Big Crypto’s Struggle with Basic Accounting and Finance – by Martin Walker – Attack of the 50 Foot Blockchain

Guest post by Martin Walker

The leaders of “Big Crypto” seem to have a big problem in understanding the basic concepts of conventional finance – such as balance sheet, audit and cash flows.

Changpeng Zhao, aka “CZ”, from Binance cryptocurrency exchange, recently described how they managed over $580 million of FTT crypto tokens: “We never touched it, we actually kind of forgot about it.” Sam Bankman-Fried has expressed endless confusion about the management of assets of the FTX cryptocurrency exchange and the Alameda hedge fund.

Even before the collapse of FTX, Sam had some unusual ideas about the methods the crypto industry uses to generate value:

… the smart money is like, oh, wow, this thing is now doing about 60% a year in X tokens. Of course I’ll take my 60% return, right? So they go and put another 300 million dollars in the box and you get a psych and then it goes to infinity. And then everyone makes money.

Cynical people, like most of the mainstream media and the Securities and Exchange Commission (SEC), have finally started to think that much of Big Crypto is run by people who are ruthlessly incompetent and/or criminal. Maybe some of them are. But it is worth trying to understand how the billionaires (and recently ex-billionaires) developed their ideas about the financial world.

Back in 2016, I wrote an article pointing out that cryptocurrencies like Bitcoin are “an asset without a liability.” In other words, “created out of nothing that defies the laws of double-entry bookkeeping.” Financial assets are always someone else’s responsibility. If they are not the responsibility of another party, then who will pay the return on the asset that ultimately gives it value? None, therefore they have no fundamental value.

Big crypto firms have been buying and selling “nothing” for so long, mostly in return for various lumps of “nothing”, that many have truly come to believe that taking nothing, giving it a name – and sometimes a story – combined with a little trading back and forth with friends gives “nothing” immense value.

Whether huge valuations for “nothing” tokens came from simply inflating the market price of old-fashioned cryptocurrencies or creating complex DeFi (Decentralised Finance) structures, faith in the value of nothing is easily lost in sight of the facts of the underlying reality. : it is the influx of real money rather than the “technology”, “community”, “network” or “freedom” that gives cryptoassets value.

A crypto enthusiast who struggles with the idea that financial assets have corresponding liabilities must find the concept of a balance sheet quite insane. Unfortunately, the misunderstanding of basic bookkeeping is reinforced by basic misunderstandings about banking and finance.

The leaders of Big Crypto, including those regularly interviewed on the likes of CNBC, seem to mostly learn about banking and finance by repeating adventures to each other in ultimately based and ancient tweets and blogs about Austrian economics. Most of them seem to genuinely believe that the banks are “creating money out of thin air”, selfishly enriching themselves and defrauding the public by creating inflation. If they had some understanding of balance sheets, they might understand how making a loan creates both an asset for the bank (the loan) and a liability (the funds placed in the borrower’s account) and that the bank does not create money for itself. of nothing, with even the amount of credit creation controlled by the requirement to have sufficient capital.

Oddly enough, given the disdain for inflation that generates fiat money, Big Crypto really creates “money” out of thin air. Their preferred way of dealing with the resulting dissonance is based on further misunderstandings. They believe that having a fixed supply of a given token – which represents “nothing” – protects against inflation. Although some major cryptocurrencies such as Ethereum and Dogecoin do not have a fixed supply.

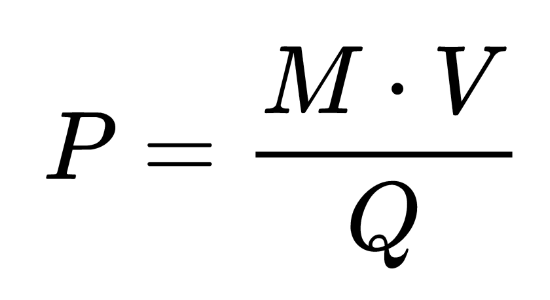

Maybe if they studied some basic monetary economics and learned all four letters of the Quantity Theory of Money equation:

In plain English, the price level (P) is held constant only — i.e. no inflation – if the rate at which money (V) is spent is constant and it is real expenditure on goods and services (Q). Since there is no real spending of crypto on goods and services, it does not matter if the money supply is fixed.

Which brings us to the crypto industry’s struggle with the concept of auditing. CZ stated about audit firms that “A lot of them don’t know how to audit crypto exchanges.” With the crypto industry largely living outside the basic laws of finance and economics, what hope do auditors have of using their old-fashioned ideas about assets, liabilities and balance sheets? Very little – but not just because of the crypto industry’s struggle to understand the basics.

One of the tenets of the Crypto faith is that everything is transparent “because it’s on the blockchain.” Inspections are not really necessary, and if they must be done, they involve complicated mathematical analysis. Unfortunately, blockchains don’t make things transparent in the old fashioned way auditors like. A certain amount of crypto may be held at a specific address on the blockchain – but that does not mean it is under the control of the party being audited. An auditor cannot simply see an asset in the accounts and reconcile it with an account statement.

In the crypto world, the best guarantee that you own the crypto you use is to move some crypto from one address to another and hopefully back again – as Craig Wright notoriously failed. Unfortunately, even this provides limited security. A conventional audit can check who is authorized to move funds from a bank account. In the crypto world, anyone who has seen the private keys associated with crypto funds can take them, and there is no central party that can question whether they are authorized or even reverse the transaction.

Hopefully the reader now has a little more sympathy for the poor confused leaders of Big Crypto. If any of them unfortunately end up in prison, the least society can do for them is to give them a basic accounting and finance course. Something that will certainly help rehabilitation. Perhaps taking the appropriate courses could be made a condition of parole to encourage more diligent study.