Bank deposits fall as investors flee to volatile Bitcoin

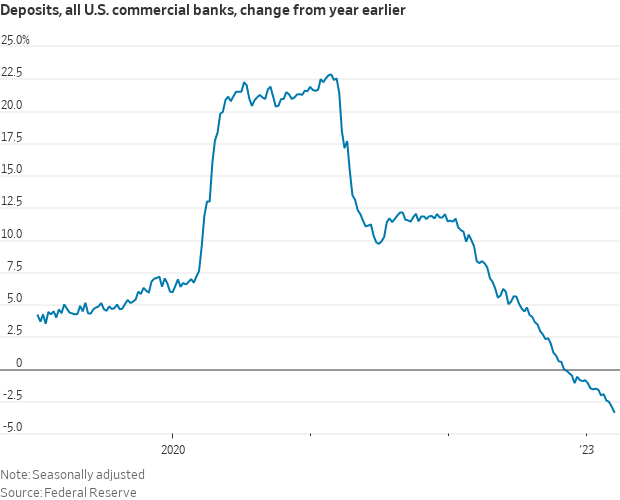

US bank deposits fell significantly between March 8 and March 15 due to fears of bank collapse. On the other hand, Bitcoin has increased by 35% in the last two weeks.

Data from the Federal Reserve showed that deposits at all U.S. commercial banks fell by $98 billion during that week, but increased by $67 billion for the top 25 banks in the country. This suggests that customers moved their money from regional banks to banks considered too big to fail – signaling fears of bank collapse.

This behavior also underlines the concern that the government may not help the smaller banks, especially if they are not considered systemically important. Gemini co-founder Tyler Winklevoss described the American banking system as a modern caste system where people who bank with the top banks are protected while the rest are exposed to risk.

Banks lend at unprecedented rates

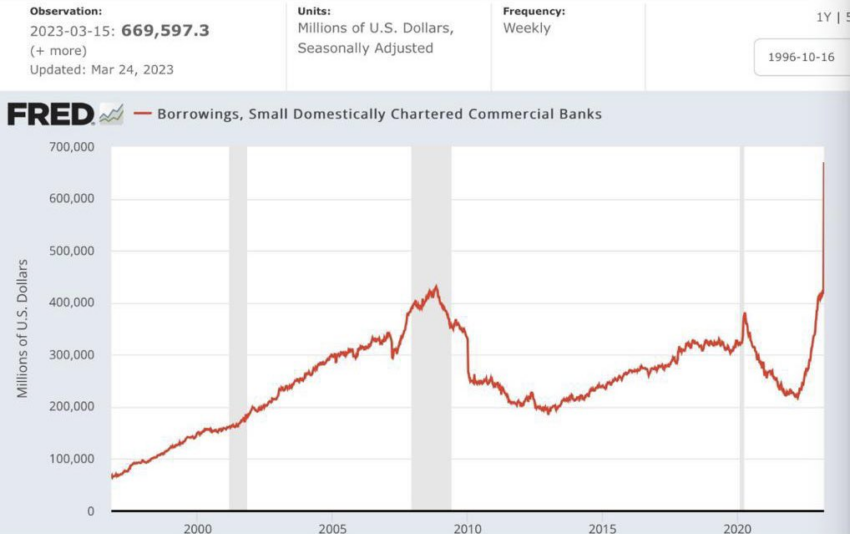

Meanwhile, moves by the government and the big banks to calm nerves have not eased concerns about a potential crisis in the banking system. More users are still moving funds out of small banks, causing banks to borrow at an alarming rate to prevent bank runs.

CNN reported that loans from small US banks reached their highest rate since the turn of the century. According to the report, banks lent 669.6 billion dollars this week. But analysts believe this is just an attempt by the banks to prepare for any bank run and does not necessarily signal a current problem.

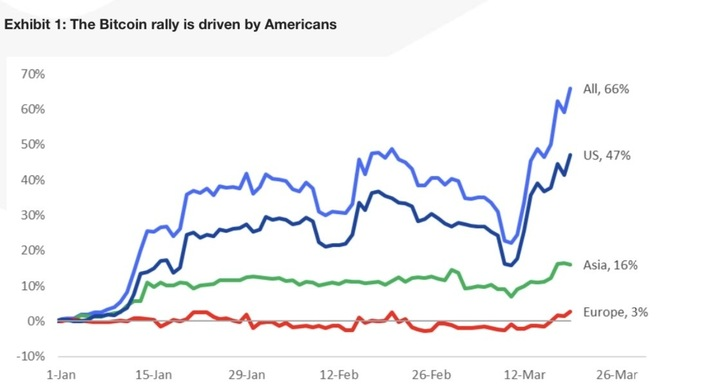

US investors are piling into Bitcoin

A look at Bitcoin’s recent rally showed that US investors had played a significant role in the price rally. According to Matrixport’s head of research and strategy, Markus Thielin, “Americans are buying Bitcoin with both hands.” Thielen noted that 47% of the purchases that drove BTC’s price increase came from US institutional players.

Coinbase former CTO Balaji Srinivasan pointed out that investors usually stop devaluing currencies in distress. According to him, this is where the US dollar currently falls in, adding that he expects Bitcoin (BTC) to replace it as the global reserve currency.

During this banking crisis, Bitcoin has surged 35% in the past two weeks to as high as $27,944. Several BTC bulls have predicted the impending collapse of the banking system and the possibility of the flagship asset rising to $1 million.

Disclaimer

BeInCrypto has reached out to the company or person involved in the story for an official statement on the latest development, but has yet to hear back.