Assess the best performing Layer-1 Blockchain protocols

Cryptotechnology has made incredible strides in recent years, and now the blockchain protocol industry is extremely competitive. As gains in speed, scale and power consumption have been made, the promise of Web3 and the growth of a blockchain-based internet are beginning to redefine the possibilities in technology.

With Bitcoin, blockchain technology was first introduced as an economic tool for creating and managing cryptocurrency. It quickly evolved into programmable money and smart contracts after the launch of Ethereum. Now blockchain aims to counter the centralization of all databases, storage and computations to support innovative new dapps and services.

As the industry matures from a predominantly financial products focus to a revolutionary decentralized technology stack for Web3, a handful of key metrics are useful for comparing and evaluating tier-1 competitors: transaction throughput, finality, transaction cost, energy efficiencyand storage cost in the chain.

This article presents a review of these metrics from leading protocols obtained from public datasets and real-time dashboards to provide a clear and comparative picture of the level at which these chains are currently operating.

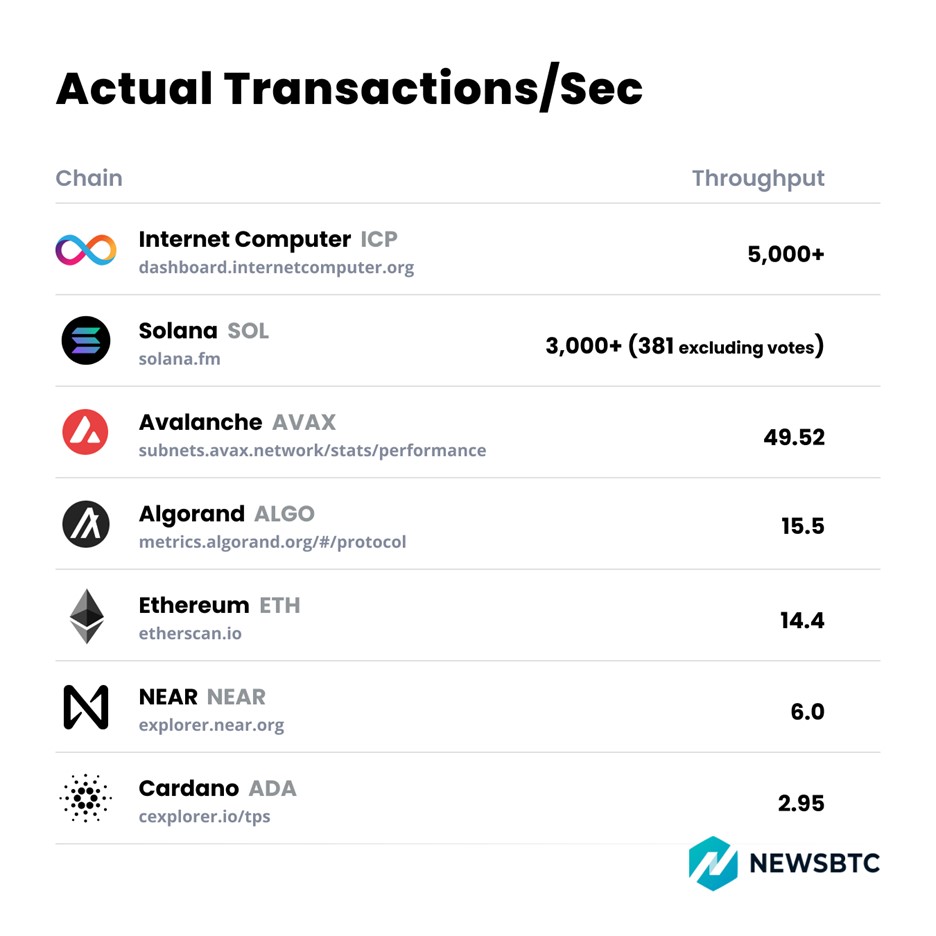

Transaction throughput

For blockchain networks to attract users, they must be able to provide an experience that meets the expectations of today’s web users and do so in a scalable manner. This means delivering fast web page and application screen loads (read operations) and moderately fast data writing. Most blockchains perform well enough on read operations, but layer-1 protocols can struggle to scale the data writes to accommodate millions of users and still provide a good user experience.

Throughput is a measure that captures the scalability of a network—the ability of a blockchain to write data and update state to millions and billions of Internet users and Internet of Things (IoT) devices. To provide a satisfactory user experience for ordinary internet users, a blockchain must be able to process thousands of transactions per second. Only Solana and the Internet computer show actual transaction rates that achieve this feat, although most of Solana’s transactions are voice transactions from validators. Voice transactions do not exist on other chains; The SolanaFM explorer puts Solana’s true TPS at approximately 381. Other chains have either not generated the traffic required to demonstrate high throughput or are technically unable to achieve high throughput.

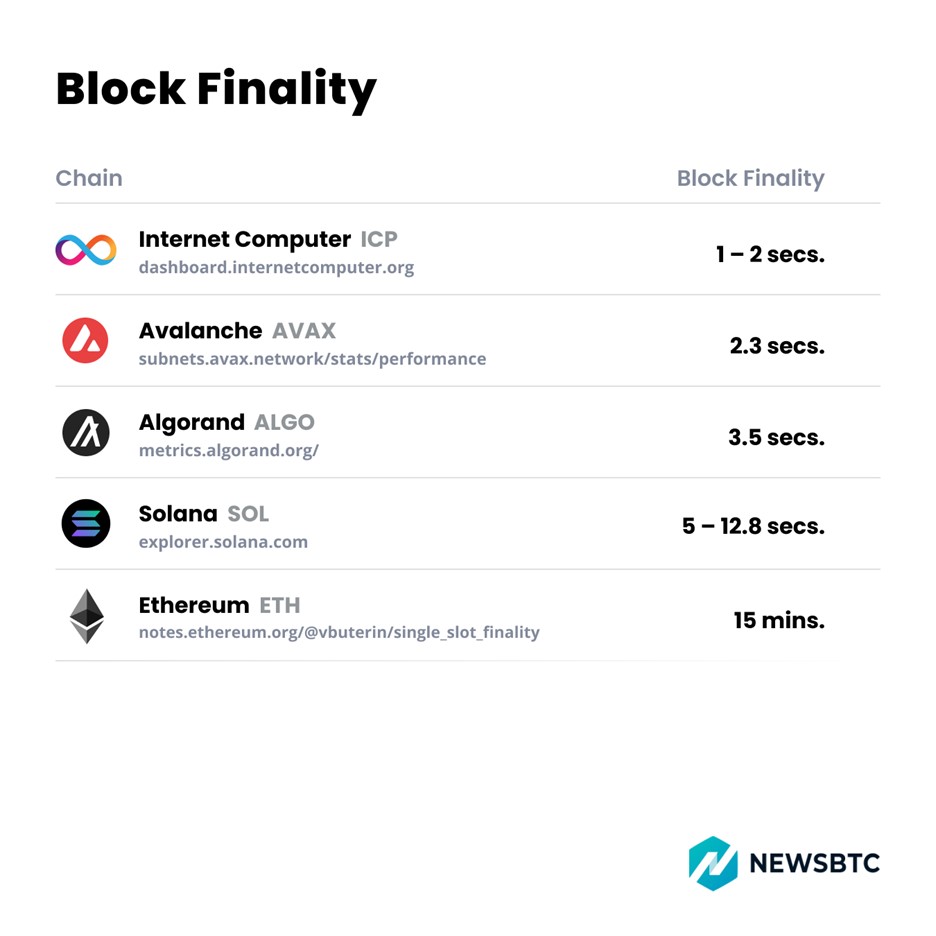

Finality

Finality refers to the average time that elapses between the proposal of a new valid block containing transactions until the block is finalized and its contents are guaranteed not to be reversed or modified. (For some blockchains, such as Bitcoin, determining the moment of finality can only be a matter of probability.) This calculation also affects the user experience, as users are unlikely to use applications that require more than a few seconds to complete an operation.

Transaction costs

Blockchain has its roots as a financial product that can provide much lower transaction costs than traditional finance and can execute transactions faster. High transaction costs have shaped the way we use the internet and monetize content. Because of these costs, content creators and applications tend to prefer models with greater transaction value, such as subscriptions or bulk purchases of content. Transaction costs are usually correlated in some way with the value of their associated network tokens, so the following values are current as of writing the week of November 14, 2022.

Cheaper transaction costs can support the development of new revenue models for websites and applications, such as microtransaction models such as tipping. For this type of model to emerge, the transaction costs of the blockchain must be a fraction of the expected average transaction value.

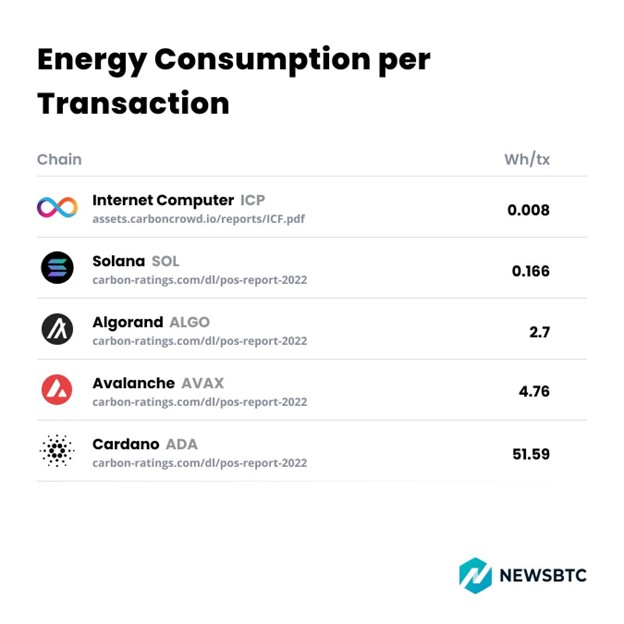

Energy efficiency

Industries around the world are working to become more sustainable in the face of climate change. Energy efficiency has also become a major area of focus within the crypto sector, where it can also be seen as a measure of a blockchain’s ability to perform and, by extension, scale.

Improving the efficiency of a blockchain not only reduces the carbon footprint of the technology stack, but also reduces the energy costs associated with the protocol. Networks that are more energy efficient, and the applications built on top of them, will have an advantage in an increasingly competitive market.

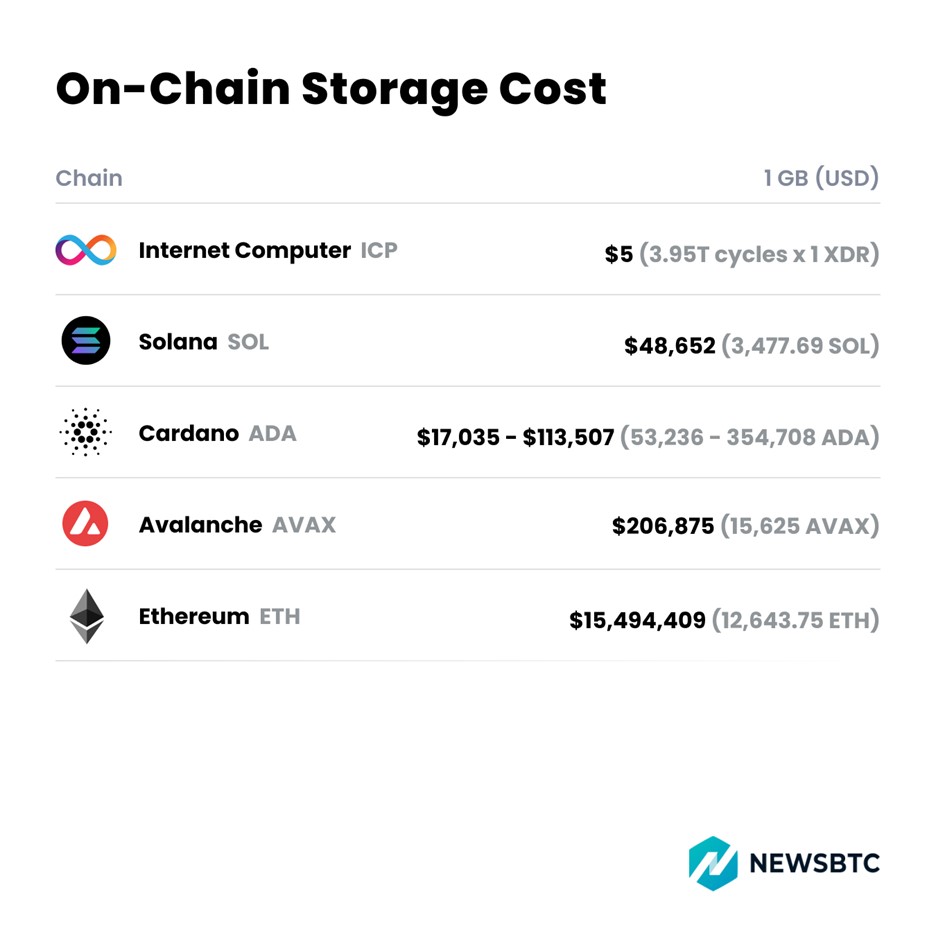

Storage costs on the chain

On-chain storage has been an ongoing challenge for blockchains, which generally have trouble scaling to meet the demands of consumer-facing applications that require significant data hosting. This has forced many developers to rely on Web2 intermediaries for storage and interfaces, compromising security, resiliency, and decentralization.

The Internet computer was found to have the lowest and most stable on-chain data storage cost among the top L1s. “Gas” takes the form of “cycles”, with 1 trillion cycles tied to 1 XDR (equivalent to $1.31 at the time of writing). Developers convert ICP to cycles to pay for data usage, with 1GB per month requiring 329B cycles equivalent to $0.423 – equivalent to $5.07 per GB per year.

The cost of data storage on L1 protocols typically fluctuates with the value of their associated network token, with the expense increasing along with the token’s value and vice versa. Solana’s rent per byte-year is 0.00000348 SOL at the time of writing, which comes to 3,477.69 SOL rent per GB per year. At SOL’s current price of $13.99, this equates to a rate of $48,652.

Cardano cannot currently store non-financial data as media files, and stores all transactions permanently. For simplicity, we skip the computational costs associated with processing the transaction. At a price of $0.32 at the time of writing, the cost of storing 1 GB of transactions depends on the size of each transaction, with 2 million transactions of 500 bytes each resulting in 354,708 ADA ($113,506.56) and 62,500 transactions of 16 KB each equals 53,08,236 ADA ($17,035.54) which represents the lowest fee per byte.

Avalanche has a gas price of around 25 NanoAVAX, with 32 bytes fetching about 0.0005 AVAX. For simplicity, we skip the gas costs of smart contract code execution and storage allocation, and instead consider only the minimum costs of SSTORE operation. This means that storing 1 GB of data costs around 15,625 AVAX. AVAX is $13.24 at the time of writing, which comes to $206,875.

Ethereum’s congestion and high costs have inspired the push for efficiency in the chain, and that continues to set the cost line. For simplicity, we skip the gas costs of smart contract code execution and storage allocation, and instead consider only the minimum costs of SSTORE operation. The network uses 20K gas units to perform STORE operation on 32 bytes of data. By extension, it costs 625B gas units for 1GB of data. With an average gas cost of 20.23 Gwei at the time of writing, that comes to 12.64375T Gwei, or 12,643.75 ETH. With ETH at $1,225.46 at the time of writing, this equates to $15,494,409.

Conclusion

As the blockchain industry evolves into a next-generation technology stack capable of re-opening the consumer internet, only a handful of platforms have the technical specifications necessary to deliver the user experiences expected by the majority of internet users.

High-performance layer-1 networks will enable the development of applications and services not possible, including revolutionary functionality in the areas of security, microtransactions and decentralized ownership of data and applications.