Bitcoin (22k), Ethereum (1.5k), Cardano Price Analysis

by James · July 25, 2022

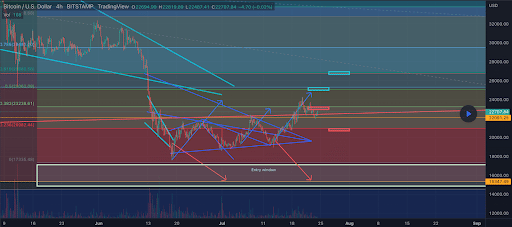

Bitcoin Analysis

Bitcoin’s price ended Sunday’s daily session in the green, snapping four days of consecutive selling pressure from bearish traders. BTC closed Sunday’s daily candle +$133.2.

The first chart we lead our price analysis off of this week is BTC/USD 4HR Chart below from Auronex. BTC’s price is trading between 0.236 [$20,982.44] and 0.382 [$23,238.61]at the time of writing.

The short-term overhead targets for bullish BTC traders is 0.382, 0.5 [$25,062.08]and 0.618 [$26,885.56].

Bearish BTC traders looking for a reversal to the downside looking first at the 0.236 level with a secondary target of a full retracement of 0 [$17,335.48].

Bitcoin’s moving average: 5 days [$22,759.92]20 days [$20,926.36]50 days [$24,599.34]100 days [$32,374.48]200 days [$40,909.66]Year to date [$35,057.11].

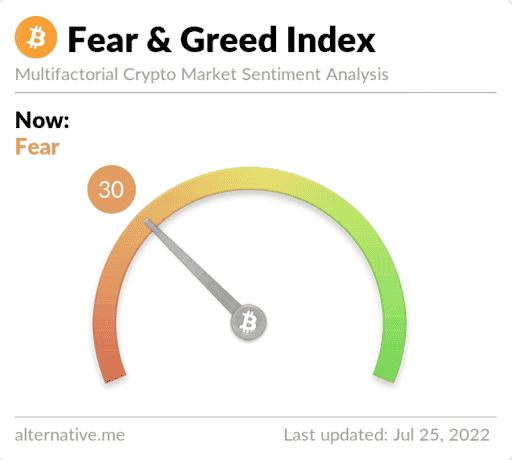

The fear and greed index is 30 Fear and is even for Sunday’s reading.

BTC’s 24-hour price range is $22,261-$23,006 and its 7-day price range is $20,806-$24,160. Bitcoin’s 52-week price range is $17,611-$69,044.

The price of Bitcoin on this date last year was $35,407.

The average price of BTC for the last 30 days is $21,039.02 and +7.2% over the same duration.

Bitcoin’s price [+0.59%] closed its daily candle worth $22,579.2 on Sunday.

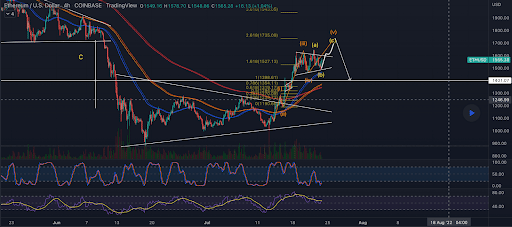

Ethereum analysis

Ether price also climbed higher on Sunday and ended its daily session at +$48.66.

The second chart we analyze this Monday is ETH/USD 4HR Chart under Big_Mike716. Ethers outperformed BTC by 23.53% over the last 30 days and bulls hope to eclipse 2.618 [$1,527.13] next level.

Bearish Ether traders is conversely looking to push ETH’s price back below 1.618 [$1,527.13]. The second target for bearish traders is 1 [$1,398.61] followed by a third target to the downside of .786 [$1,354.11].

Ether’s Moving Average: 5-day [$1,533.06]20 days [$1,242.36]50 days [$1,481.29]100 days [$2,188.16]200 days [$2,916.89]Year to date [$2,424.85].

ETH’s 24-hour price range is $1,545.67-$1,664.34 and its 7-day price range is $1,359.22-$1,664.34. Ether’s 52-week price range is $883.62-$4,878.

The price of ETH on this date in 2021 was $2,190.59.

The average price of ETH for the last 30 days is $1,256.4 and +39.2% over the same time frame.

Ether price [+3.14%] closed its daily candle on Sunday worth $1,598.22 and in the green for the second day in a row.

Cardano analysis

Cardano’s price ended in negative numbers on Sunday and -0.005 dollars.

For the third chart today we analyze ADA/USD 1D Chart from Trade_Journal.

Traders will take note ADA’s price is trading just above the heart line of the current descending channel which dates back to the end of 2021.

Cardano’s price trades between two important levels. Bullish traders looking for a return to the $0.64-$0.67 range.

Bearish ADA traders reverse is aiming to send ADA’s price back below the heart line and down again to test the $0.395-$0.43 range.

Cardano’s moving average: 5-day [$0.49]20 days [$0.46]50 days [$0.50]100 days [$0.70]200 days [$1.07]Year to date [$0.83].

Cardano’s 24-hour price range is $0.497-$0.536 and its 7-day price range is $0.455-$0.539. ADA’s 52-week price range is $0.4-$3.09.

Cardano’s price on this date last year was $1.22.

The average price of ADA in the last 30 days is $0.47 and its +8.89% over the same period.

Cardano’s price [-0.97%] ended its daily session worth $0.512 on Sunday and in the red for the second time in the last three days.