Asia’s Bitcoin supply registers new ATH as US and EU reserves shrink

Asia’s Bitcoin (BTC) supply reached its all-time high (ATH) and currently accounts for 7.3% of all Bitcoin supply, while US and EU Bitcoin reserves are in negative year-over-year supply.

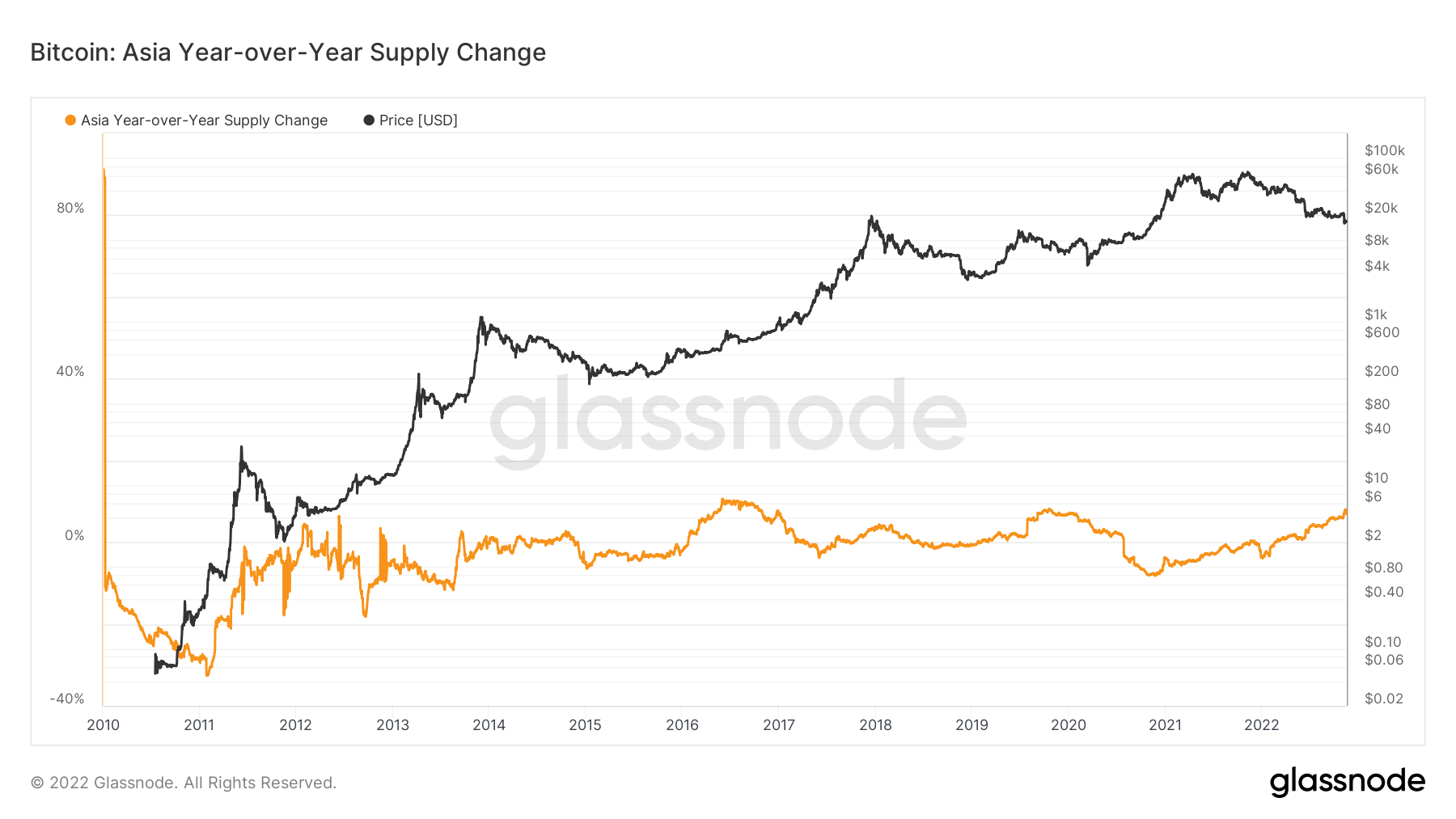

Asia markets

The chart below shows the size of Asia’s Bitcoin supply since 2010. Apart from brief periods in 2016-2017 and 2020, the region has struggled with negative supply levels.

Asia’s Bitcoin reserves started rising above zero at the beginning of the year and reached their ATH from November. The region currently holds 7.3% of the total Bitcoin supply, which equates to 1,402,330 Bitcoins.

USA and EU

While Asia has been accumulating, the EU and the US have been steadily losing Bitcoins.

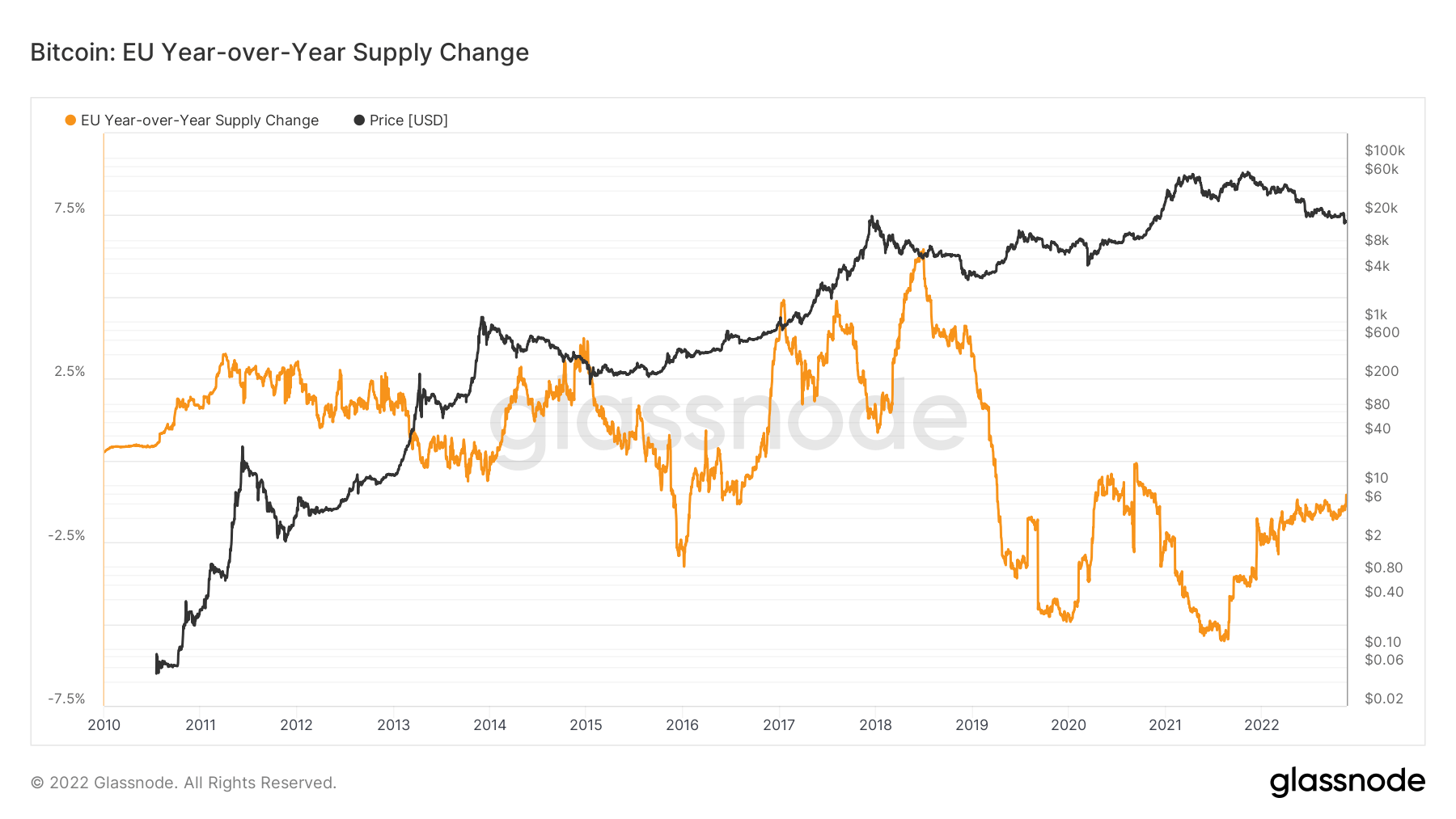

EU

The chart below shows the growth of EU Bitcoin reserves since the beginning of 2010. While the region also struggled with sub-zero supply levels like Asia, it did relatively better until the end of 2019.

EU Bitcoin reserves recorded their ATH at the end of 2018, accounting for almost 6.25% of the total supply. However, this percentage fell to negative 2.5% in mid-2019 and negative 5% in 2020.

The EU’s reserves recovered to zero in mid-2020 before falling back to negative 5% by mid-2021. Currently, it is on a recovery path but remains at around negative 1.25%.

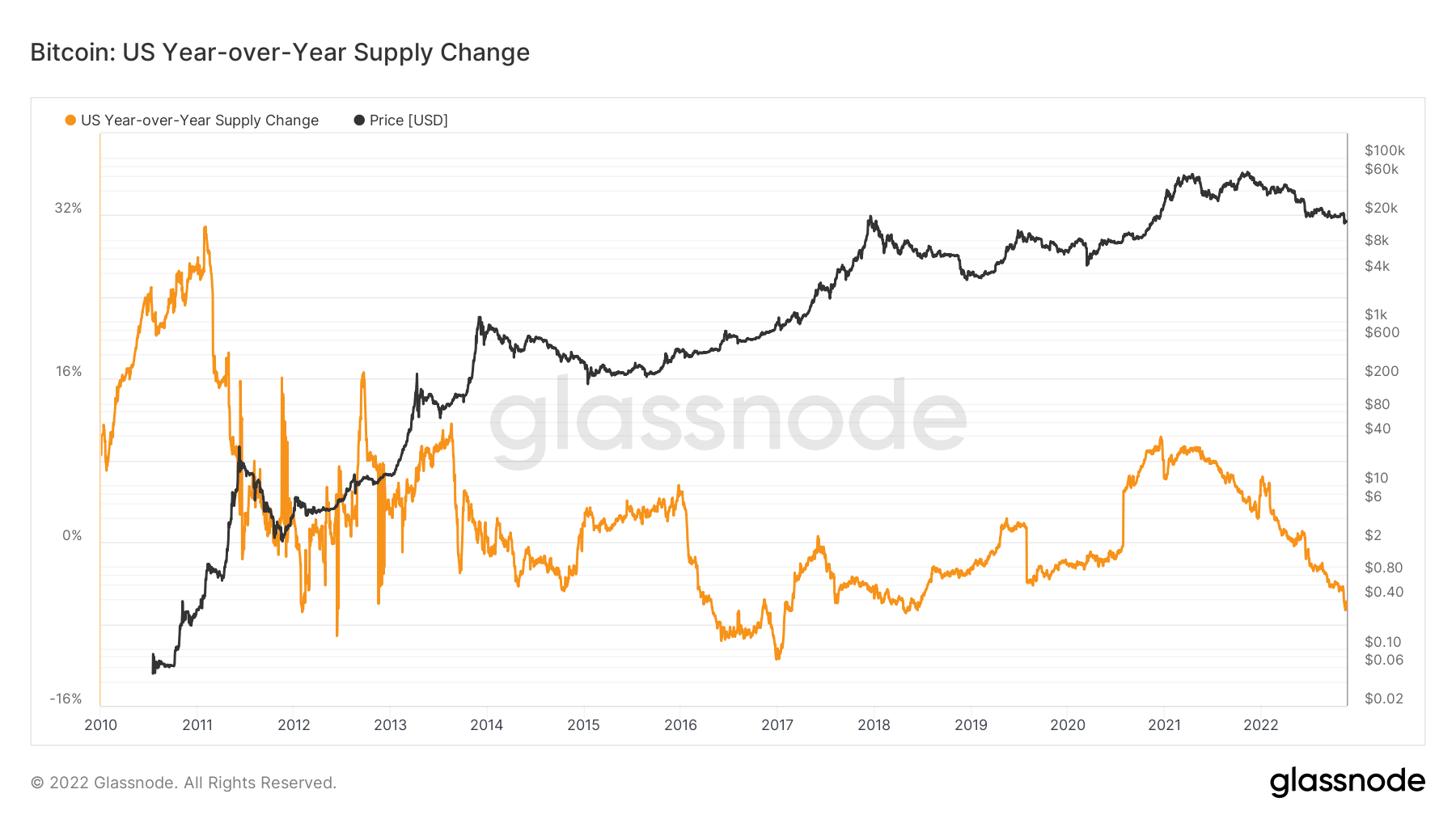

USA

Unlike Asia and the EU, the US recorded a worsening scenario with its Bitcoin reserves. As can also be seen from the chart below, US Bitcoin reserves were mostly above zero between 2010 and 2016.

After falling below zero in early 2016, it struggled to rise to the positive side until the end of 2020. However, although it recovered above zero in 2021, the US Bitcoin supply has been shrinking.

The American Bitcoin supply ATH was registered in 2011, accounting for almost 30% of the entire supply. However, the US failed to maintain the positive supply level it recovered to in 2021 and fell below zero in early 2022. Currently, the US Bitcoin reserves are almost negative 8% of all Bitcoin supply.

Asia on crypto

Recent studies turned their eyes to Asia regarding growing crypto adoption in the region. A study by HSBC and KPMG revealed that a quarter of 6,472 startups operating in the region are crypto-related businesses. Another July 2022 report also concluded that mass crypto adoption is expected in Asia Pacific.

Major countries in the region also support these findings by taking significant steps to further increase crypto adoption.

Japan has taken decisions to further increase adoption by softening regulatory obligations and tax burdens and composing better KYC rules and anti-money laundering precautions to create a healthy environment for investors. In addition, the country has been practicing with Central Bank Digital Currency (CBDC) and Metaverse to push adoption higher.

China, on the other hand, may remain averse to crypto, but Hong Kong’s recent initiatives have the community questioning whether China will use Hong Kong to catalyze the crypto market.

In July 2022, the Hong Kong Monetary Authority said that crypto is likely to integrate with traditional finance soon. Hong Kong has also prepared for that future by experimenting with CBDCs and issuing policy statements to regulate crypto use.

Singapore is emerging as another crypto hub in the region. The country has been crypto-friendly for years and has established a strong base of crypto companies and enthusiasts. Although the country decided to tighten its crypto-related regulations after the collapse of Three Arrows Capital, the country remains one of the largest crypto hubs in the world. Like Japan and Hong Kong, Singapore is also participating in CBDC and Metaverse projects while improving regulations to promote crypto adoption.

In addition to these countries, Vietnam, the Philippines, India, Pakistan and Thailand are among the top ten countries with the highest crypto adoption, according to Chainalysis’ latest adoption report. Furthermore, Vietnam and the Philippines emerged as the world’s first and second most crypto-adapted countries.