This is the monthly market insight report for June 2022 of Bitcoin.com Exchange. In this and subsequent reports, expect to find a summary of crypto market results, a macro recap, market structure analysis and more.

Crypto Market performance

The crypto markets continued on a downward trend as BTC and ETH fell 30% and 44% respectively over the last 30 days.

The macroeconomic outlook continues to be unfavorable for risky assets as high inflation is combined with high commodity prices and tight labor market conditions in the United States. In addition, crypto has experienced a credit crisis as large loan / loan players such as Celsius, 3AC and Babel Finance have gone bankrupt.

Despite the large losses seen on BTC and ETH, some large assets have remained strong. Of the top 50 assets by market value, Helium performed most positively, gaining 33% over the past 30 days. LEO was up 11.20% and LINK remained virtually unchanged. The biggest underperformance was seen by AVAX which was down 44%, Bitcoin Cash (down 39%) and Cronos (down 40%).

Macro summary: Commodity pressure despite central bank actions

At the last FOMC meeting, for the first time since 1994, the US Federal Reserve raised interest rates by 75 basis points. This was against the background of still high CPI data, which came in at 8.1% for May 2022 (the highest since 1981). Working conditions in the USA are still tight as the figures for April (released on 1 June) showed that vacancies only fell slightly to 11.4 million after record highs of 11.8 million for March. Chairman Powel suggested a new rate hike of between 50 and 75 bps, which will be announced at the FOMC’s meeting in July 2022.

As central banks tighten, supply chain problems combined with political instability continue to push commodity prices higher. Oil led, with light oil futures reaching $ 120 USD per barrel before stabilizing above $ 105 in recent trading sessions. Supply / demand continues to balance against higher demand. Despite some destruction of demand from high oil prices, supply chain restrictions due to sanctions against Russian exports have kept supply tight.

Market structure: Forced capitulation a sign of local bottom?

BTC markets have seen two significant sales of significant size over the course of a month. First was the liquidation of assets of the Luna Foundation, which sold up to 80,000 BTC, along with significant sums of ETH and other liquid assets. Second was the credit crunch and the liquidation of Celsius, 3AC and Babel Finance. The crypto market value fell by $ 2.1T from all-time highs reached in November 2021.

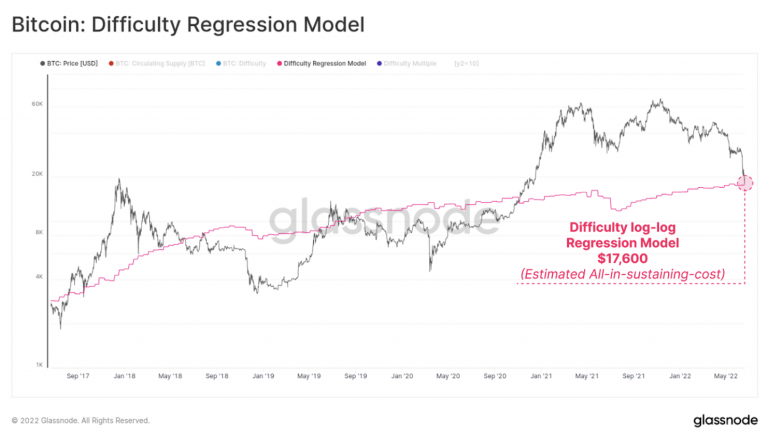

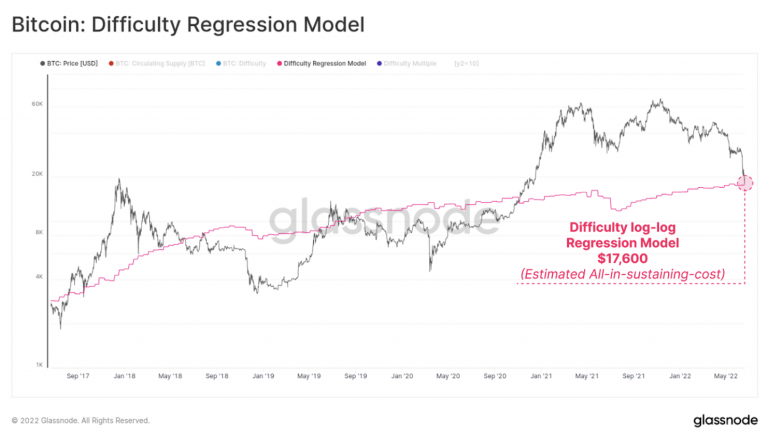

This has put pressure on miners, who are also facing increased electricity costs. As prices continue to fall, we can see that the profitability of miners is declining. According to Glassnode’s difficulty regression model, the “all-in-one maintenance” cost for mining is currently $ 17,800, which is roughly where BTC traded last weekend.

With Bitcoin’s hashrate already down 10% from the all-time high, it seems that unprofitable miners are already going offline.

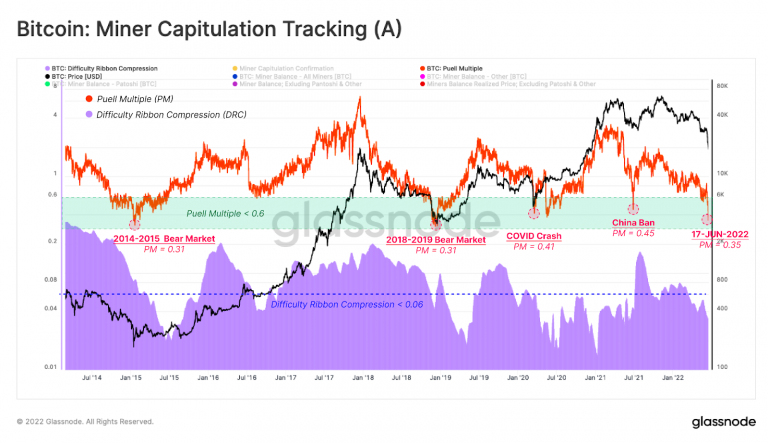

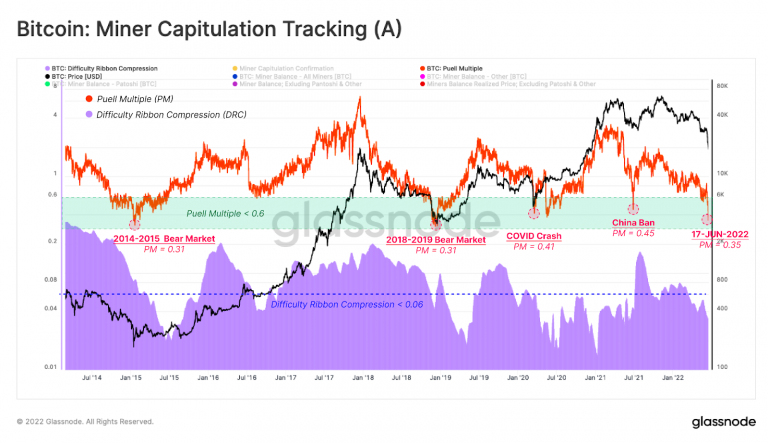

It can be argued that as profitability declines, miners will become forced sellers. Puell Multiple (PM), shown in orange in the chart below, is an oscillator that tracks the revenue generated by miners. PM shows a value of 0.35, which corresponds to income 61% below the annual average. This is close to the levels in the bear markets 2014/2015 and 2018/2019. At that time, miners saw a PM multiple of 0.31, which corresponded to a 69% decrease in income compared to the annual average.

Difficulty Ribbon Compression (DRC), shown in purple in the diagram above, is a miner’s stress model. This indicates that mining rigs are going offline. Mining rigs that go offline happen for many reasons. These include regulatory considerations, increasing difficulty for the Bitcoin algorithm, increasing electricity costs, and of course reduced profitability due to lower market prices. In the diagram above we can see a decrease in this metric, which indicates that fewer rigs are active due to one or more of the mentioned reasons.

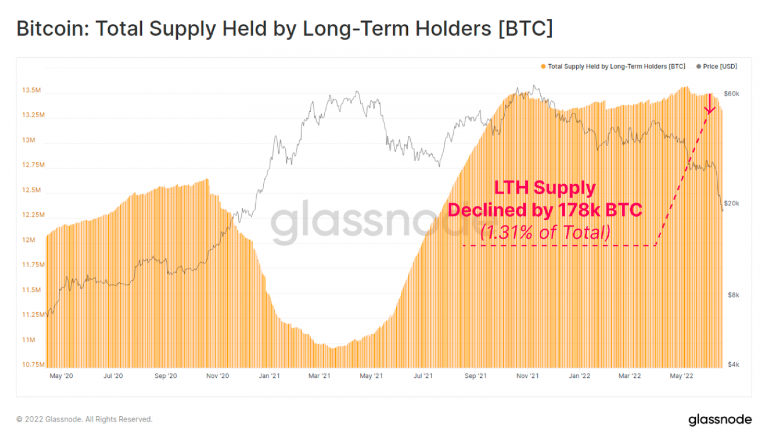

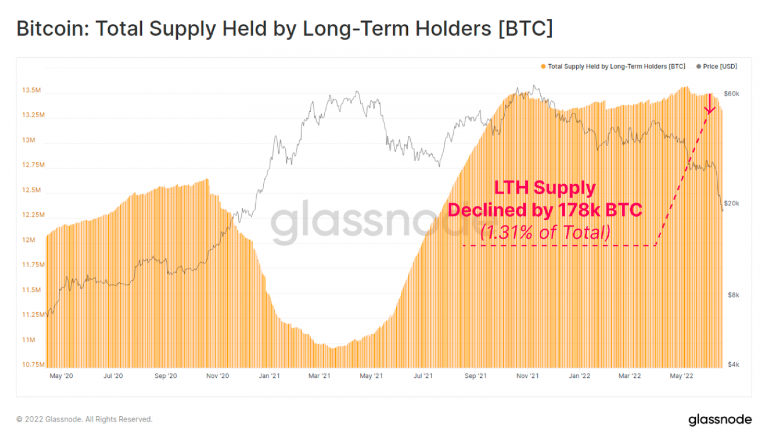

Then we will look at the Long Time Holders (LTH) cohort. When market participants capitulate, LTHs come under stress. As shown below, the LTH cohort has seen a total supply decline of 178K BTC in the last month, representing 1.31% of the total holdings of this group.

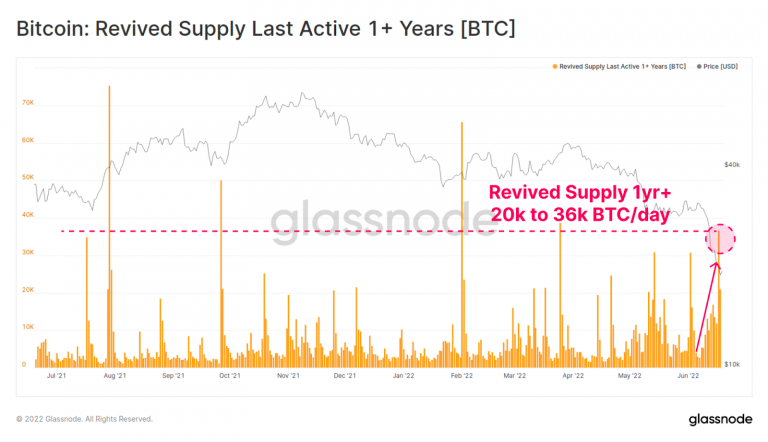

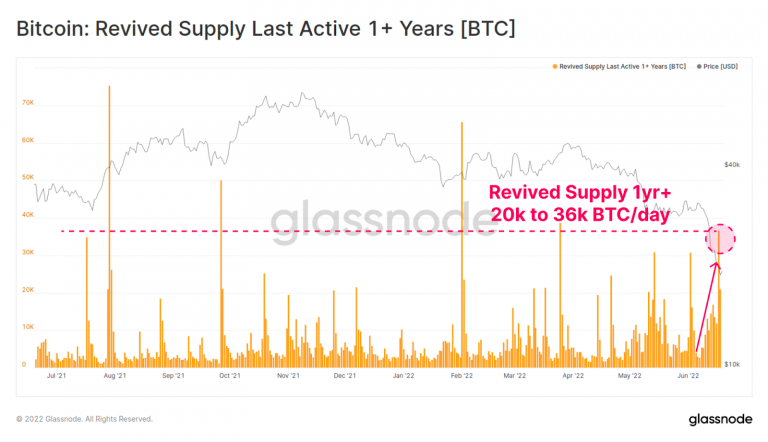

Another interesting calculation to understand the status of the current sale is the old supply that is being revived. As you can see below, approx. 20-36K BTC per day, which is equivalent to the levels seen on April 22nd. This indicator can be seen as a fear index, as it shows the need for long-term owners to sell their positions due to the current conditions.

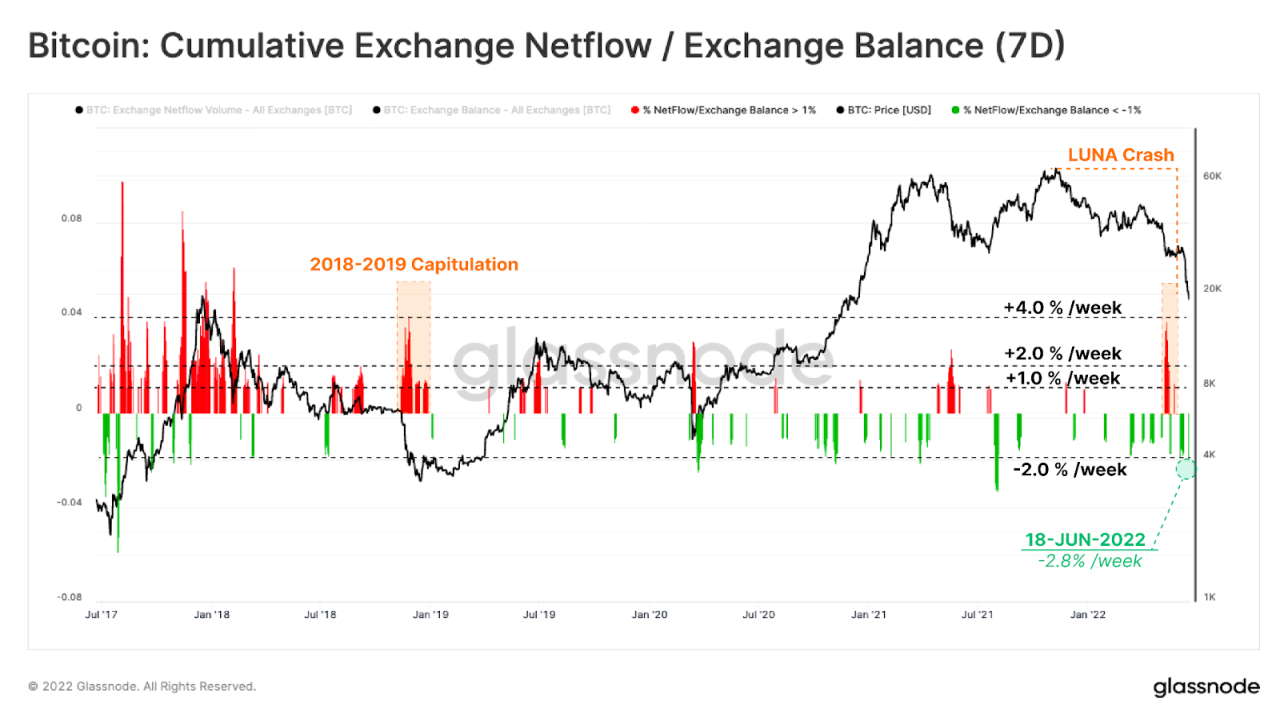

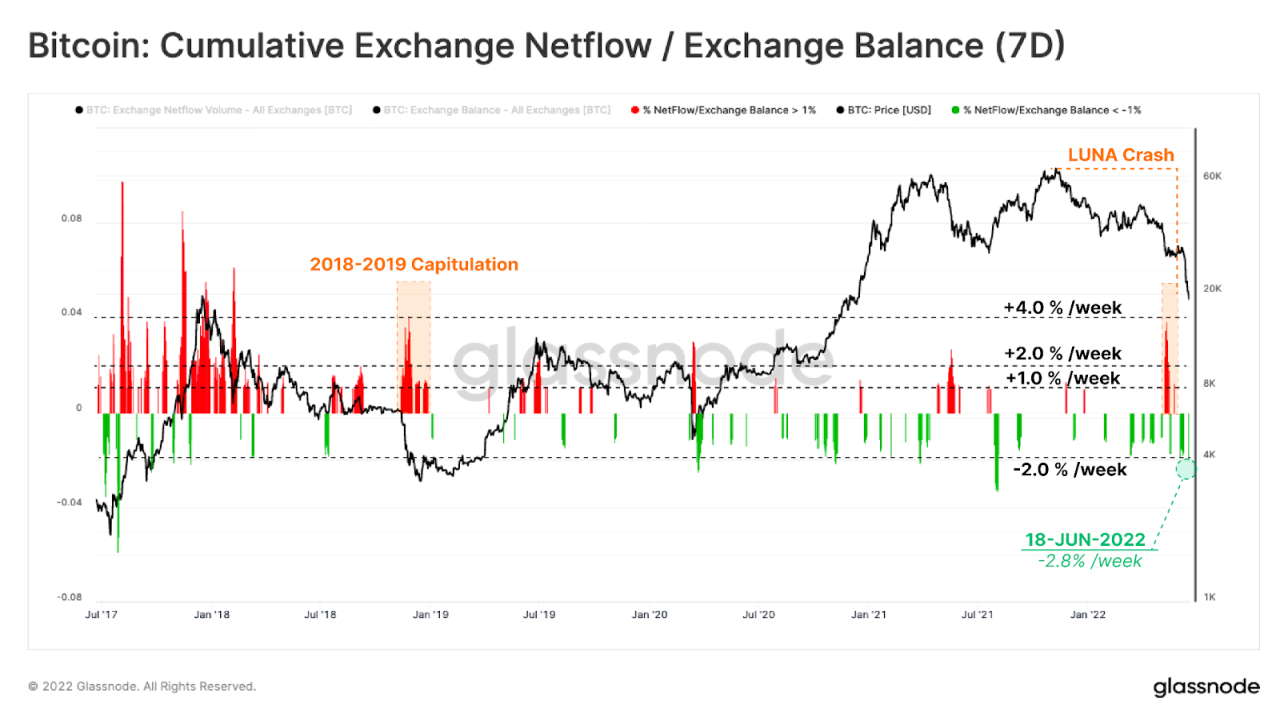

Finally, we will look at inflows and outflows from centralized stock exchanges, also known as the net stock exchange balance. When we see market influx to stock exchanges, we can assume that market participants are looking to sell their tokens. When we see market outflows from stock exchanges, we can assume that market participants want to keep tokens.

Below we can notice a strong market inflow in May 2022 due to the LUNA crash, with inflows reaching + 4% per week (currency balance). This was equal to sales from 2018-2019 (> 1% of the opening currency balance).

In the last sale (June), however, we notice an outflow of 2.8% per week. This can be attributed to the uniqueness of the sale. As the creditworthiness of some of the largest crypto players came into play, participants may have been driven to move tokens to self-deposit, where there is less perceived risk.

In summary, the market experienced back-to-back sales in May and June 2022. Although these were triggered by strong macroeconomic headwinds, two black-swan incidents (namely the LUNA crash and the insolvency of 3AC and other major players) may have caused oversales . This may indicate that we have already seen a local bottom. In the long run, however, it is likely that the macro picture will continue to have a strong influence on the markets.

Bitcoin.com Exchange

Bitcoin.com Exchange gives you the tools you need to trade like a pro and earn a return on your crypto. Get 40+ spot pairs, perpetual and futures pairs with influence up to 100x, return strategies for AMM +, repo market and more.

Photo credit: Shutterstock, Pixabay, Wiki Commons