Bitcoin and Crypto Slide Amid ‘Signs of Exhaustion’, BTC and ETH See Investment Inflows Again

The crypto market saw declines across the board in the past 24 hours, as bitcoin (BTC) ended the week below a key technical level and market participants seemed uncertain about its near-term direction.

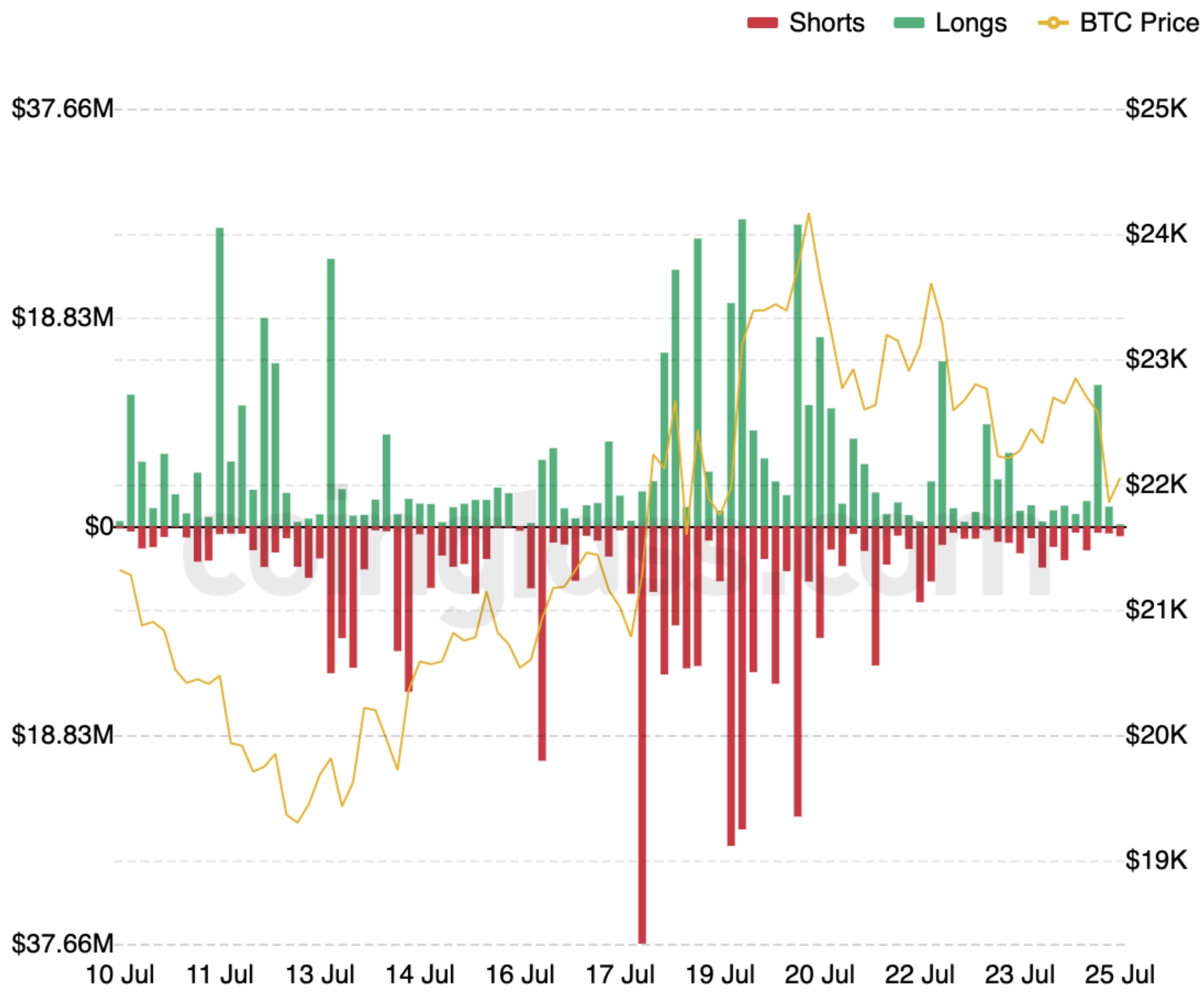

As usual, the crypto sell-off was accompanied by liquidations by traders of leveraged derivatives, with long liquidations of leveraged bitcoin positions reaching USD 12.7 million in the four hours from midnight to 04:00 UTC on Monday.

Still, the level of liquidations was not out of the ordinary, with a sell-off as late as last Friday leading to even greater liquidations.

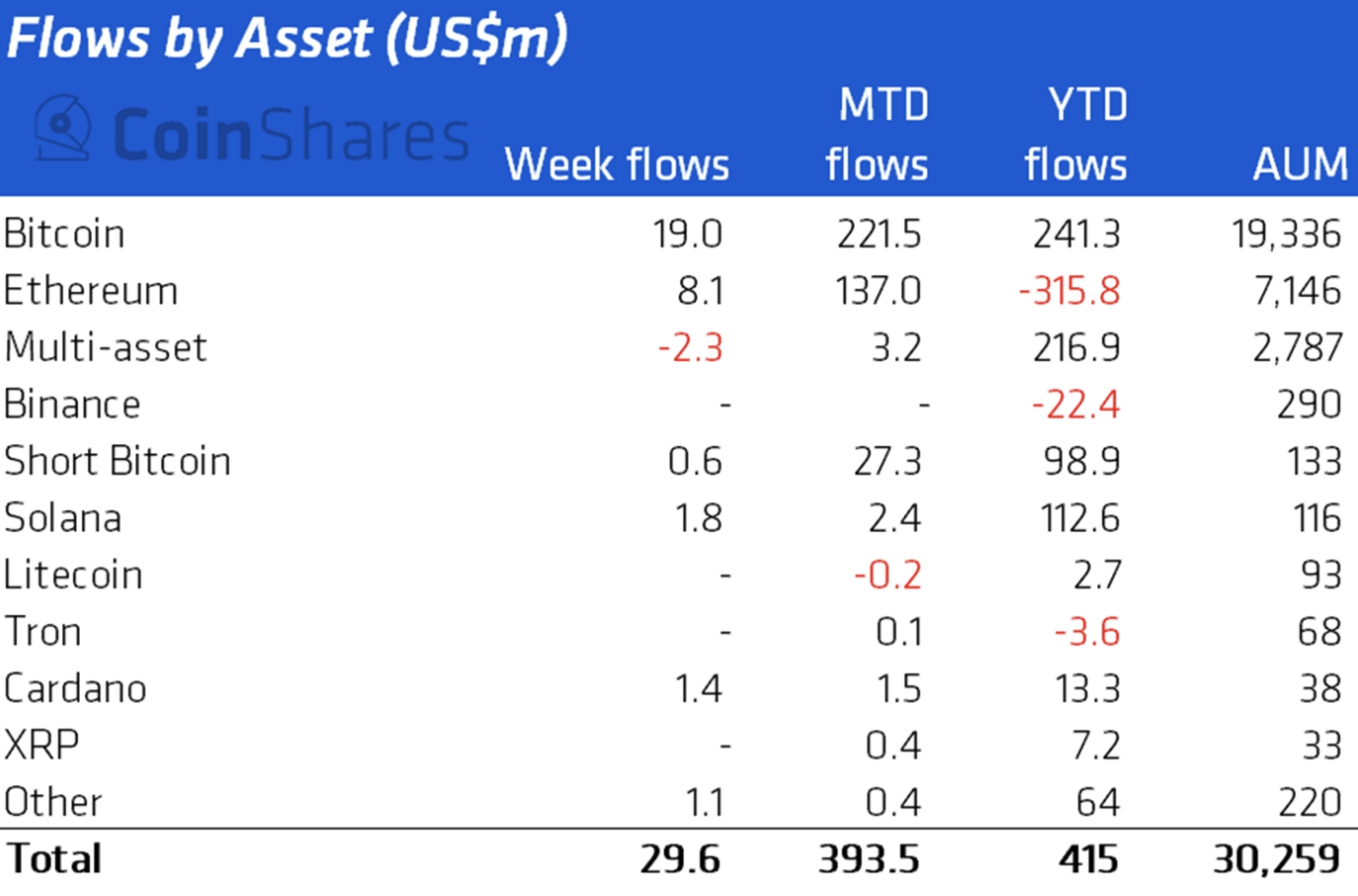

Meanwhile, fresh data from the crypto investment and research firm Coin shares on Monday showed that crypto-backed mutual funds once again saw an influx last week. In total, the week ended with inflows of USD 30m, with USD 19m of those flowing into BTC-backed funds.

After bitcoin, the second most popular crypto asset among fund investors last week was ethereum (ETH), with USD 8.1 million inflows. The multi-asset fund category was the only category to see outflows last week, with USD 2.3 million withdrawn.

Notably, the latest data release from CoinShares also included a correction of the figures from the previous week, when a total of USD 12 million was reported for the sector. After accounting for late reporting of trades, this figure has been adjusted to USD 343m – the largest weekly inflow seen in crypto investment funds since November 2021.

The inflows came despite bitcoin ending last week below the key 200-week moving average line. The line – considered by many to be a key technical level below which BTC has never traded for an extended period – currently sits at $22,786, with the bitcoin price trading below it since Sunday evening in Europe.

BTC weekly chart with 200-week moving average:

On Monday at 10:55 UTC, BTC was trading at USD 22,058, down 2.1% in the last 24 hours and up 5.9% for the week.

Apart from bitcoin, other major coins that stood out at the time of writing were ETH, which was down 2.4% in the last 24 hours to USD 1,547, and solana (SOL), which was trading down 3.2% to USD 39.1 . SOL is up 1% on a 7-day basis, while ETH is up over 15% over the same time period.

‘Signs of exhaustion’ in the market

Commenting on the outlook for the crypto market ahead of the weekend, Singapore-based crypto trading firm QCP Capital wrote in an update that they are “not sure if the upside momentum continues to a large extent.”

“The speed of this move higher felt positioning driven (the market was shorted) and the market is starting to show some signs of exhaustion,” the trading firm wrote.

The latest update from QCP Capital marks a softening of the company’s bearish stance from early July, when it said its “positive outlook is diminishing” and warned that “any significant upside will be limited in the near term.”

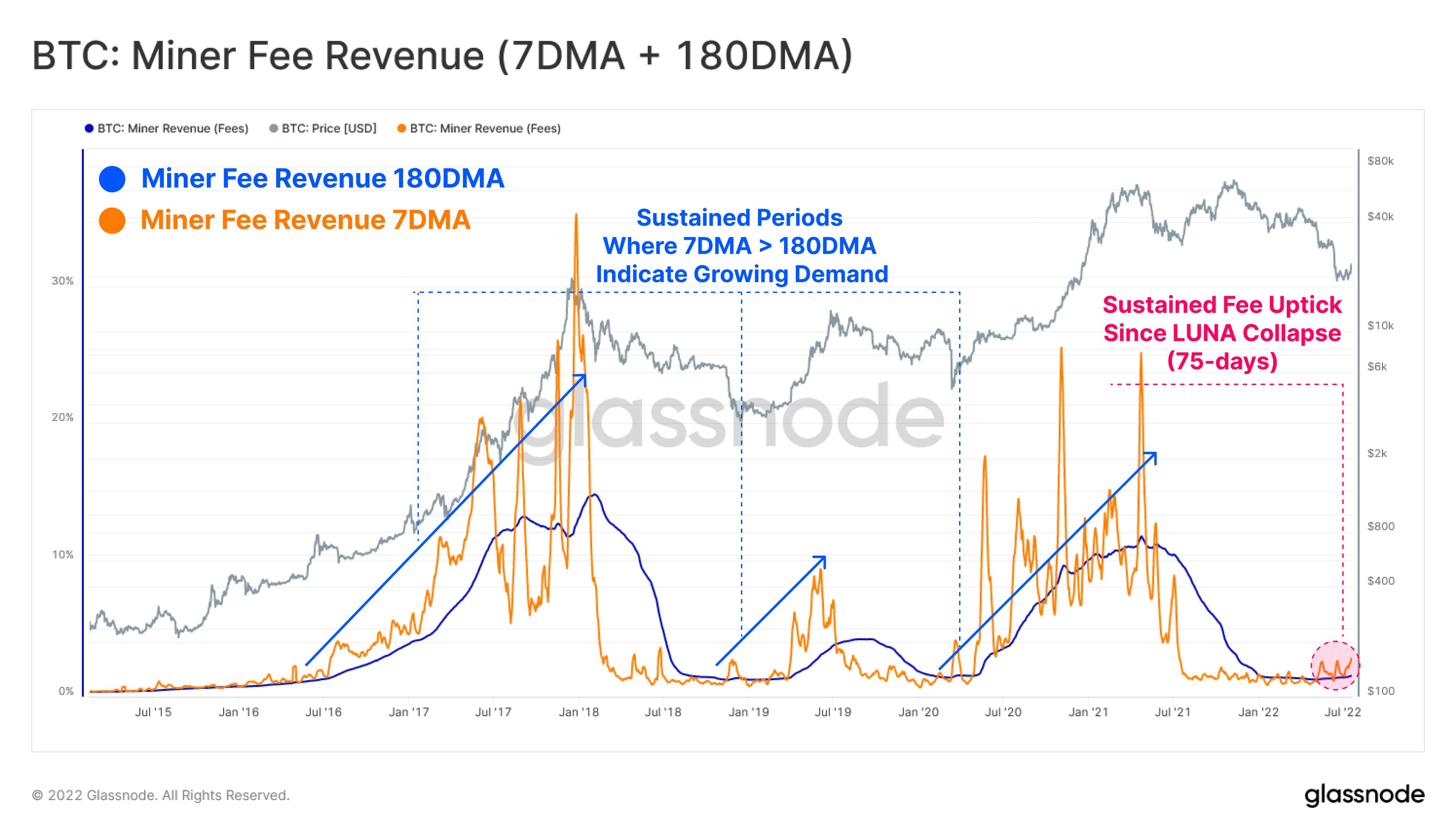

Others, including the research firm in the chain Glass nodepointed to some early signs of bullishness in Bitcoin, given the high transaction fees seen on the network since the collapse of the Terra (LUNA) network.

“A regime with higher fees, there [7-day moving average] is higher than [180-day moving average]is historically a signal of market recovery,” the firm wrote on Twitter. It also shared a chart showing how similar events have played out historically.

____

Learn more:

– Bitcoin mining difficulty sees its biggest drop in 12 months

– Volatile months ahead for Ethereum and USD 1711 likely at year-end, says Crypto Industry Panel

– Little upside for Solana this year, but the long-term future remains bright, predicts the panel

– Year-end Cardano price at $0.63, increasingly bearish panel estimates

– The crypto winter will end before 2022 is out – Korbit

– Did Tesla make a profit on its Bitcoin investment?