Bitcoin: A fall in these holders could spell trouble for BTC because…

- Bitcoin whales fall to a new two-year low

- Bitcoin also showed resistance at the $17,000 level

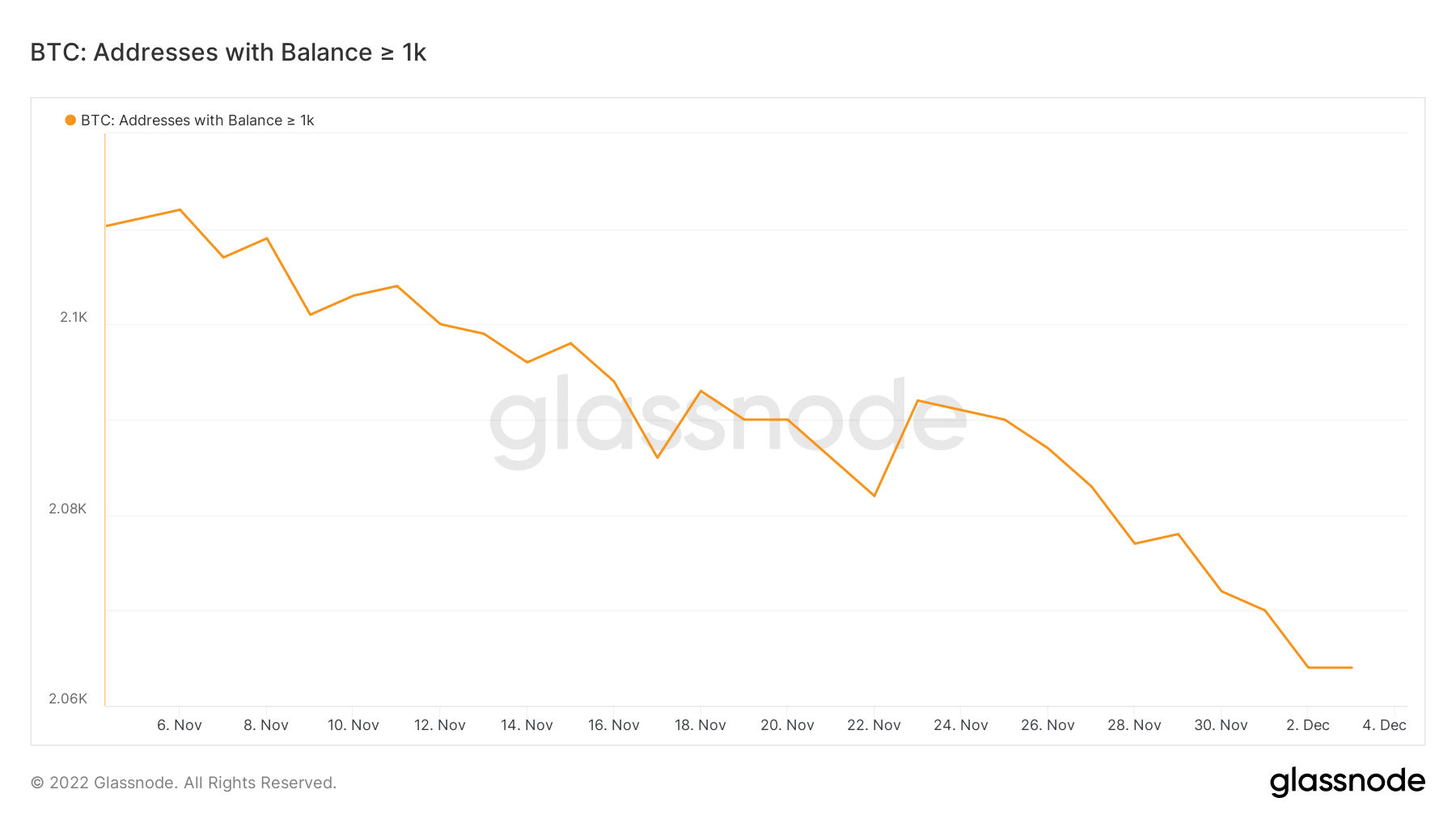

Bitcoin [BTC] managed to bounce back above the $17,000 price range. While the current expectation was that it could continue to increase, whale activity suggested otherwise. According to a recent Glassnode update, the number of Bitcoin whales has been on the decline.

📉 #Bitcoin $BTC The number of whales just hit a 2-year low of 1,665

The previous 2-year low of 1671 was observed on November 22, 2022

See calculation: pic.twitter.com/CPJxLaybbH

— glassnode alerts (@glassnodealerts) 4 December 2022

Read Bitcoins [BTC] price forecast 2023-2024

The Glassnode update revealed that the number of whales holding BTC dropped to the lowest levels in the past two years. According to the update, the number of whales was lower than it was on 21 November. Furthermore, the latter happens to be the date when Bitcoin fell to its current 12-month low.

Such a decline often indicated that whales have sold or lack of strong demand from whales. The above observation can also be consistent with the monthly decrease in the number of addresses that have more than 1000 BTC.

Source: Glassnodeitcoi

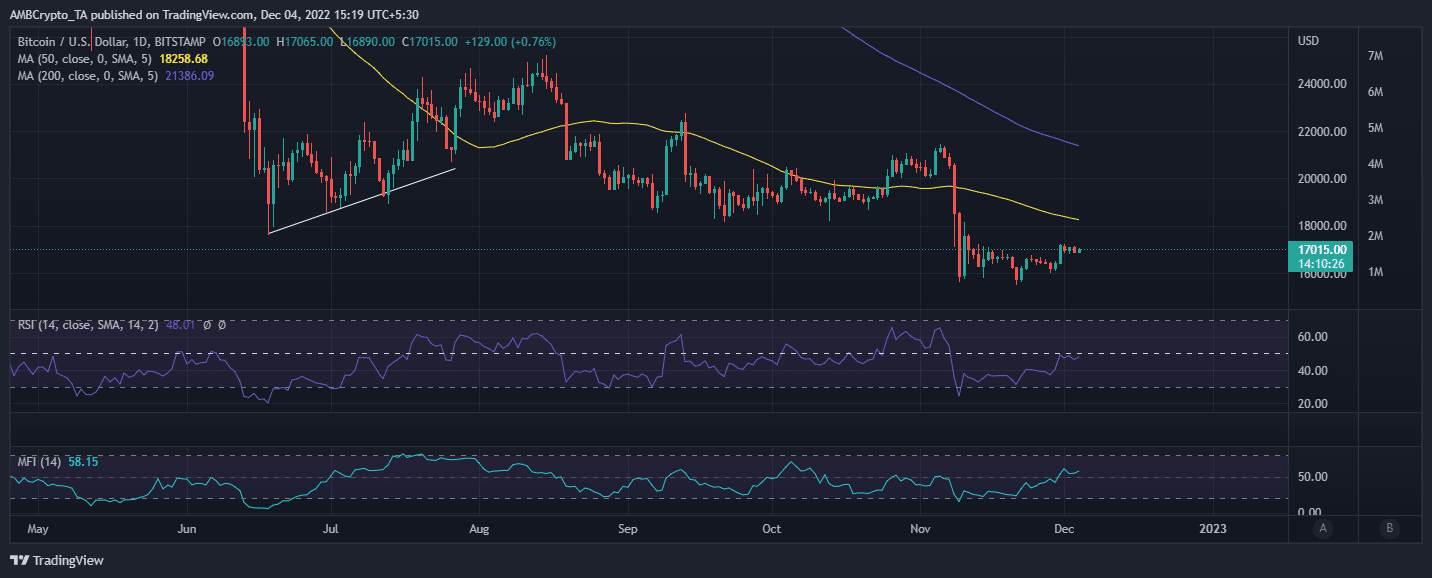

Despite the observed lower interest from whales, Bitcoin’s current price level indicated significant accumulation to support the weak upside. This was especially compared to the current monthly low. In particular, it showed some resilience above the $17,000 price level.

Source: TradingView

But why has the price gone up despite lower participation from the whales? A potential explanation could be that retail traders have been aggressively accumulating BTC. This may explain why the Money Flow Indicator (MFI) could have achieved notable upside since the second week of November. It also explained why the upside may be weak or relatively limited.

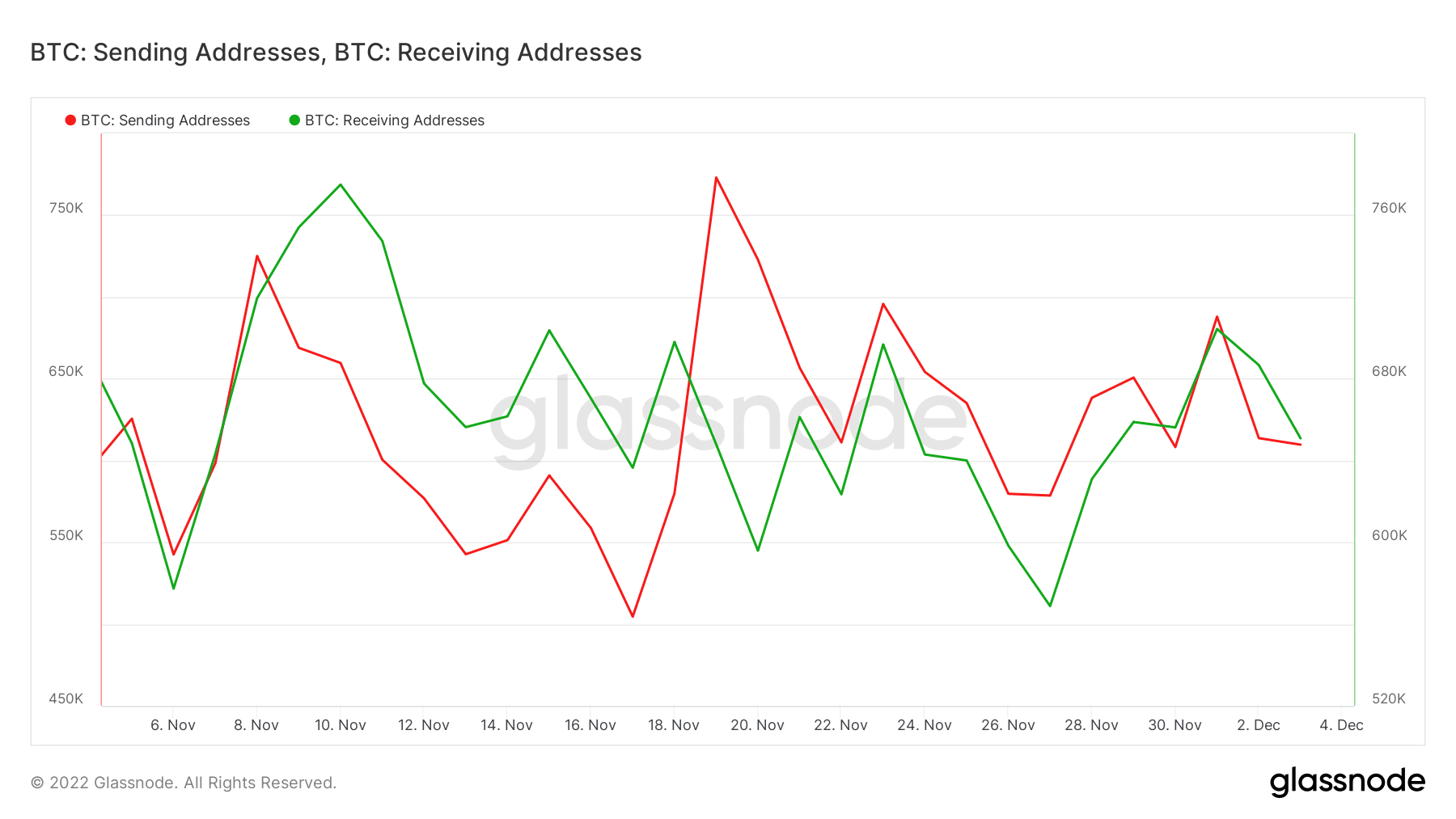

Assessing the prevailing retail demand for Bitcoin

A look at the shipping and receiving addresses further supported the above conclusion about the retail segment supporting the upside. According to the latest Glassnode readings, the number of receiving addresses outweighed the sending addresses.

In other words, the buying pressure exceeded the prevailing selling pressure. This explained why BTC managed to stay above $17,000 in recent days.

Source: Glassnode

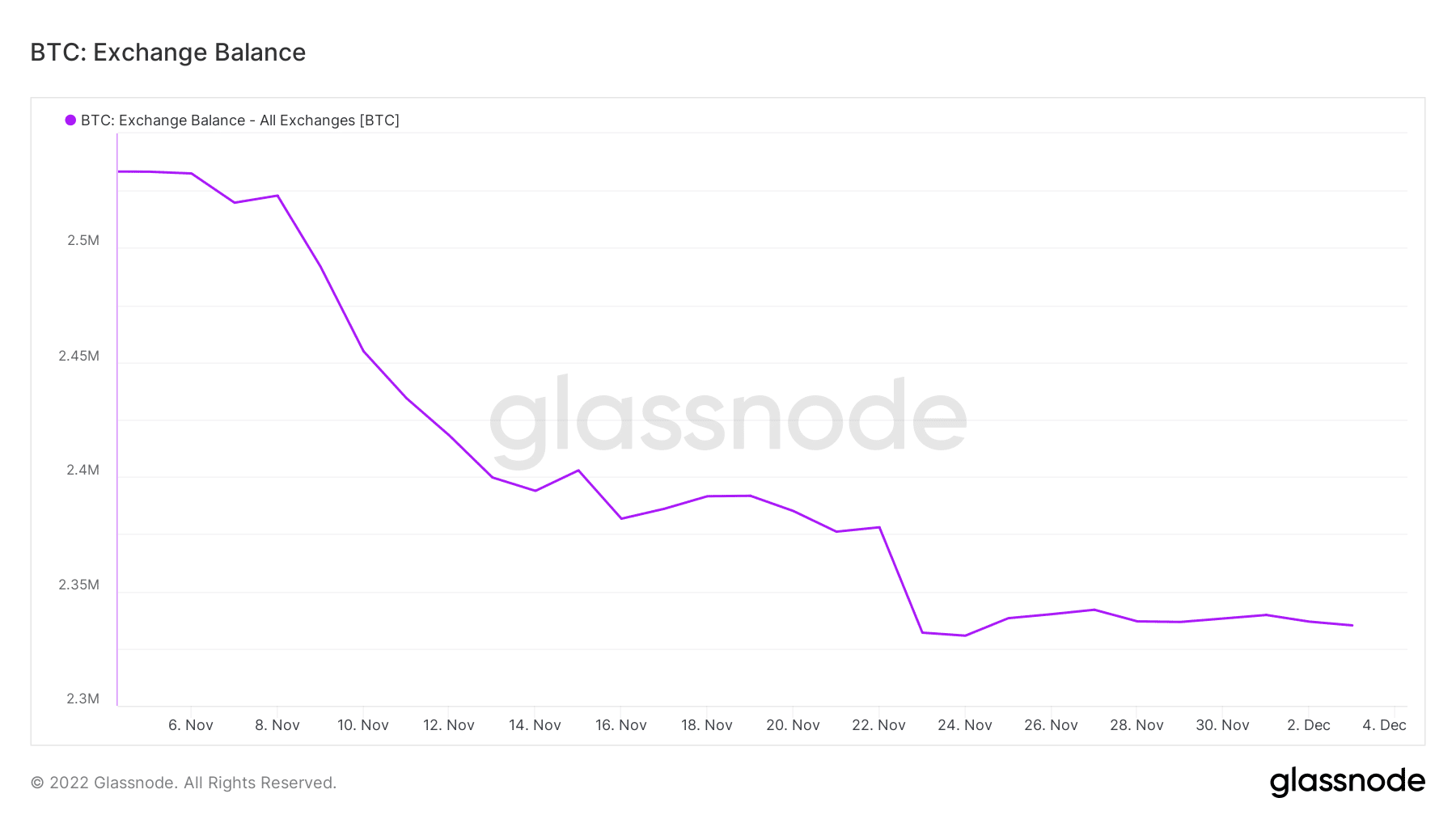

Additionally, the lack of more downside may have been supported by the fact that foreign exchange balances have not increased. Instead, the balance of Bitcoin on exchanges remained within its monthly lows. This was confirmation around the absence of significant selling pressure to support more downside thanks to strong retail demand.

Source: Glassnode

Bitcoin will likely continue to move sideways if current market conditions prevail. Lack of whale participation may also mean that demand will remain limited. Furthermore, it may not give more upside in the short term. Especially if retail runs out.

The current situation also suggested that there was a likelihood that the selling pressure would return. On the other hand, traders could see continued bullish momentum if whales regain interest in BTC.