Binance looks set to strengthen its leading position in the crypto market with free trading

Crypto exchange Binance is stepping up its bid to gain market share by expanding its free trade to include popular token ether, ahead of one of the most anticipated events in the crypto market’s short history.

Already the world’s largest digital asset exchange by volume, Binance is waiving fees for a month for customers trading ether – the second largest digital token – using Binance’s house currency known as BUSD.

The initiative comes ahead of a long-awaited upgrade to the ethereum blockchain, where ethereum transactions are recorded. Known in the industry as the merger, it promises a shift from an older, energy-intensive digital ledger system described as “proof of work” in favor of a “proof of stake” model that will significantly reduce its carbon footprint.

The move to offer free ether trading ahead of the big event underscores how Binance is using the fallout from this year’s crypto crash to make another attempt to attract customers to the platform. About 90 percent of Binance’s overall revenue comes from trading fees, which fluctuate with the price of bitcoin and other cryptocurrencies, the privately held group’s CEO Changpeng Zhao said earlier this year.

Over the summer, Binance began offering free cash trading in several bitcoin pairs, including the euro and pound sterling. In the following eight weeks, BUSD’s market capitalization has grown by 8 percent, to $19 billion, according to data compiled by CryptoCompare.

So-called stablecoins such as BUSD are often used as a store of value between bets on digital coins because they are designed to track the price of the dollar and other traditional currencies. BUSD is one of the world’s largest stablecoins, competing with tether and Circle’s USDC.

Sipho Arntzen, Next Generation Research analyst at Julius Baer, said Binance’s move “may actually represent something of a ‘market grab’ strategy”.

Binance’s latest initiative will last until September 26. It described the merger as “an important milestone for ethereum and the large Web3 ecosystem that all users should have the opportunity to be a part of”. Ethereum is widely used by crypto developers as it aims to make blockchains more useful than a simple database of transactions.

Binance’s fee-free trade comes after bitcoin, the industry’s flagship cryptocurrency, plunged from a price of nearly $70,000 to a low of under $20,000, while the failure of stablecoin TerraUSD triggered a selloff that engulfed many big industry names, including lenders Celsius and BlockFi and hedge fund Three Arrows Capital.

“This approach [to free trading] has also been seen in traditional finance of late, where a well-capitalized newcomer seeks dominance with the lure of commission-free trading for a limited period, said Rufus Round, CEO of GlobalBlock Digital Asset Trading, a broker.

Binance said it would “miss out on some fees” but the company “continues to have strong reserves”.

Crypto finance

Critical intelligence on the digital asset industry. Explore the FT’s coverage here.

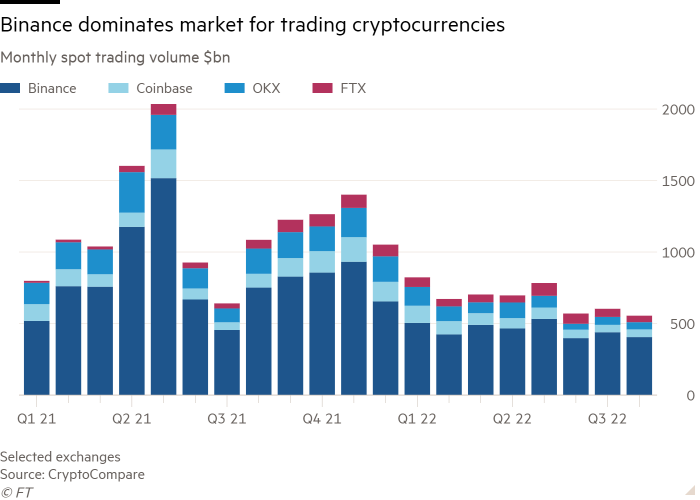

Binance has already increased its leading role in the crypto market this year. The exchange has a market share of 55 percent in cash trading, according to CryptoCompare, an increase of almost 10 percentage points since January. Its closest rivals, Coinbase and FTX, have shares of less than 10 percent.

In response to the collapse in digital asset prices, rival crypto exchanges have begun to reconfigure their long-term business strategies. Coinbase said nearly a fifth of its second-quarter revenue came from services and subscriptions, although it posted a net loss of $1.1 billion.

“Temporarily waiving fees on their main trading pairs could be seen as a concession to attract more liquidity in the current low trading volume environment, which [Binance] will benefit indirectly through increased traffic in other trading pairs and other product lines and offerings,” said Peter Habermacher, CEO and co-founder of crypto-focused investment firm Aaro Capital.

However, FTX has put the rest of the crypto industry on notice that it is trying to attract customers, with a number of high-profile sports sponsors and securing an option to buy the struggling BlockFi.

“I could imagine [Binance] looking at the expansion of FTX into all kinds of areas and thinking they need to step up their game”, said Ilan Solot, partner at venture capital firm Tagus Capital.

Still, Julius Baer’s Arntzen said free trading potentially indicated that Binance expected the size of the market to remain small in the near future.

“This ranking of Binance may represent the beginning of a trend of fee-free trading among the major centralized exchanges,” he said. “We may have a situation in the future where fee-free trading is the norm rather than the exception, similar to what we have seen in the traditional financial world.”

Click here to go to the Digital Assets dashboard