At the World Economic Forum this year, panels debated Blockchain ‘Case Studies’

I arrived at the airport in Zurich and the first person I met was a friend from Austin who was visiting her family in Reykjavik. Anyway, I’m OOO this week, so if you need anything email someone else.

Last week, the crypto industry went on a rehabilitation tour in Davos, Switzerland, among the world’s elite at the World Economic Forum’s annual meeting. To my surprise, there was an audience interested in what the industry looks like now.

You’re reading State of Crypto, a CoinDesk newsletter that looks at the intersection of cryptocurrency and government. click here to sign up for future issues.

The narrative

The industry projected strength and all that is good at this week’s meeting in Davos. And there was an audience – at least in some of the panels – of people who are not usually part of the industry.

Why it matters

Obviously, FTX was a looming shadow over crypto’s presence in Switzerland. And as my colleagues and I wrote last week, the industry had a much lighter presence in 2023 than it did last May. Even without FTX’s collapse, we would still be in a bear market, so it makes sense.

Breaks it down

“Crypto” barely came up on any of the industry panels during last week’s World Economic Forum (WEF) conference or during the side events in Davos, Switzerland. There were discussions about specific issues within the industry or about use cases for blockchain technology (and I was told that the term “use cases” is being phased out in favor of “case studies”), but the word itself did not come up.

Instead, you got the industry talking about issues that might be adjacent to crypto, such as data storage and sharing, or sub-issues within crypto like stablecoins. And you saw government officials talk to use cases for the technology that underpins cryptocurrencies.

CoinDesk Chief Content Officer Michael Casey wrote about what he saw, also noting that no matter what the industry wants, it won’t be able to escape the term “crypto” right now.

And yet it may not matter. While the industry had a smaller presence, the panels that took place were significant. The official WEF had more panels related to crypto and crypto-adjacent topics this year than last year. The speakers at the side events represented the United Nations, NASA, CERN, BlackRock, the US Congress, the Parliament of Ukraine and a host of other traditional heavyweights.

These speakers didn’t wander onto a stage hosted by a crypto company by accident. Their willingness to be associated with the industry, even as loosely as a speaker, is suggestive.

Of course, the industry is currently still in full tilt towards increasing its impressively large landfill status, so we’ll have to wait and see how that plays out in the long term.

You can see CoinDesk’s coverage of the week below.

Biden’s rule

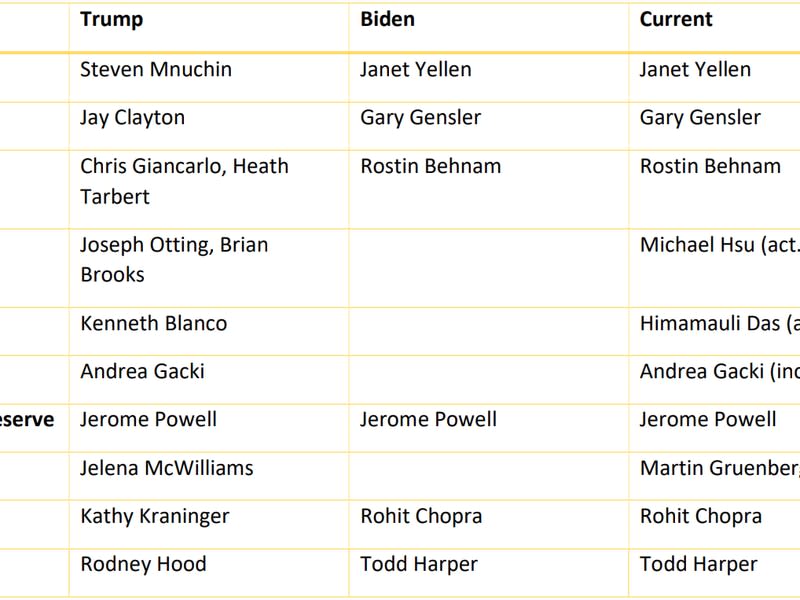

Changing of the guard

NOW

-

(The Wall Street Journal) Come news that new FTX CEO John J. Ray III has formed a task force to examine whether the bankrupt crypto exchange has more value in starting over than being sold for parts, stay for it fascinating pseudo-back – and further on the claims of JJR3 and former CEO Sam Bankman-Fried.

-

(New York Magazine) Zoë Schiffer, Casey Newton and Alex Heath write about Twitter under its new boss.

-

(The Wall Street Journal) Prepare for every rich crypto person to talk about how much they want to buy CoinDesk.

If you have thoughts or questions about what I should discuss next week or any other feedback you’d like to share, feel free to email me at [email protected] or find me on Twitter @nikhileshde.

You can also join the group conversation on Telegram.

See you next week!