Bitcoin: 10 years ago Cyprus (Cryptocurrency: BTC-USD)

Ahmed Zaggoudi/iStock via Getty Images

In March 2023, it will be ten years since the Cypriot bank bailout. Without going into all the brutal details of what caused the problems, on a strictly human level the consequences of the banking crisis were profound. After making a deal that would see banks “bailed in” at the expense of depositors, banks closed and rationed withdrawals in an attempt to prevent a total influx of assets:

There are fears that as soon as the banks open their doors, Cypriots will try to withdraw as much money as they can from their accounts.

Depositors were effectively locked out of their accounts, and the idea of non-custodial digital currency immediately began to gain momentum.

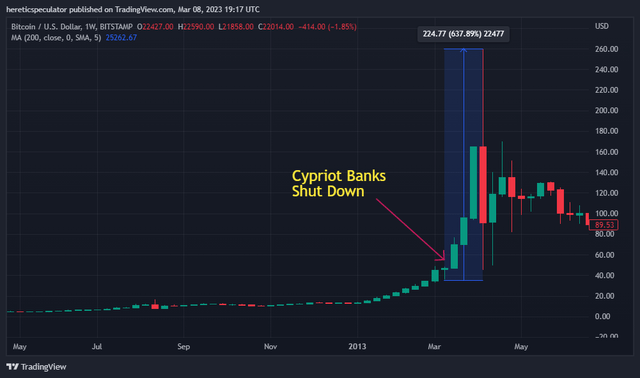

Bitcoin Moons After Cyprus

It may not be well understood by Bitcoiners who have joined the network in this last bull run, but the Cypriot banking crisis led to a bit of a party for Bitcoin (BTC-USD) back in 2013:

Weekly BTC Chart (Trade View)

2013 was still very much the early days of the network. Aside from the Winkevoss twins and perhaps a handful of other notable investors in Silicon Valley, very few people were talking about, let alone buying, bitcoin at the time. But that changed when BTC owners enjoyed a 600% rally in just a few weeks after the Cyprus bank bailout. Suddenly, the mainstream media recognized the connection between the rise in bitcoin’s price and the crisis in Cyprus:

Today it is worth $72, largely due to “incremental interest” from euro and Russian ruble holders terrified of the situation in Cyprus, said Nicholas Colas, market strategist at ConvergEx Group, a financial technology firm in Manhattan.

After the big price spike, non-zero bitcoin wallet addresses rose by 22% by the end of April 2013.

Network growth

Over the past 10 years, the growth of Bitcoin has continued, far outstripping the price of BTC in dollars – which at $22k is still up a staggering 62,000% since the Cypriot banking crisis. At the time, the annual inflation rate of BTC was over 14%. Today, annual inflation is now below 2%.

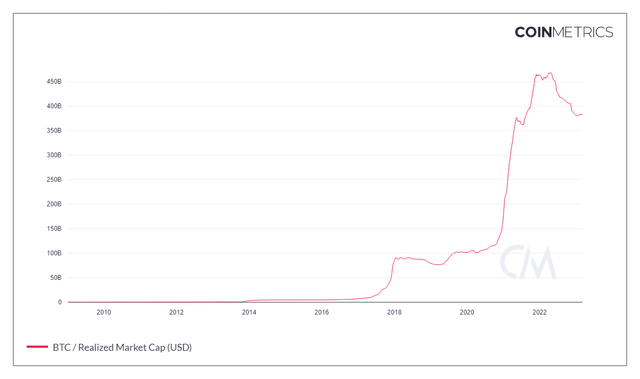

BTC Realized Cap (CoinMetrics)

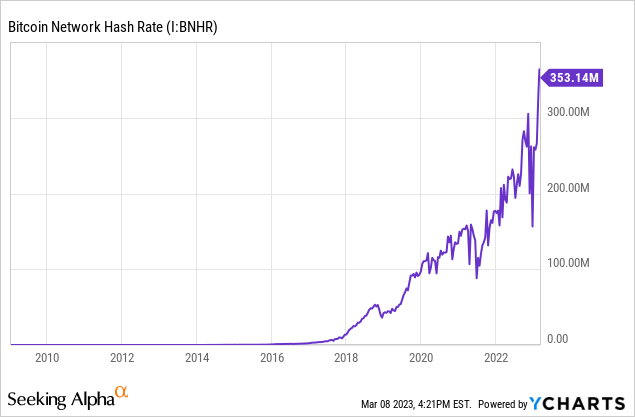

When we adjust our market valuation framework to realized cap in an attempt to take into account all the new coins that have come into circulation since Cyprus and the price that has been paid for those coins, we can really get a sense of how incredible the valuation of bitcoin is. the journey has been for the last 10 years. In mid-March 2013, the realized ceiling was 156.2 million dollars. It is now almost $382 billion, a simply astronomical increase. And this is overshadowed by the growth in average hash rate which can only be described as parabolic:

The average hash rate, or computing power allocated to securing Bitcoin, is up 852 million percent since Cyprus. From a user standpoint, we’ve seen clear network adoption in the key metrics, judging by the 3,353% increase in non-null wallet addresses and the 1,581% increase in active addresses:

| March 15, 2013 | March 7, 2023 | Change | |

|---|---|---|---|

| Non-null wallet addresses | 1,289,445 | 44,524,030 | 3353% |

| Active addresses | 63,245 | 1,063,023 | 1581% |

| Daily transactions | 62,880 | 360,867 | 473.9% |

| Annual inflation rate | 14.4% | 1.95% | -86.5% |

| Equality of supply | 0.007956 | 0.1074 | 1250% |

Source: CoinMetrics

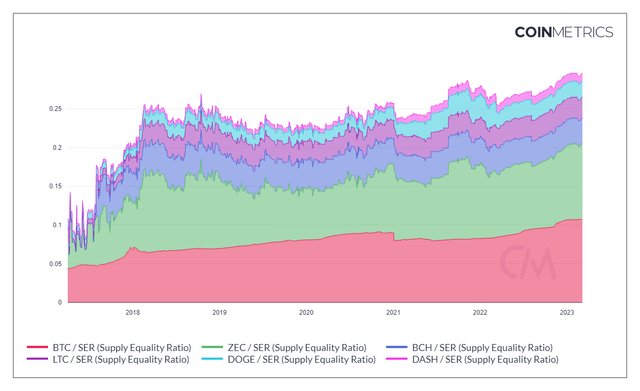

What I find very interesting from the table above is the Supply Equality Ratio, or SER. According to CoinMetrics, SER is similar to a 20:20 asset ratio in traditional finance:

Instead of income, SER looks at offers held by different accounts in a network. It compares the poorest accounts (the sum held by all accounts with a balance less than 0.00001% of the supply) with the richest accounts (the sum held by all the top 1% addresses)

Essentially, SER tells us whether the coin supply is well distributed or not. To provide some context for Bitcoin’s SER compared to other cryptocurrency networks, I show SER trends for the various payment-focused Proof of Work coins in this chart:

SER PoW Coins (CoinMetrics)

While Zcash (ZEC-USD) actually comes pretty close to Bitcoin’s SER, no other cryptocurrency is distributed among large holders and small holders as well as bitcoin is, and this distribution has only improved over the past decade.

Why does Bitcoin exist?

Is it a store of value or a medium of exchange? I don’t know if anyone really knows for sure what the network will be in ten years. Throughout history, I would argue that bitcoin has been a very simple narrative trade when you remove all the noise. The most straight forward way I think we can look at BTC is as a bet against the current system. Hedge against inflation? More debatable. But it is to a large extent a safeguard against bank deposits and central planning.

And it is a safeguard that I believe requires attention. Cyprus is perhaps the most serious example of bank/depositor fraud. But even the recent Canadian trucker protests showed why decentralized currencies should be considered:

The prime minister has invoked emergency powers that allow him to “manage” banks and insurance companies. Despite the fact that peaceful protests are constitutionally protected in Canada’s Charter of Rights and Freedoms, two key protest organizers were arrested in the capital Ottawa last week. GoFundMe fundraisers have been shut down and bank accounts have been frozen without a court order.

When GoFundMe was compromised, Canadian protesters found financial help through Bitcoin. But the bigger issue here isn’t even protesting or bypassing the state, it’s simply wise to secure the trust of third parties by putting some trust in yourself. Paul Krugman doesn’t appear to be suspected of any crimes, but even he found his Venmo account useless on Wednesday. He said on Twitter:

I have used Venmo for years but now it won’t allow me to make payments. I spent a long time chatting with representatives and they told me they can’t explain why – or fix it. The software has taken control.

Krugman’s problem ended up being dealt with, but the cost of his transparency came with a sound thump from crypto advocates who first pointed out how Krugman’s earlier view of managers was contradicted by his own experience. And then again with the same ones crypto advocates notes how most people can’t just tweet their displeasure to 4.5 million followers to get attention for their problem. This is why the distribution of BTC is so important; guys like Paul Krugman, Charlie Munger and Jamie Dimon don’t need bitcoin. But the “dirty masses” maybe.

Investor Takeaway

‘Not your keys, not your coins’ is a lesson that apparently needs to be learned again and again as history finds ways to repeat itself. It is very easy to sit comfortably in the Western world with a perception of safe and regulated banking institutions and not understand why anyone would feel compelled to buy assets that live outside of that world. But history shows that banks are capable of making bad plays or bad decisions.

Even the banks servicing crypto markets, as we just learned from Silvergate Capital (SI), can succumb to bad choices. 10 full years ago Bitcoin’s 600% rally in one month in response to the Cyprus banking crisis would indicate that this is an asset that has staying power.

PEACE

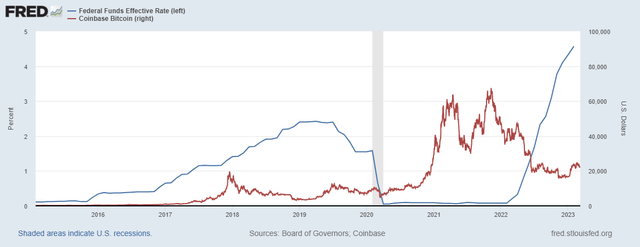

Bitcoin has seen several face-rending demonstrations since Cyprus. One thing Bitcoin has yet to see is a rate hike cycle quite similar to the one we are currently in. Price is price and it will fluctuate. Holders, hashrate, transactions and active addresses tell the real story. How valuable is code? It may depend on whether your bank allows you to use your money or not.