Bitcoin and Ethereum look set to break out

Important takeaways

- Bitcoin gained over 1,000 in market capitalization early Monday.

- Meanwhile, Ethereum saw its price jump above $1,800.

- The technical and fundamentals now point to further gains on the horizon.

Share this article

The total cryptocurrency market capitalization has increased by approximately $49 billion since the start of Monday’s trading session, helping Bitcoin and Ethereum post significant gains.

Bitcoin and Ethereum on the rise

Bitcoin and Ethereum have started the week in the green, signaling the beginning of a new uptrend.

The top cryptocurrency has gained over 1,000 points in market value after the opening of Monday’s trading session. The sudden increase in upward pressure surprised many cryptocurrency enthusiasts given the prevailing macroeconomic uncertainty. Still, Bitcoin appears to have breached a crucial resistance area that could allow it to advance further.

From a technical perspective, BTC bounced off the middle trendline into a parallel channel that had developed on the daily chart. The technical formation suggests that it may now march towards the upper trend line around $25,700. Bitcoin needs to continue trading above the $23,300 support level to achieve the upside potential.

On-chain data lends credence to the technical outlook as IntoTheBlock’s In/Out of the Money Around Price (IOMAP) model shows that Bitcoin has developed a significant support floor. About 1.4 million addresses bought over 1 million BTC between $22,650 and $23,325. The significant amount of interest around this level could help limit any increase in profit-taking, potentially allowing prices to rebound.

It is worth noting that the IOMAP is showing little or no significant resistance going forward. The most significant supply barrier is $26,670, where 63,530 addresses have previously purchased over 181,270 BTC.

Ethereum has also gained significant bullish momentum today. The mounting buying pressure has helped ETH’s price rally by nearly 7%, peaking at $1,800 at press time. As speculation mounts around the blockchain’s long-awaited “Merge” upgrade, ETH appears to have more room to rise.

The second largest cryptocurrency by market capitalization has broken out of a symmetrical triangle that had developed on the four-hour chart. The height of the pattern’s Y-axis suggests that Ethereum may now enter a 22.5% uptrend. Further bullish momentum could help ETH validate the bullish outlook and reach $2,130.

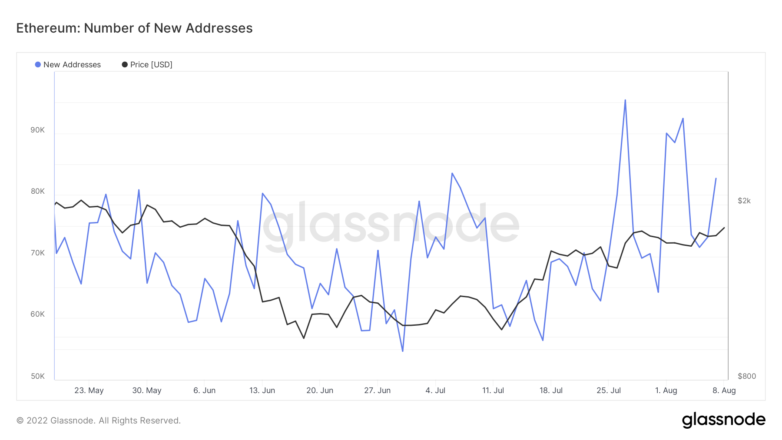

Activity in the chain also indicates an increase in interest in Ethereum. The number of new daily addresses on the network seems to be increasing, creating a series of higher highs and higher lows. The uptrend suggests that investors on the sidelines have been accumulating ETH around the current price levels.

Network growth is often considered one of the most accurate price predictors for cryptocurrencies. In general, a steady increase in the number of new addresses created on a given blockchain leads to increasing prices over time.

Despite the improving technical and fundamental conditions, ETH needs to continue to trade above $1,700 to continue its upward trend. If it falls below that crucial level, it could face a sell-off that invalidates the bullish thesis and triggers a correction to $1,600 or even $1,450.

Disclosure: At the time of writing, the author of this piece owned BTC and ETH.

For more key market trends, subscribe to our YouTube channel and get weekly updates from our lead bitcoin analyst Nathan Batchelor.