Kevin Helms

A student of Austrian economics, Kevin found Bitcoin in 2011 and has been an evangelist ever since. His interests lie in Bitcoin security, open source systems, network effects and the intersection of finance and cryptography.

all about cryptop referances

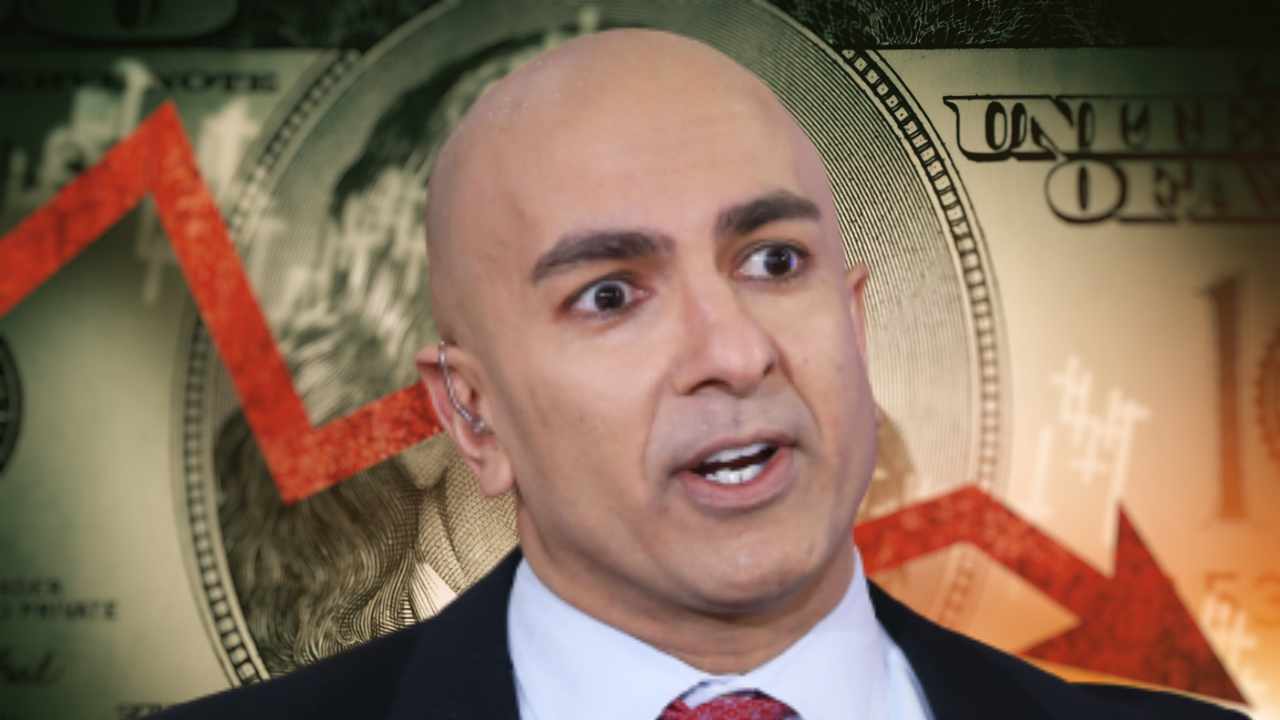

The president of the Federal Reserve Bank of Minneapolis, Neel Kashkari, says the current banking crisis has pushed the US economy closer to a recession. “We have fundamental problems, regulatory problems that our banking system is facing,” the Fed official stressed.

Federal Reserve Bank of Minneapolis President Neel Kashkari shared his thoughts on the state of the U.S. economy, the current banking crisis, and whether the U.S. is headed for a recession in an interview with CBS News Sunday.

In response to a question about whether the current banking crisis has pushed the US economy closer to recession, Kashkari said:

It definitely brings us closer. Right now, it is unclear to us how much of these bank strains lead to a widespread credit crunch.

“This credit crunch … would then slow down the economy,” he warned, noting that the Fed is monitoring the situation “very, very closely.”

“Such pressures can then bring down inflation. So we need to do less work on the federal funds rate to bring the economy into balance,” Kashkari continued. “But right now it’s unclear how much of an impact these bank strains are going to have on the economy.”

Several major banks, including Silicon Valley Bank and Signature Bank, failed in recent weeks, prompting the Federal Reserve, the Treasury Department and the Federal Deposit Insurance Corporation (FDIC) to step in to protect depositors.

Kashkari was asked whether more rules are needed to prevent bank failures and whether the FDIC deposit insurance should be raised above $250,000. In addition, he was asked whether the rollback of the 2018 regulation of medium-sized banks should be reinstated. The Economic Growth, Regulatory Relief, and Consumer Protection Act of 2018 reversed some of the regulations implemented after the 2008 financial crisis.

The Fed official responded:

Well, we have fundamental problems, regulatory problems that our banking system is facing. I have argued for years that the biggest banks in the world are still too big to fail.

Commenting on deposit outflows from smaller banks to larger institutions, the Fed bank president emphasized: “The reason deposits are flowing to the big banks, the reason Credit Suisse was bailed out by the Swiss government, is because the banks have this premium position, and that is unfair.” He elaborated:

It’s an unfair playing field that puts tremendous pressure on regional banks and community banks, and it needs to be addressed. We need regional banks in America, we need community banks in America.

“As we come through this period of stress, we must come up with a regulatory system that both ensures the soundness of our banking system, but is also fair and even, so that the community banks and regional banks can thrive. We don’t have that today, Kashkari concluded.

Some people have called on the government to extend the bailout to smaller banks. Billionaire Bill Ackman recently said, “We’re headed for a train wreck,” and warned of permanent damage to smaller banks if the government allows the current banking crisis to continue.

What do you think of the statements made by Federal Reserve Bank of Minneapolis President Neel Kashkari? Let us know in the comments section below.

Image credit: Shutterstock, Pixabay, Wiki Commons

Disclaimer: This article is for informational purposes only. It is not a direct offer or solicitation of an offer to buy or sell, or an endorsement or recommendation of products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is responsible, directly or indirectly, for any damage or loss caused or alleged to be caused by or in connection with the use of or reliance on content, goods or services mentioned in this article.