Bitcoin: A Flash Crash and a Look at the Basics (BTC-USD)

spawns/iStock via Getty Images

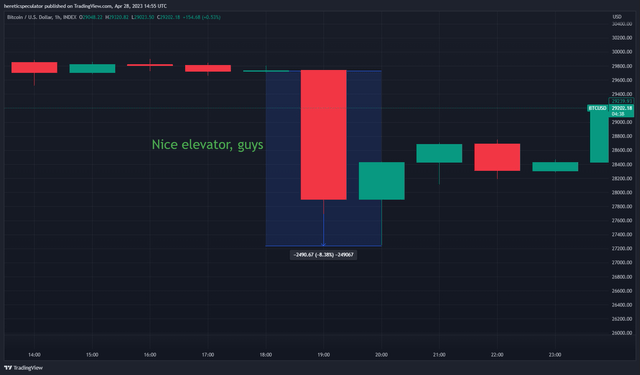

In one of the more bizarre price movements we’ve seen in the crypto market in a while, it was the stairs up and the elevator down for Bitcoin (BTC-USD) on Wednesday. Bulls and bears both took it on the chin at various points during the session. First, bulls pushed the price up to $30,000 from a Tuesday close of $28,300.

BTC 1 Hour Chart (TradingView)

So late in the Wednesday session, BTC’s dollar rate crashed by more than 8% in a 90-minute time frame from $29,700 down to $27,200 before somewhat amusingly ending the Wednesday session back at $28,400. In the process, more than $2.5 billion in open interest was wiped out under the single elevator light.

What caused it?

There was some speculation that the dump was caused by rumour-related panic sell following a $26.6 million BTC deposit to Binance from market maker Jump Trading. This deposit was alerted via Twitter by chain analysis company Arkham Intelligence and was in close proximity to a false alert that the US federal government was actively selling seized BTC holdings from the Silk Road confiscations. That notice was attributed to Arkham.

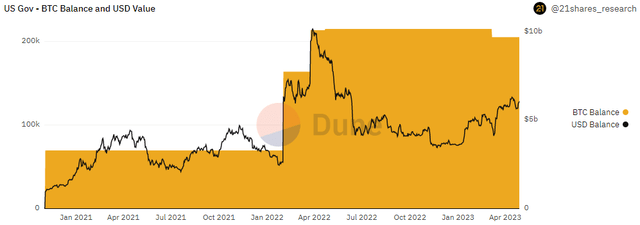

US Gov BTC Holdings (Dune Analytics/21Shares)

That turned out not to be true as the US government’s balance is still well over 205k BTC and hasn’t reached since the beginning of March. Arkham’s explanation online was that the alert actually happened, but that was it incorrectly configured at the user end of a well followed crypto news account on Twitter. The account then shared the incorrect information online.

Onlookers mistakenly attributed the drop in BTC’s price to Jump Trading reacting to the Arkham Silk Road fund alert, when in reality it was Jump’s deposit an hour earlier. The end result was a highly volatile Wednesday session that closed at roughly breakeven, but not before traders lost billions in the process.

Network measurements

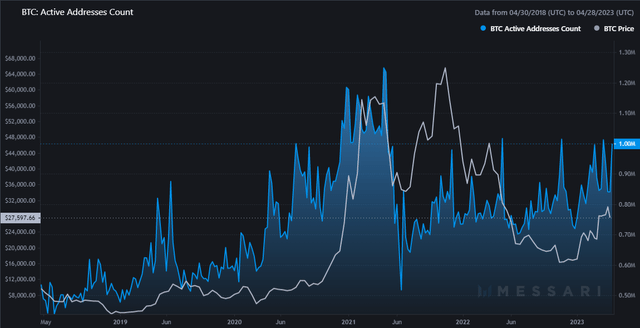

In terms of actual activity on the network, Bitcoin’s usage has remained stable over the past few weeks, and we see that activity reflected through a generally positive trend in daily active users:

Active addresses (Messari)

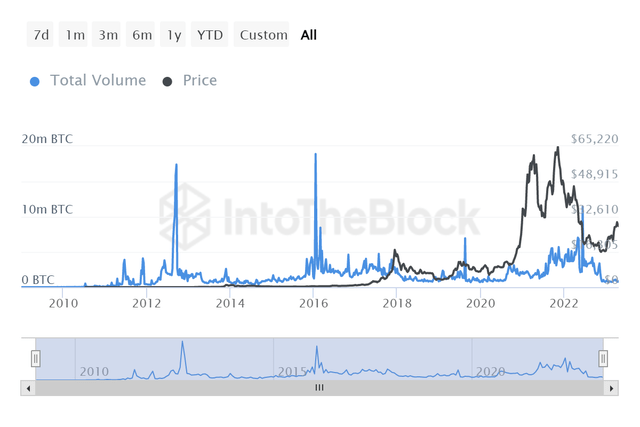

DAUs on the main team have fluctuated between 800k and 1 million over the last few weeks. Raw transaction numbers have increased in recent days according to data from IntoTheBlock. However, despite the increase in total transactions, the BTC volume of transactions has remained low compared to 2022 levels.

BTC Transaction Volume (IntoTheBlock)

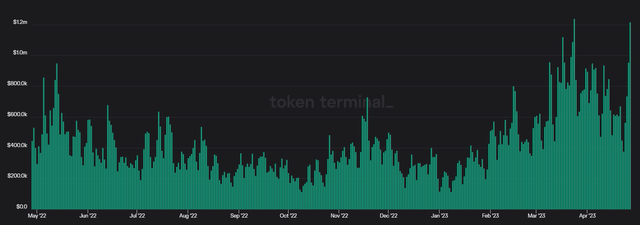

After cooling off for much of April, there has been a noticeable jump in daily charges over the last couple of days:

BTC Daily Fees (Token Terminal)

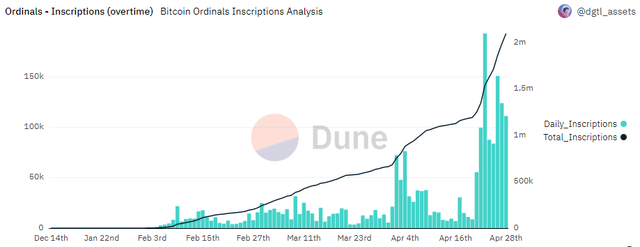

In my opinion, this can probably be attributed to another increase in the Ordinals coins. Adoption of Bitcoin’s controversial NFT project Ordinals continues to make new daily inscriptions. There have now been over 2 million NFTs minted with Bitcoin’s block space since that project launched a few months ago.

Ordinals Daily Mints (Dune Analytics/dgtl_assets)

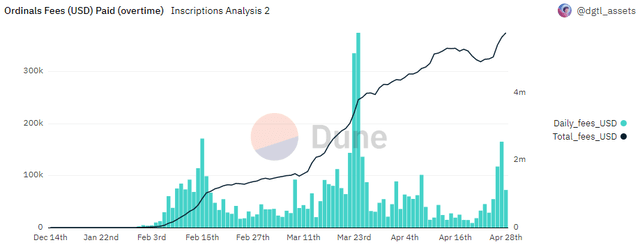

However, what has been different about this latest increase higher in Ordinal’s mint has been the lack of an increase in transaction fees until the last couple of days.

Ordinal Fees (Dune Analytics/dgtl_assets)

We can see from the chart above that daily fees paid to enter Ordinals dropped from a peak of $375k on March 24th down to just $8.8k on April 20th. This recent uptick in daily subscriptions has resulted in more fee income than was evident during the early April subscriptions.

Other considerations

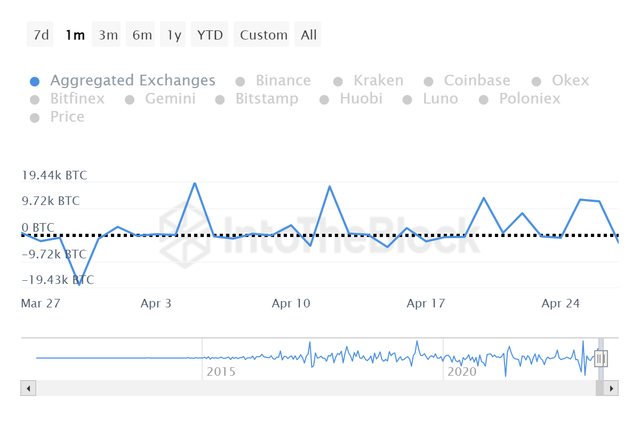

Another important metric to consider when guessing where the BTC price is going in the short to medium term is currency flows. Usually, when the exchange rate is net negative, it means that buyers are piling up and taking assets into their own custody. Conversely, when net dividend flow is positive, it may be a sign that holders want to take profits.

Exchange net flows 1 month (IntoTheBlock)

According to data provided by IntoTheBlock, aggregate exchange flows have been positive by almost 76k BTC since the beginning of April. That represents $2.2 billion in positive net flow over the past 27 days. I would call it a fairly bearish development in the short term.

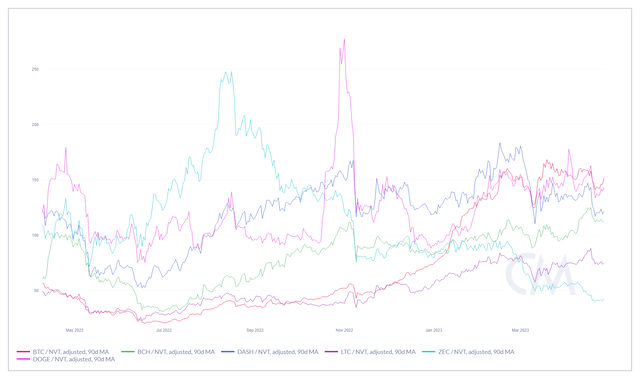

90 day NVT (CoinMetrics)

Something else I often point to when looking at these more payment-focused cryptocurrencies is the NVT ratio. NVT uses the USD value of the transaction volume and market capitalization of each cryptocurrency to try to determine when a coin is moving more based on speculation rather than when it is moving due to an increase in value being transacted. The higher the NVT, the more overvalued the coin is theoretically.

The day-to-day variation of this calculation can be very volatile, so to smooth it out, I like to look at the 90-day adjustment. Bitcoin’s 90 day NVT ratio is still above 150. It has gone from the cheapest PoW coin by NVT last summer to the most expensive now. There is no standard rule for what a low NVT is or what a high NVT is. Personally, I think 150 is high. I take that view because before February of this year, the last time BTC was above 150 on a 90 day adjusted NVT was in November 2013.

Summary

There are many lessons that crypto participants can take from the Jump/Arkham debacle. From where I sit, the most important thing to watch is the chains, not the Twitter feed. I would also be very careful when using leverage in these assets. Market participants who buy and hold with confidence were not wiped out on Wednesday. It was the day traders and margin bettors who did it.

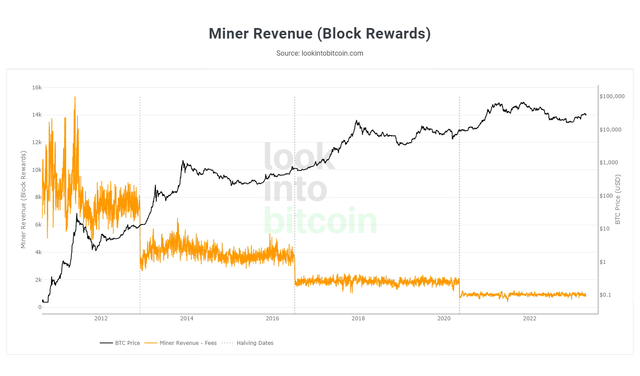

Block reward vs price (LookIntoBitcoin)

A Bitcoin halving is a year away. If history holds true, BTC’s dollar-denominated price will be much higher in 18 to 24 months than it is now. Dollar cost averaging holders who don’t play the margin game are likely to do very well after the halving. At this point, the last thing a Bitcoin bull should want is to be wiped out through leverage before the next cycle starts. The risk certainly remains, and there is no guarantee that BTC will continue to behave the way it has after previous halving events.

Considering everything I’m seeing on the chain, I’d probably be cautious rather than aggressive at this point. It is very possible that we will see a higher BTC price in the weeks and months ahead. There are positive signs from a usage and holder growth point of view. However, I think in the shorter term, bulls looking to aggressively scale a position rather than dollar cost averaging over time can probably be patient and wait for a better price.