Bitcoin addresses with non-zero balances may soon reach record highs – what this means for BTC price

According to Glassnode data, the number of Bitcoin wallet addresses with non-zero balances could soon reach an all-time high, with the recent price surge that has seen the value of the world’s largest cryptocurrency jump by nearly 40% this year apparently taking hold. new investors.

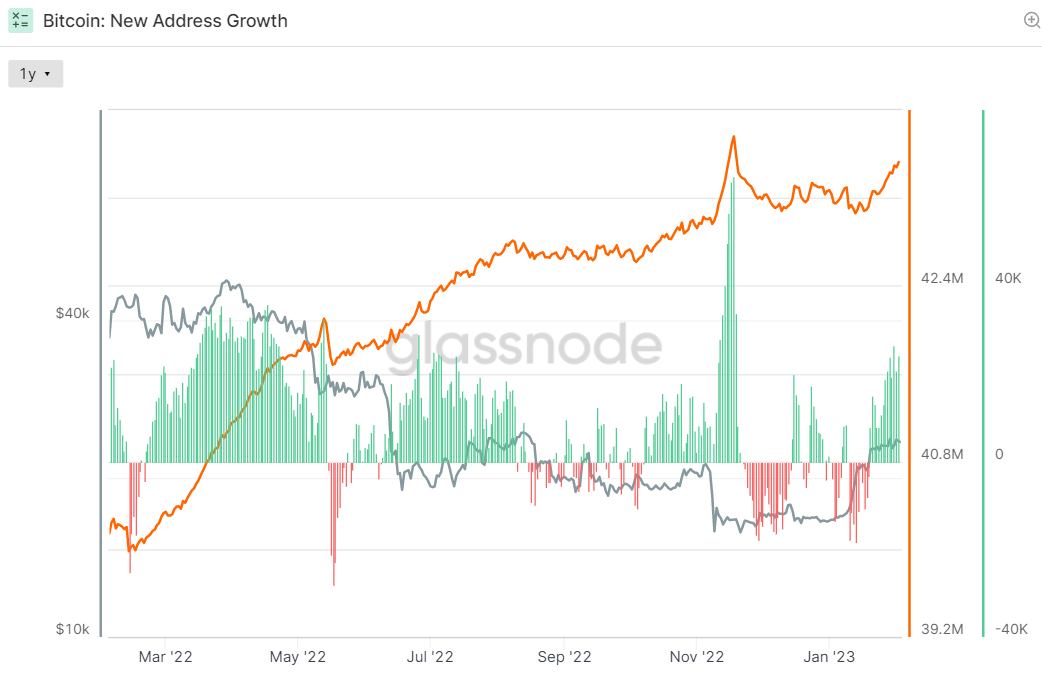

According to the crypto analytics firm, there were 43,525,546 Bitcoin addresses with a non-zero balance on February 2nd, up nearly 300,000 from this time last month. The record number of non-zero addresses of 43,759,663 was hit in the immediate aftermath of the collapse of what had previously been one of the world’s largest cryptocurrency exchanges FTX last November.

At the time, this sparked a rush to withdraw crypto from exchanges, with many Bitcoin owners apparently creating a self-custodial wallet for the first time. However, capitulation as prices fell over the following month resulted in non-zero Bitcoin wallet numbers quickly falling back to pre-FTX collapse levels.

But the recent rise in non-zero address numbers suggests that, amid Bitcoin’s impressive rally since the beginning of the year, investors are once again returning to the Bitcoin market in greater numbers than they are leaving it. If the number of non-zero wallet addresses continues to rise at the rate it has over the past few weeks, a new record could be reached by the end of the month/beginning of March.

What does this mean for BTC?

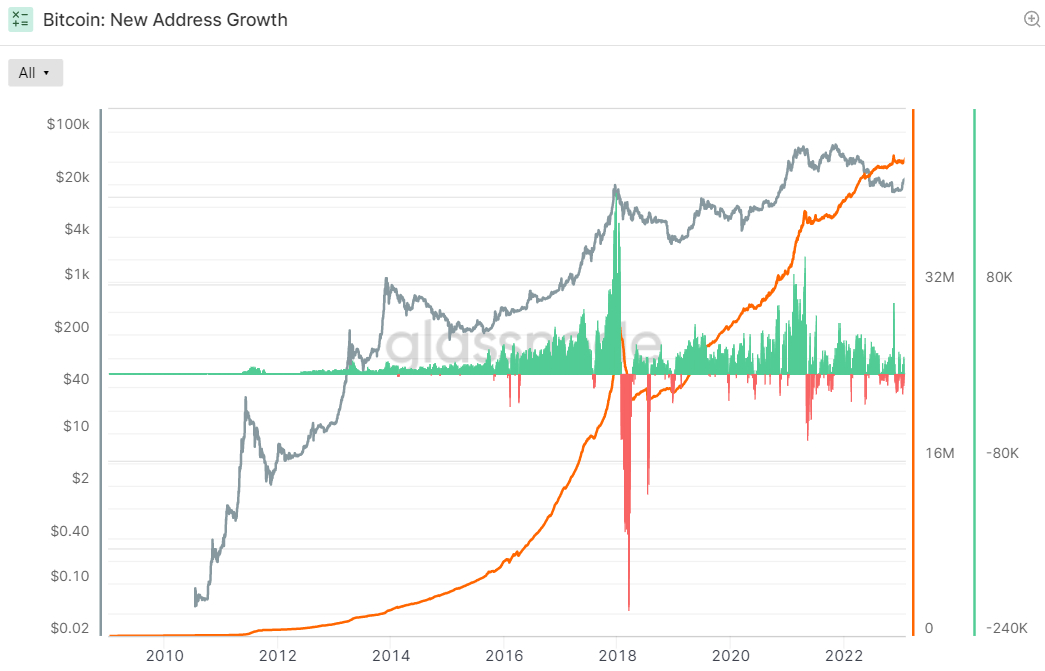

Despite the bear market of 2022, the number of non-zero Bitcoin addresses continued to rise steadily. However, in previous bull market cycles, such as in the run-up to the 2017 peak and in late 2020/early 2021, the pace of creation of new non-zero addresses has been much faster.

In the absence of sustained rapid growth in the number of non-zero wallets, an indication of new investors entering the market to pump prices, Bitcoin may struggle to gain further ground. Bitcoin bulls will thus be hoping that the recent surge in non-zero address numbers represents the start of a sustained rally, and that the prospect of Bitcoin being in the early stages of a new bull market will continue to attract new buyers.

In fact, several separate leading indicators on the chain are all flashing bullish signs. As discussed in a recent article, seven out of eight key on-chain indicators and technical indicators tracked by crypto analytics firm Glassnode’s “Recovering from a Bitcoin Bear” now signal that the next Bitcoin bull market may be here. Glassnode’s dashboard analyzes whether Bitcoin is trading above key price models, whether network exploitation momentum is increasing or not, whether market profitability is returning, and whether the balance of USD-denominated Bitcoin wealth is in favor of long-term HODLers.

However, things could be bumpy for Bitcoin in the near future. Bitcoin initially rallied in the wake of a not-so-hawkish-as-feared Fed policy announcement on Wednesday, but a super-strong US jobs report just released in January has revived bets that the US economy can finally avoid recession this year . That could mean the Fed raises interest rates longer, a prospect that could trigger short-term profit-taking in Bitcoin.