Binance has the most Bitcoin on exchanges after the roles have reversed with Coinbase

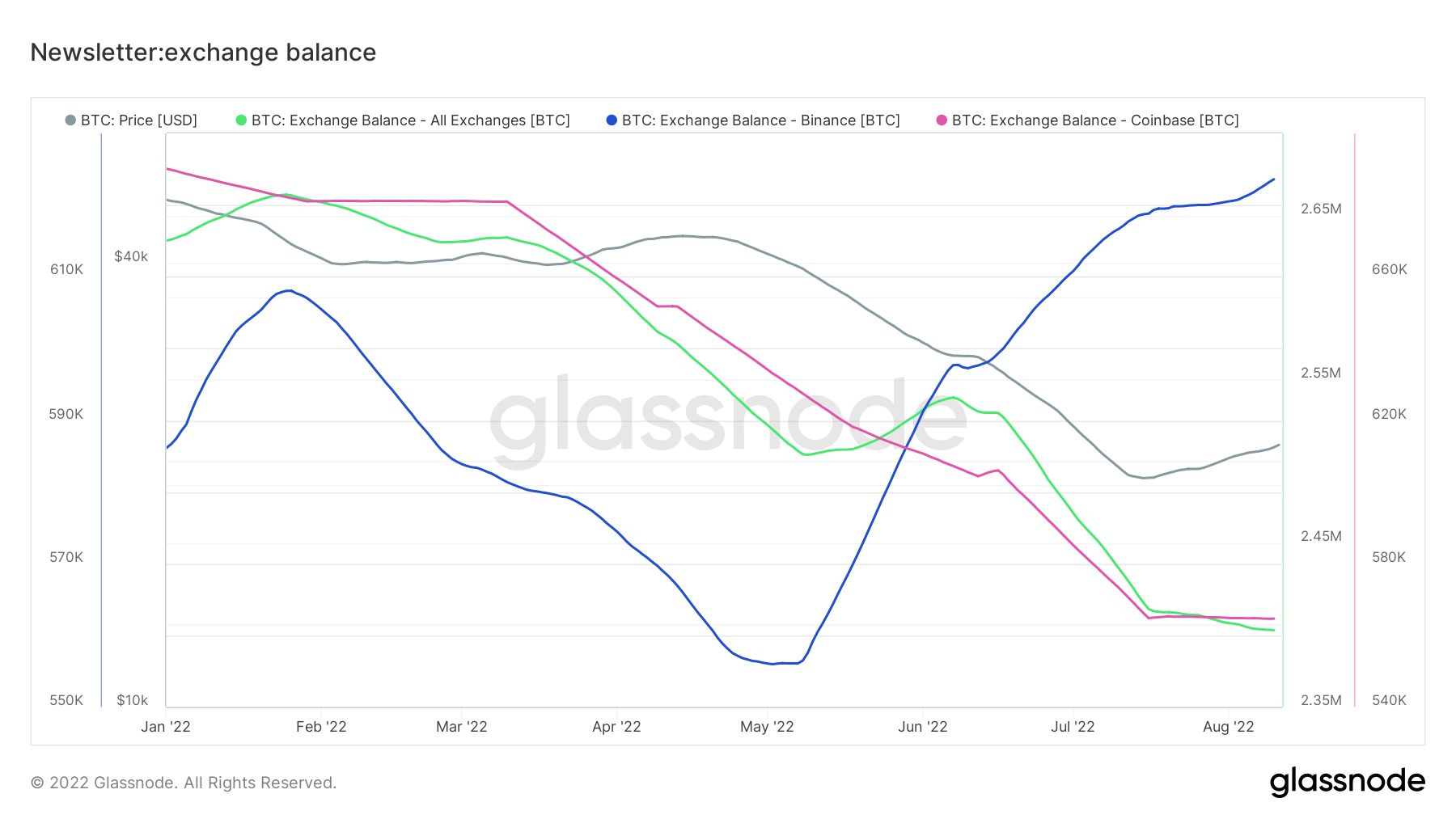

Currency balance refers to the amount of Bitcoin sitting on exchanges, and it has followed a downward trend since January 2022 for both Coinbase and Binance when Binance’s currency balance suddenly took a turn and started to rise in May. It is still increasing, while both the total and Coinbase’s currency balance continue to fall.

The chart above shows the cumulative Bitcoin exchange balance, Bitcoin price and currency balances of both exchange giants Binance and Coinbase.

The green line representing the cumulative currency balance has followed a sharp downward trend since February. At the beginning of the year, there were more than 2.6 million Bitcoins on exchanges. This number is now below 2.4 million, showing a net outflow of 200,000 Bitcoins.

This means Bitcoin supply has been removed from exchanges, indicating a long-term bullish tendency to hold.

Coin base

Coinbase has followed the same trend with the total balance. The exchange had almost 690,000 Bitcoins at the beginning of the year and fell below 560,000 in eight months.

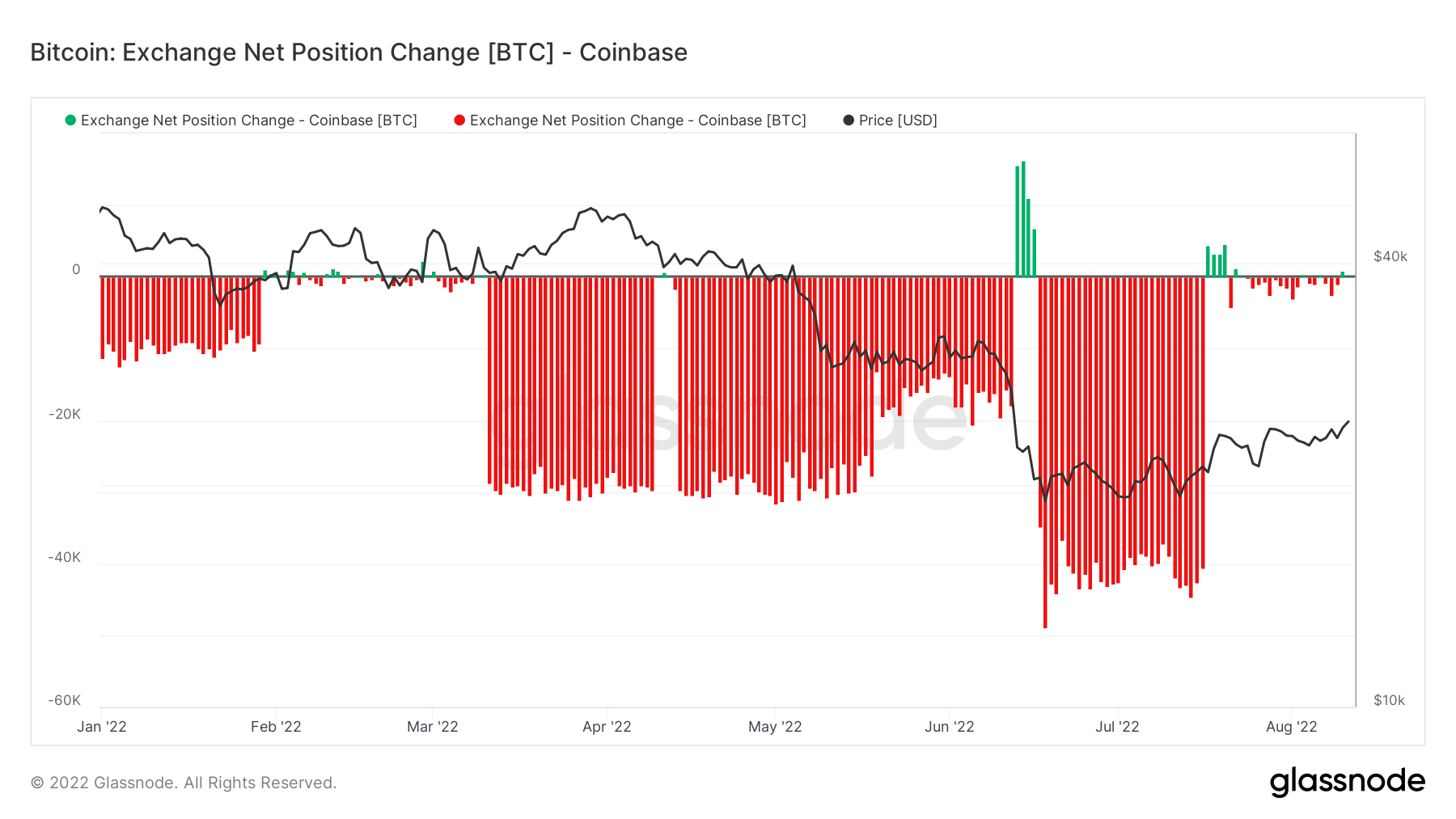

The chart above shows the movements of coins on Coinbase. Red lines represent Bitcoins leaving the exchange, while green indicate incoming balances. Coinbase has seen a significant amount of Bitcoin withdrawn since the beginning of the year. The amounts withdrawn also doubled once between March and May; and again in July.

The fact that US institutions prefer Coinbase may have played a role in these transactions. When faced with a bear market, institutions are more likely to operate on a buy-and-hold basis, which may have motivated them to pull Bitcoins out of Coinbase.

Binance

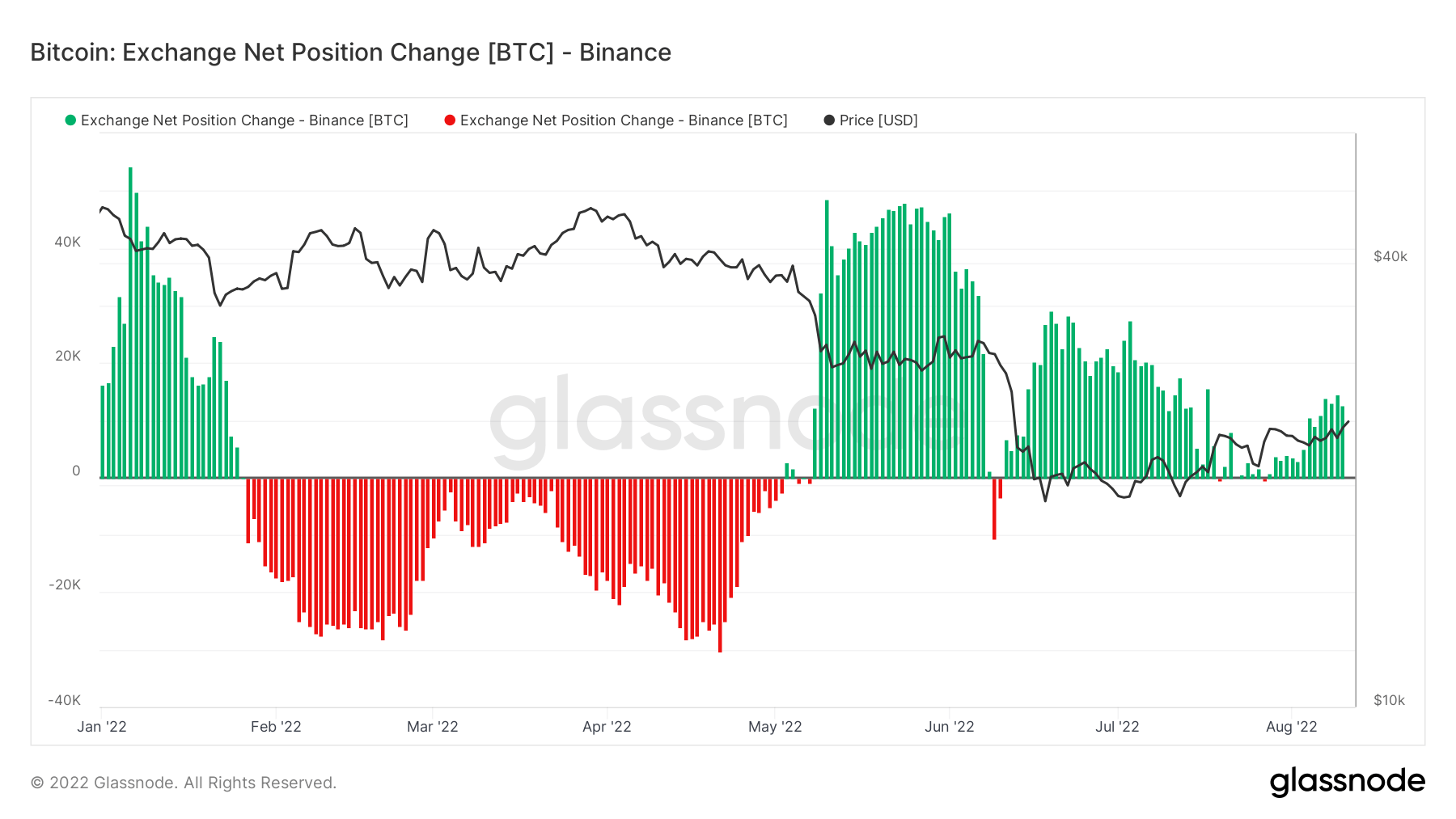

Even though Binance was caught in the same downward trend at the beginning of the year, Binance ended up with more Bitcoins than January. The exchange started the year with 586,000 Bitcoins, fell below 560,000 until May, and ended at 623,000 Bitcoins as of August.

The chart above reflects the shrinking Bitcoin reserves between February and May, which then reverses.

Coinbase and Binance in bear market

Judging by the news from the last few months, Binance and Coinbase are handling the winter market differently. While Binance is not flinching under the harsh winter conditions and continues to put customers first, Coinbase is dealing with layoffs, lawsuits and bankruptcy speculation.

Binance

Before the coldest winter in crypto history started, Binance US was valued at $4.5 billion in a seed funding round, and the exchange took the first step towards expanding in Abu Dhabi. Binance continued its investments and hiring even after winter started. Binance’s CEO, Changpeng Zhao, even said that the company is in a very prosperous position and will soon start acquiring other companies.

Coin base

On the other hand, Coinbase has dealt with the bankruptcy formulations in its quarterly report just before winter started. Soon after, Coinbase users lost Wormhole Lunas while trying to send to the exchange, which Coinbase refused to help with at the time. Subsequently, the exchange was sued by the customers and Craig Wright. In addition to dealing with them, Coinbase’s staking product is also being investigated by the SEC.

Meanwhile, the exchange shed new recruits due to market conditions and laid off 1,100 employees following a petition against managers. Finally, according to Goldman Sachs, Coinbase’s revenue could drop by 61% due to the winter conditions, and the company may have to lay off more workers to survive.