Bitcoin Adoption In The West KYC – Bitcoin Magazine

This is an opinion piece by Robert Hall, a content creator and small business owner.

What is the most likely path to hyperbitcoinization? This is a question that has popped into my mind time and time again. Will it be a top-down implementation like we saw in El Salvador last year? When it comes to world leaders, Nayib Bukele is the rare exception to the rule. Most world leaders think within a predefined box of fiat options.

Will adoption look more crowd-driven like in Nigeria, where Bitcoin was integral to funding the youth-led protest against the Special Anti-Robbery Squad (SARS) in October 2020, after protesters’ bank accounts were frozen?

Bitcoin adoption in Nigeria has continued to grow despite their central bank banning legacy financial institutions in Nigeria from interacting with Bitcoin at all. Bitcoin P2P trading in Nigeria is up 27 percent despite the ban.

Bitcoin adoption in Nigeria and El Salvador are two examples on opposite sides of the adoption spectrum. Both are working despite legal obstacles and educating more people about Bitcoin.

What will widespread adoption look like in developed countries such as the US, Europe and developed countries? The dynamics in the West are significantly different from developing countries. Western countries have the rule of law, regulated markets, a population that has access to bank accounts and a currency that does not expire as quickly as other currencies.

Bitcoin adoption in the West is going to take a fundamentally different path than the path other parts of the world are going to take. This should be recognized and inform how Bitcoiners talk about adoption in the Western world.

If you live in the West, you live in an economic and political panopticon. Your government knows who you are, where you live and how much money you make. They can also collect phone records, transaction history and online activity with impunity via third-party providers.

If you have money in a bank account, Western authorities can call your bank, tell them you’re a terrorist and seize your bank account. Don’t think it could happen to you? It happened in Canada with ordinary everyday citizens protesting government policies they disagreed with and agitating for change. The Canadian truckers were not violent thugs with guns; they used well-established protest tactics to make their voices heard.

What did the Canadian government do in response? They froze assets and used violence against them.

Do you think this is an isolated incident? Authorities in the Netherlands opened fire on a farmer protesting government plans that would see them cut nitrogen oxide and ammonia emissions by 70 percent in seven years. The state can give two shits about your life if it gets in the way of their plan, plain and simple. You know it and I know it. There is no need to sugar coat anything here.

The idea that we are free is folly. Bitcoin is our best hope for changing our current circumstances, but it starts with people buying and owning Bitcoin.

Where do people in the West buy Bitcoin?

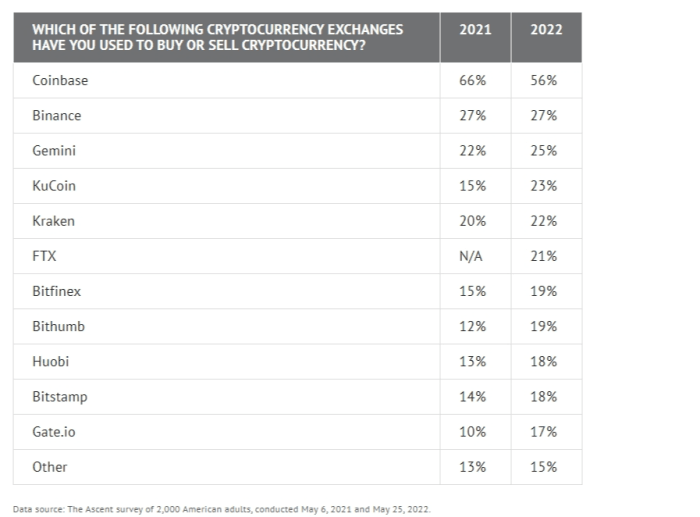

For a large majority of people new to Bitcoin, their first interaction with bitcoin will be through exchanges such as Coinbase, Kraken, Binance, and OkCoin. Not ideal, but these are the facts.

When someone new to Bitcoin searches “how to buy bitcoin”, the first page results will show you where to buy bitcoin from exchanges.

According to a recent article, 46.5 million Americans have never owned cryptocurrency and plan to buy it in the next year. 32 percent believe that cryptocurrency will replace fiat currency over time. Presumably, a large portion of these new buyers will look at buying bitcoin. They will buy bitcoin on exchanges.

These entities comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulations set by their jurisdictions.

People who are new to Bitcoin will have no problem handing over their personal information to these companies because they see it as normal and something they have done all their lives. This is a fact of life that won’t go away anytime soon.

This is an unpopular opinion, but I will say it anyway. Mass adoption of Bitcoin in the Western world will be with KYC’d Bitcoin. I wish that wasn’t the case, but I don’t see how it can’t be. There is even an implicit realization of this fact on Bitcoin Twitter.

The new people coming into Bitcoin will not be your anarcho-capitalist types who want nothing to do with the state. The next wave of people entering the space will be the mom-and-pop store owners down the street, your truck driver, the mailman, or a teacher who wants to save their hard-earned money in money that the government can’t debase.

Many look to the authorities and the laws and regulations they promulgate as a form of security. They may see KYC as a good thing. Currently, KYC is a fact of life, and this creates honeypots of information that hackers can target. We have dealt with this problem in the fiat world; we also need to handle it on a bitcoin standard. I didn’t make rules; I’m just looking at the facts as they are now. That doesn’t mean any of this can’t be changed.

Still, I think advising newcomers about different privacy practices is the way to go. There are many great articles here on how to make your Bitcoin more private.

“How CoinJoin, CoinSwap Enable Basic Bitcoin Privacy”

“A Comprehensive Bitcoin CoinJoin Guide”

“Trace Me If You Can – How Bitcoin Forward Anonymity Set Works”

“How to Whirlpool on the Desktop with RoninDojo”

“How to Maintain Privacy When Using Mixed Bitcoin”

“Federated Chaumian Mints: The Future Of Bitcoin Privacy?”

In addition to educating newcomers about privacy practices, we should all work to create a bitcoin-powered parallel economy where we don’t need fiat offrampers. This is the ultimate goal.

El Zonte in El Salvador and other local communities have shown us how to follow in their footsteps.

“On the Coast of El Salvador, Bitcoin Becomes the Standard”

“Bitcoin Ekasi: The Township One Year Later”

“Bitcoin Beach Brazil: Inspired by El Salvador”

“‘Bitcoin Valley’ Hub Launches in Honduras”

The future of bitcoin is bright if we can get enough people on the bitcoin lifeboat. We shouldn’t argue about which road they took to get there, but educate them about the most private ways to do it.

Stay focused on the mission. Educate others. Stack rate.

This is a guest post by Robert Hall. Opinions expressed are entirely their own and do not necessarily reflect the opinions of BTC Inc. or Bitcoin Magazine.