Binance Sends $2 Billion in Bitcoin to Unknown Wallet Costing Them Only $0.42

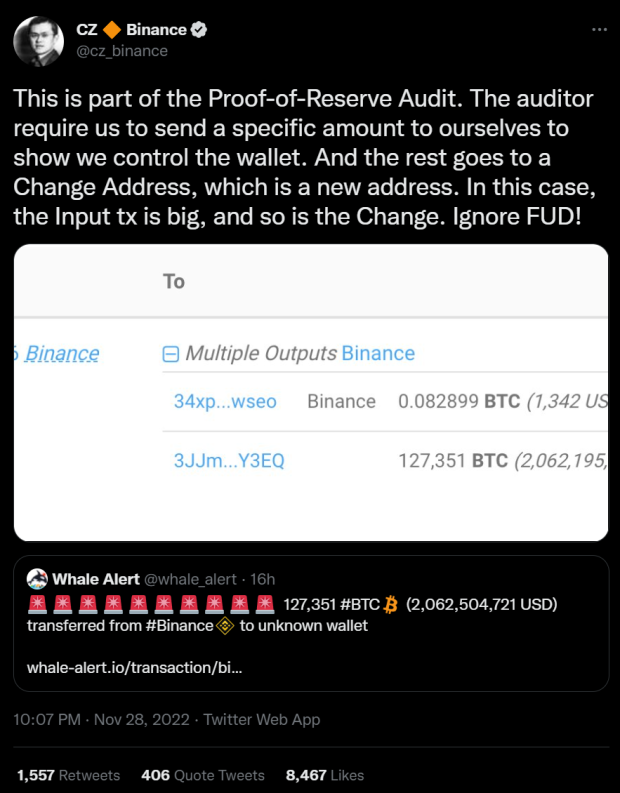

Binance has sent $2 billion worth of Bitcoin to an unknown wallet address, totaling 127,351 Bitcoins sent in a single transaction.

SEE GALLERY – 4 PICTURES

Whale Alert reported that the transaction occurred on November 28, with on-chain data indicating that $2 billion was sent at 10:00 UTC and only cost Binance a fee of 0.000026 BTC, or $0.42. After the collapse of what was the world’s second largest cryptocurrency exchange, FTX, many cryptocurrency owners are rightly concerned about the movements of cryptocurrency exchanges, especially those with such large volumes.

Unsurprisingly, the transaction caused a ripple effect of fear, uncertainty and doubt (FUD) to spread online, prompting a response from Binance CEO Changpeng.CZ” Zhao, who took to Twitter to explain that the $2 billion transaction was part of Binance’s proof-of-reserve (PoR) audits. These audits are supposed to demonstrate that the cryptocurrency exchange has the same number of funds as it publicly claims to have, therefore”proof-of-reserve“.

The Binance CEO wrote on Twitter that the auditor has required the exchange to send a specific amount to another wallet address to prove that Binance has control over the wallet. In addition, Zhao wrote that the remaining funds will go to a “change address, which is a new address. In this case the input tx is large and so is the change.“

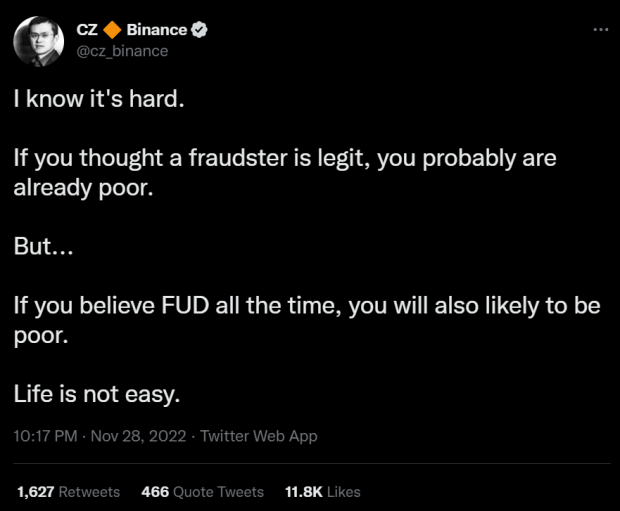

Zhao doubled down with a follow-up tweet aimed at investors who believe the FUD being spread because of the transaction. Zhao wrote, “I know it’s hard. If you thought a scammer is legit, you’re probably already poor. But… If you believe in FUD all the time, you’ll probably be poor too. Life is not easy.“

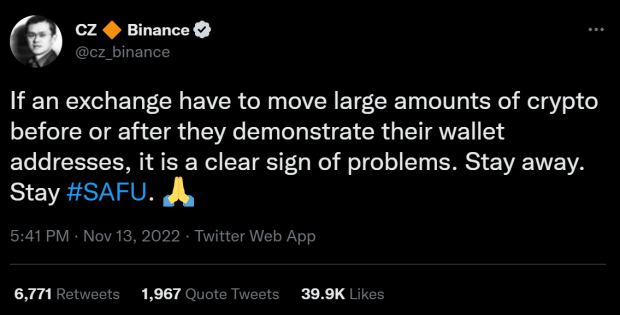

In particular, Zhao warned just earlier this month, on November 13, that it is a bad sign if an exchange has to move large amounts of cryptocurrency.before or after demonstration” their wallet addresses. Adding that the movement is a “clear signs of trouble. Stay away. Become #SAFU.“

The fall of FTX has put a target on the back of cryptocurrency exchanges, with investors now questioning the exchange’s reserves while simultaneously flocking to pull assets out of the exchanges and onto self-custodial wallets. On November 14, chain analytics firm Glassnode reported that the number of Bitcoin withdrawals from centralized exchanges has reached a 17-month high of 3,424,315. If you’re interested in reading more about that story, or more cryptocurrency-related news, check out the links above and below.