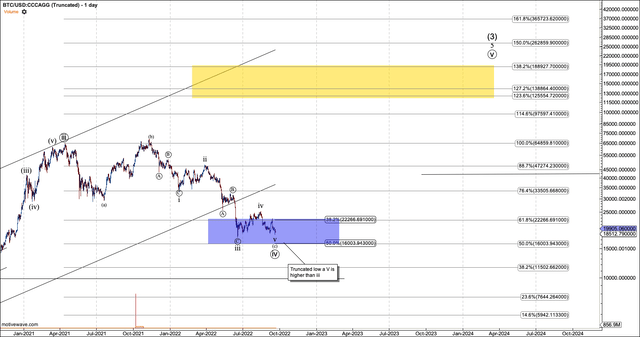

Bitcoins Slim chance

The only way Bitcoin can go from here to our $100,000 target without a new low is via a truncated low. A truncated low is where the fifth wave of wave C does not break the bottom of the previous third wave. This is shown in the diagram below. However, this is a very rare pattern and always requires a market to prove it.

For Bitcoin, breaking above $23,000 will help the case for truncation. However, Bitcoin has never held out the resistance for a fourth wave, unlike Ether. That resistance is at $25K and it could always send Bitcoin back for another attempt at a full and complete fifth wave. Bitcoin obviously has a lot of work to do to turn itself out of a bear trend.

Bitcoin daily chart showing what a truncated low looks like. (Produced by author with Motivewave Software.)

Conclusion

So here we have the recipe for Ether and Bitcoin to be separated. Ether is very positive, while Bitcoin has not been able to move above any key levels of resistance in a sustained manner. This means that the money you allocate to swing trading cryptocurrencies is better spent on Ether than Bitcoin.

Ether’s support level for a higher low is just below the current price, which is $1,350, at the time of writing. Bitcoin, on the other hand, could become a hot knife, ready to pierce the June low. And when it drops below $16K, it could drop further.