Bearish trend continues as BTC price remains below $24,705 – Cryptopolitan

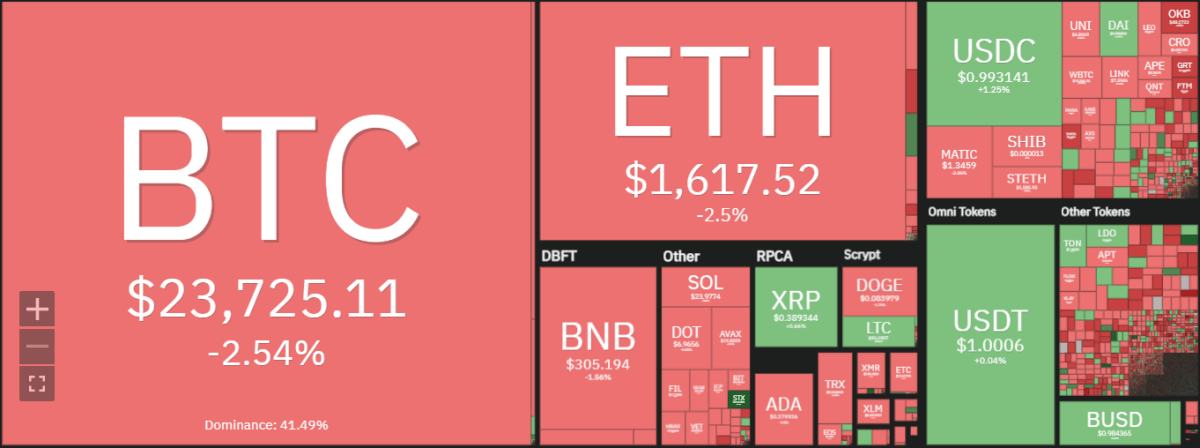

Bitcoin price analysis indicates a negative sentiment in the market. The bearish action is driven by lower trading volume and weak demand for the BTC/USD pair. The last attempt to stage a bullish recovery failed as the momentum faded after the key resistance level of $24,705 was reached. BTC/USD prices are currently trading at around $23,978, down from the highs of $25,000. As the bears try to push prices down, support is present at the $23,902 level. If the bears fail to break below this level, a consolidation phase may take place.

The digital asset has faced selling pressure in recent days due to lack of momentum. Looking ahead, we can expect some consolidation in the near term as traders wait for news that could push prices higher. The bulls are likely to target resistance levels of $24,705 and $25,000, which, if breached, could send BTC/USD prices higher. The market cap for Bitcoin is currently around $457 billion, and the trading volume in the last 24 hours has been around $30 billion.

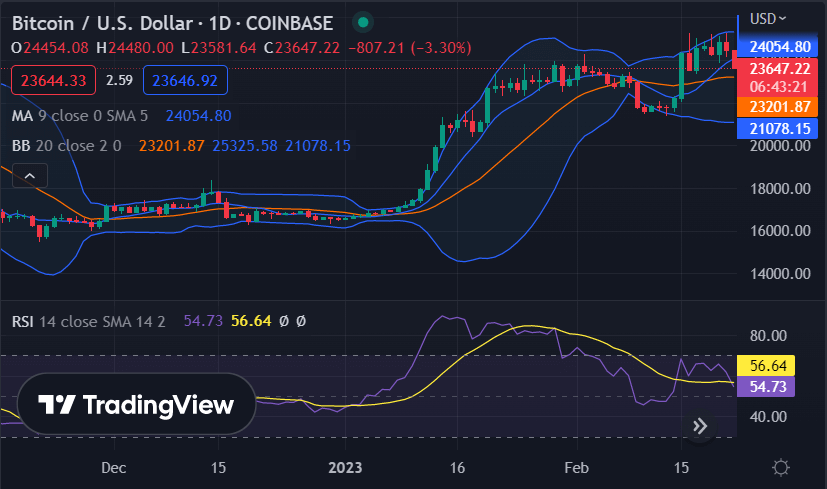

BTC/USD 1-Day Price Chart: Cryptocurrency Value Drops to $23,978 After a Decline

The one-day Bitcoin price analysis confirms a negative trend for the cryptocurrency, as the bears remained dominant throughout the day. Although the bullish curve developed rapidly in the previous days, today’s trend is relatively in favor of the bears. The price has been reduced to $23,978 due to the ongoing downtrend. If we discuss the moving average (MA) in the one-day price chart, it stands at the $24,054 level.

The volatility of the BTC/USD pair has also decreased significantly. Bollinger Bands are getting tight, which also suggests a period of consolidation in the near future. The upper Bollinger Band is at $25,325, and the lower is at $21,078. The Relative Strength Index (RSI) is hovering around the 54.73 level, indicating a neutral market sentiment.

Bitcoin Price Analysis: Bearish slide moves price to $24,705 low

The four-hour Bitcoin price analysis confirms a downtrend, as the bears have ruled the price chart for the past few days. A consistent fall in BTC/USD value was recorded for the previous hours and the price fell to $24,705 in the last four hours. The bearish wave will continue in the coming period, in addition to the fact that selling activity is on the rise.

The price is now lower than its moving average value of $24,216. The bearish trend is confirmed by a crossover between the 50-day MA and 200-day MA line that occurred earlier today. The relative strength index (RSI) confirms this by falling to 34.66 levels, indicating low activity in the market. The Bollinger Bands are also tipped towards the lower end, which means the bearish action could intensify further. The SMA 20 curve is still moving higher than the SMA 50 curve, as the bulls were ahead of the bears earlier in the day.

Bitcoin price analysis conclusion

To summarize, the bearish trend in BTC/USD is likely to continue in the near future as traders remain cautious and uncertain about the market. Also, the outlook remains bearish for BTC/USD in the short term, although a long-term price rally is still possible if support holds at $23,902. For now, we can expect some price volatility in the coming days as traders digest the latest developments.

While you wait for Bitcoin to move forward, check out our price estimates on XDC, Polkadot and Curve