Bitcoin: A 10-Minute Addition in Mining Blocks Says This About BTC’s Fragile Future

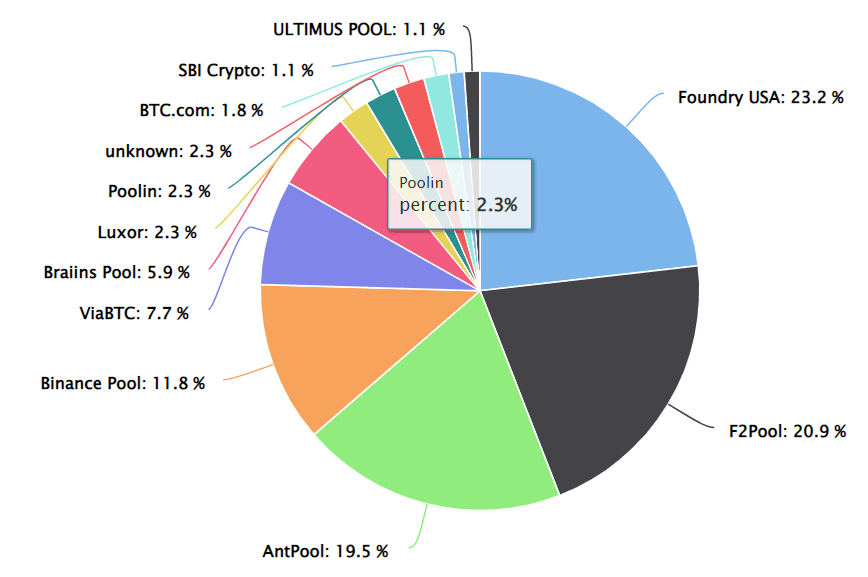

On October 17, it took over an hour to mine a block with Bitcoin [BTC], placing thousands of transactions in limbo until the mining process was completed. According to on-chain information prepared by a couple block explorers85 minutes elapsed between the last two blocks mined by Foundry USA (which controls over 23% of the mining pool) and Luxor.

At block height 759053-054, mining took an unprecedented 85 minutes, far exceeding the approximate 10-minute time frame. Before the last block could be mined, more than 13,000 transactions were stuck in the confirmation phase.

________________________________________________________________________________

Here is AMBCryptos Bitcoin price prediction [BTC] for 2022-23

________________________________________________________________________________

Source: btc.com

Mining difficulties up, profitability down

The exact cause of the block generation delay was unknown, although one can be reasonably postulated. The mining difficulty for BTC increased, making it more challenging to obtain new blocks.

Also, the hashrate increased, which meant that more energy was used to generate and add new blocks than was possible a few months ago. As a direct result of the worldwide increase in electricity prices, mining became more expensive than ever. Sustainable power sources were the obvious choice, but building a system large enough to power mining machines is prohibitively expensive.

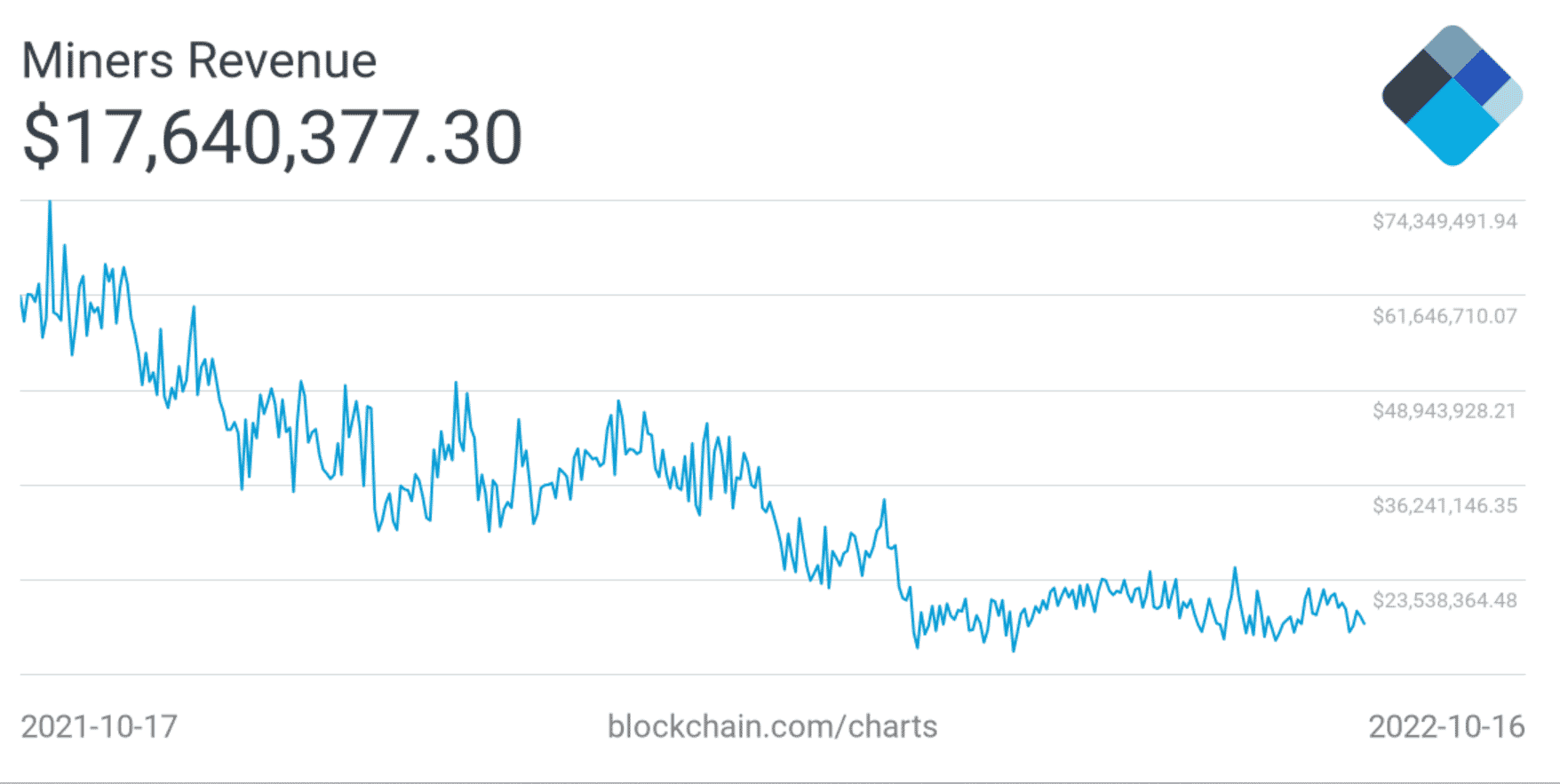

Source: Blockchain.com

The income chart indicated a drop, showing that mining was less profitable, despite the costs associated with it. This loss can be attributed to a number of variables, including the falling value of BTC and the decreasing size of the block reward.

Additionally, the unprofitability of BTC mining caused some mining companies to shut down during the crypto bear market. The existing miners may have felt the effects of this extra load, hence the delay.

Source: Blockchain.com

BTC resistance

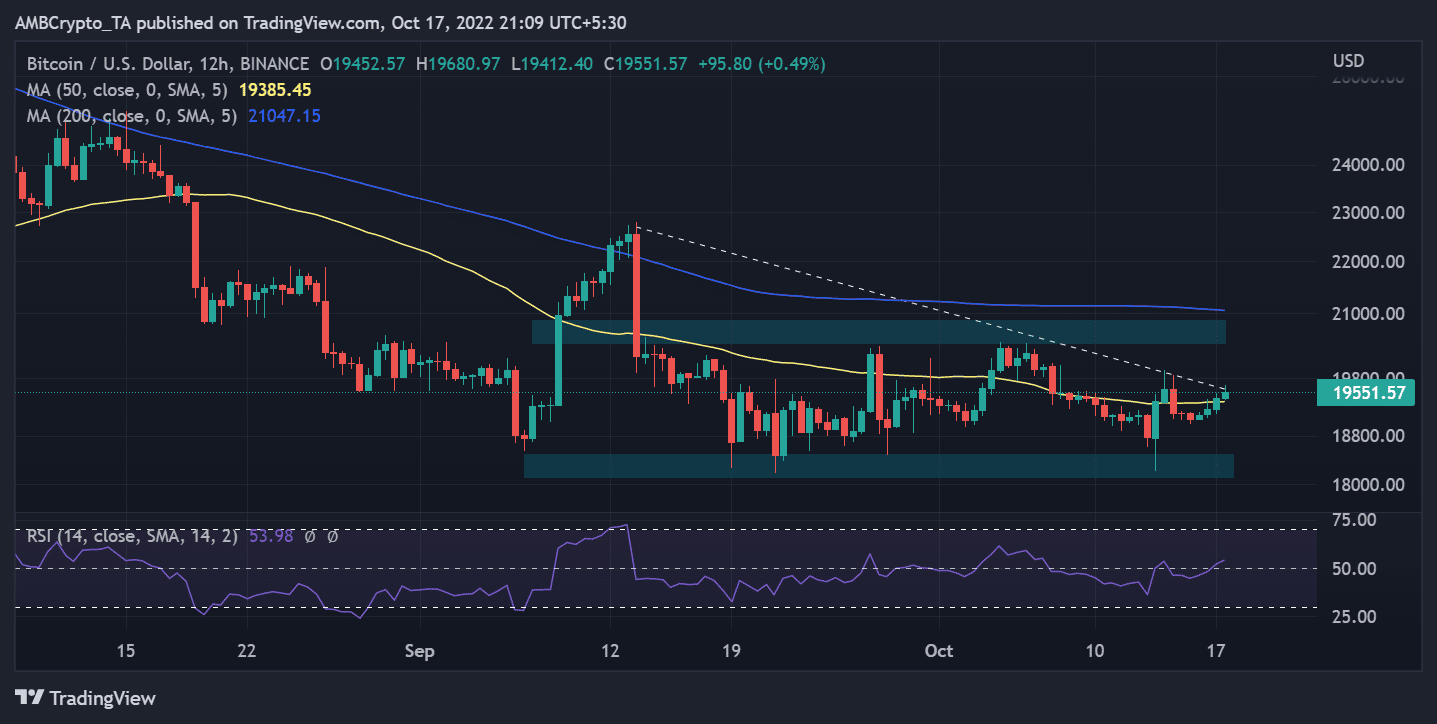

This delay in the addition of blocks did not seem to have any impact on the price of BTC. When the price movement was looked at in a 12-hour period, it had increased by more than 0.60% as of October 17. However, the trendline showed a downward trend in the overall trend of BTC.

The resistance to the price action appeared to have been there between $20,418 and $20,865. The support levels, which were seen to be in the area of $18,500 and $18,104, appeared to hold.

A bit above the resistance levels, as seen by the blue line, was the 200 Moving Average, which effectively acted as another resistance. TThe 50 Moving Average was seen to have acted as resistance as well, but it had appeared to have been breached during the 12-hour time frame.

Source: TradingView

An insurmountable failure

The period of China’s cryptocurrency ban produced Bitcoin’s slowest block time. Block addition passed 100 minutes in 2021, a year in which China stepped up its campaign against cryptocurrencies.

BTC trading volume within 24 hours reached over $26 billion, according to Coinmarketcap, as of October 17. Millions of transactions would be backed up if blocks kept failing. This will reduce Bitcoin’s attraction and may negatively affect its price.