Bitcoin and Ethereum forecast for the week ahead

Bitcoin, Ethereum – Talking Points

- Bitcoin trades through $21000 level after NFP report

- Ethereum continues bullish movement after breaking the trendline resistance

- The focus is still on economic data, CPI in focus next week

Recommended by Brendan Fagan

Get your free Bitcoin forecast

Bitcoin and Ethereum Outlook: Bullish

Bitcoin and Ethereum both posted monster sessions on Friday as risks increased on the back of the US nonfarm payrolls (NFP) report. The jobs report appears largely to be a “mixed bag” as both bulls and bears can point to aspects of the print to support their arguments for higher/lower prices. Despite that, market participants pushed risk higher during Friday’s session. US Treasury yields came in as the US Dollar had a gloomy session. Part of this was driven by NFPs, while continued development from China also led to a decline in risk.

So where does crypto fit into all of this? At the moment, its role as an “uncorrelated risk asset” roughly means that market participants are stuck in the broader macro environment. The data ultimately drives sentiment and positioning, as it weighs heavily on the market pricing of the Fed’s terminal rate. Next week, October CPI data will cross the wires on Thursday, which could lead to significant changes in prices ahead of the December FOMC meeting.

Upcoming US Economic Calendar

Courtesy of DailyFX Economic Calendar

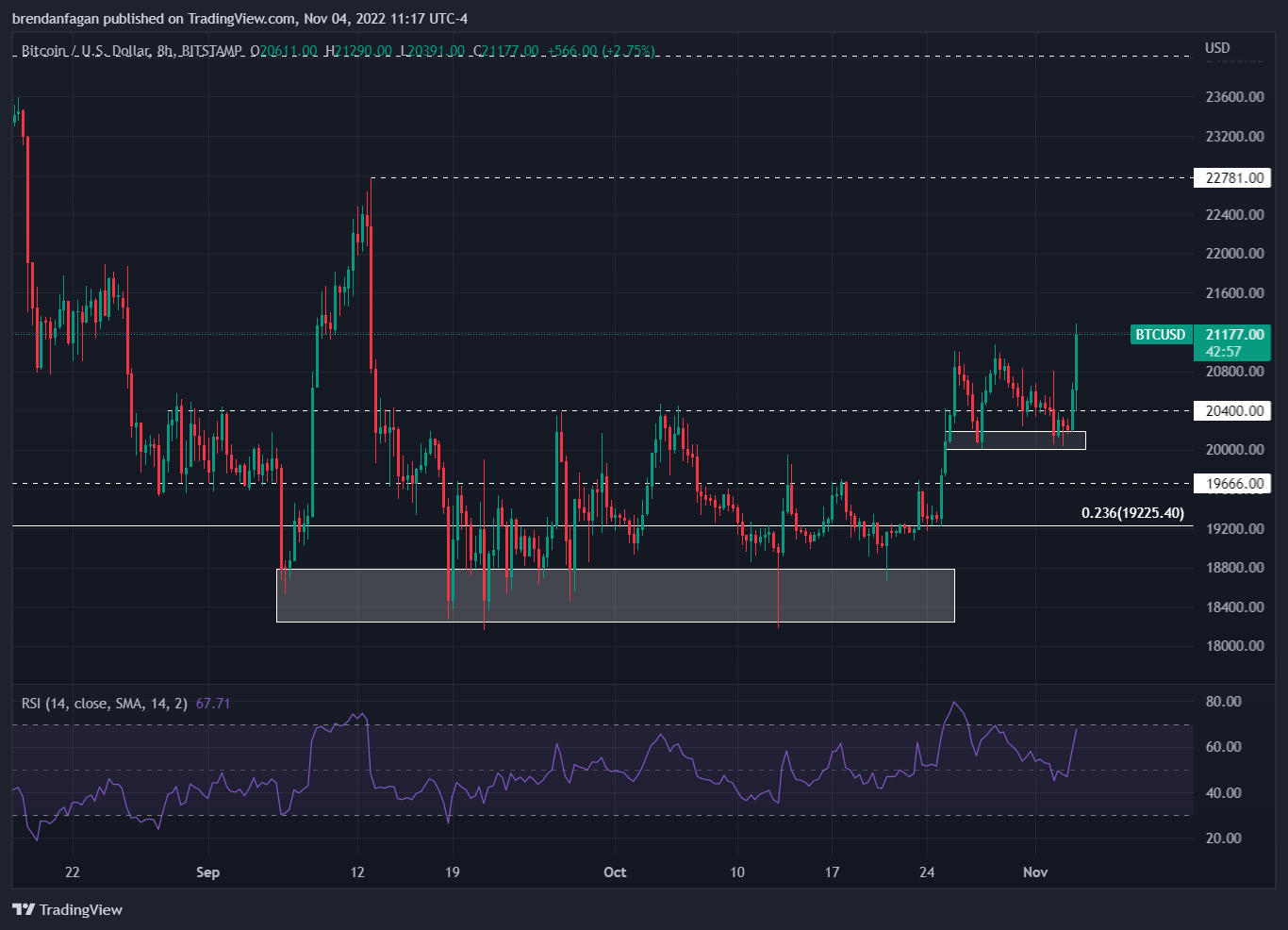

Bitcoin continues to push higher despite volatile fluctuations of late, following a long base that was built around the $18400 – $19000 zone. I wrote about this in previous articles on Bitcoin, where I noted that the cryptocurrency held up well while other risk assets struggled tremendously. The relative performance during a period of increased stress in the financial markets certainly caught my eye, and made me wonder why Bitcoin had deviated from traditional correlations.

After largely holding the support zone between $18,400 and $18,800 for most of September and all of October, Bitcoin finally made the break higher towards the end of the month. The October 25 session finally saw a daily close above the $19666 resistance, which was the 2017 high. BTCUSD has not looked back since this bullish breakout as the price has powerfully broken through the psychological barriers of $20000 and $21000 respectively. If risks continue to increase on a shift in fundamental news, BTCUSD could look to target the September high at $22781. Softness after such a strong rally on Friday could bring the support zone above $20,000 back into play in the short term. Overall, I remain bullish BTC.

Bitcoin 8 Hour Chart

Chart created with TradingView

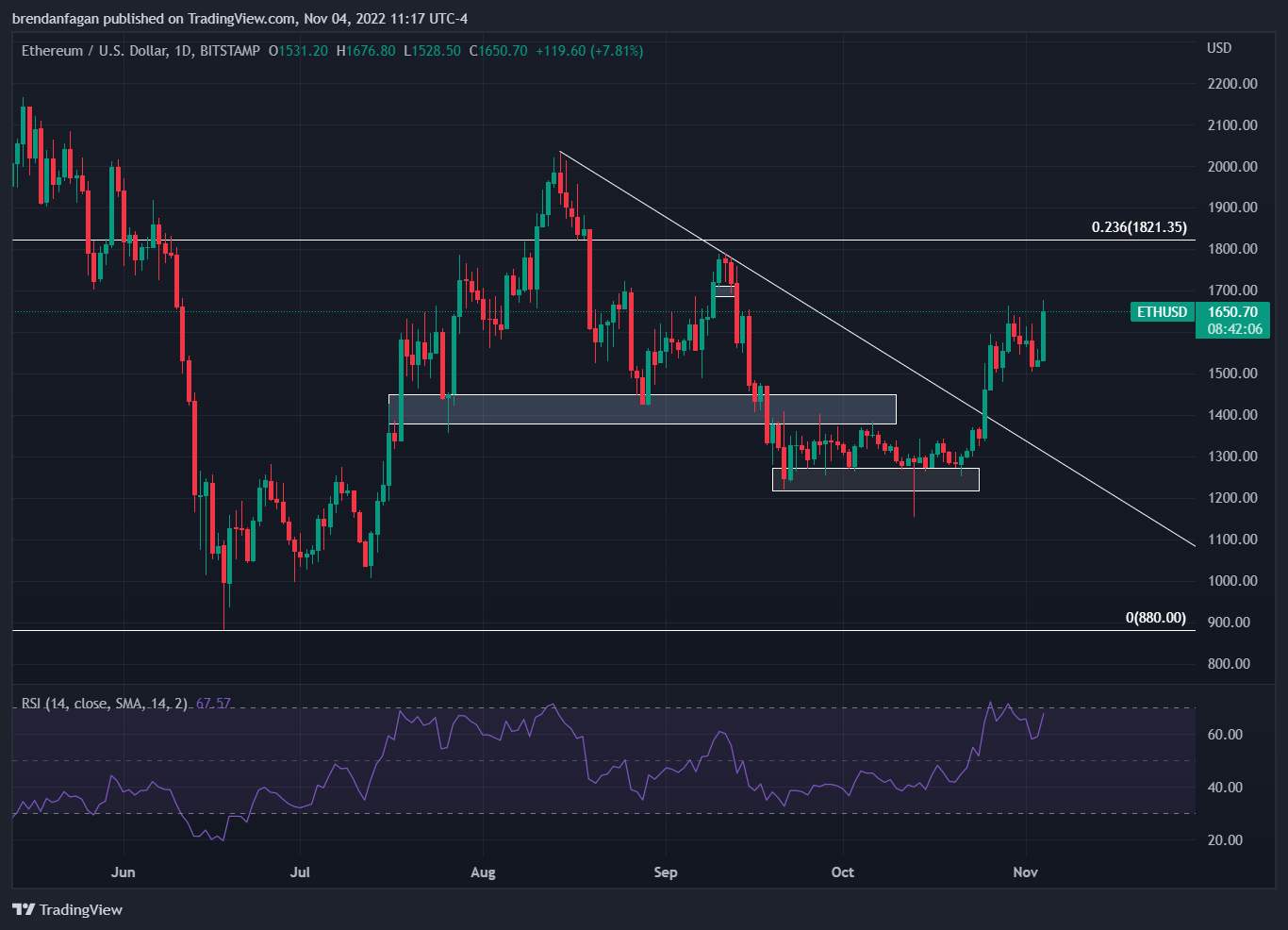

Just like Bitcoin, Ethereum has embarked on a monster rally after holding a major support zone for much of September. ETHUSD held the key zone just above $1,200 after a strong September selloff. This attempt to find a bottom ultimately proved decisive, as ETHUSD has now rallied to just below $1,700. Like BTCUSD, the ability for Ethereum to hold key support while traditional equity baskets slid hard in the latter half of September was eye-catching.

Ethereum has since broken above descending trendline resistance that rejected ETHUSD decisively in September. The daily close above this key trendline on October 25th has seen a bullish continuation materialize as we now trade just below $1,700. With risk appetite better after this week’s list of risk events, ETHUSD can target the 23.6% retracement of the 12-month range at $1821. Given Ethereum’s inability to trade back to the $880 lows despite the bearish risk environment, it remains difficult to make the case for a revisit to this area absent any potential developments in crypto regulation.

Ethereum was only trading at $5,000 this time 12 months ago, which shows how much can change in a short period of time.

Daily chart for Ethereum

Chart created with TradingView

Trade smarter – Sign up for the DailyFX newsletter

Receive timely and compelling market commentary from the DailyFX team

subscribe to newsletter

RESOURCES FOR FOREXTRADERS

Whether you are a new or experienced trader, we have several resources available to help you; indicator for tracking trader sentiment, quarterly trading forecasts, analytical and educational webinars held daily, trading guides to help you improve your trading performance, and one especially for those new to forex.

— Written by Brendan Fagan

To contact Brendan, use the comment box below or @BrendanFaganFX on Twitter