As Bitcoin address activity hits a six-month high, a dazed BTC has this to show

- Bitcoin’s address activity rose to its highest level in six months with more off-exchange supply

- Interest in the derivatives market was low despite signals that BTC could be near the bottom

The effect that FTX infection had on Bitcoin [BTC] still appeared to be visible weeks after investors parted with their assets. In addition to BTC’s price collapsing below $16,000, it appears that a number of investors have now opted for decentralized exchanges (DEXs).

Read Bitcoins [BTC] Price prediction 2023-2024

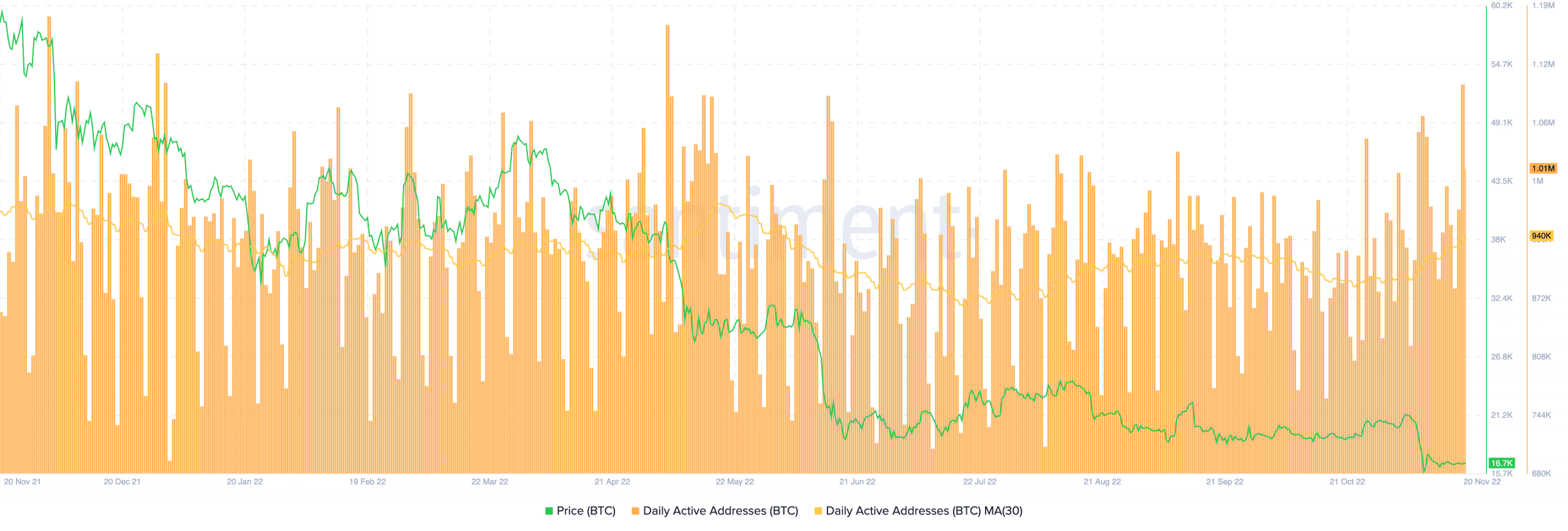

In another scenario possibly affected by the event, Bitcoin’s address activity hit a six-month high. According to Santiment, Bitcoin achieved the milestone over the weekend. A look at data showed that BTC’s daily active addresses reached 1.1 million on November 20. This meant that several unique addresses deposited the coin during that period.

Source: Sentiment

Where is the party?

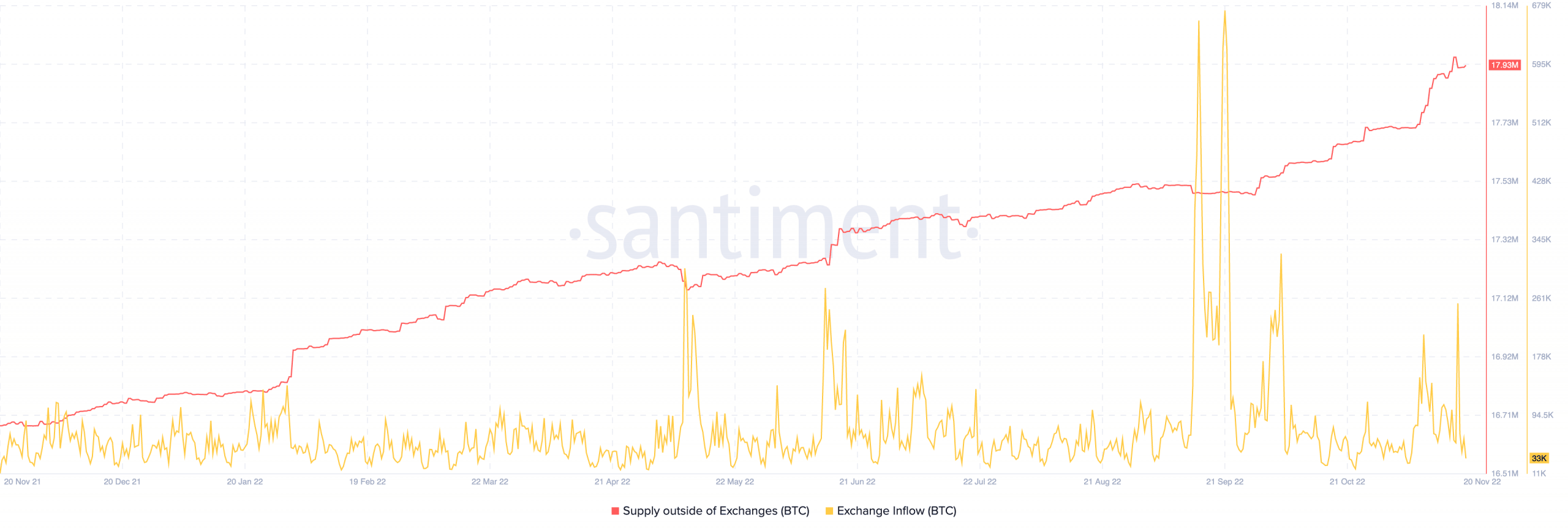

Furthermore, many investors appeared to make their word binding by moving assets outside of centralized exchanges. This was because the offer outside stock exchanges clearly exceeded the stock exchange offer. Santiment’s data revealed that the supply outside exchanges was 17.93 million at press time.

A close examination showed that the metric significant increase began around the time the FTX problem occurred. Therefore, it was likely that the increase in address activity was a result of this movement.

In contrast, the registered exchange supply has decreased in recent days. The last increase recorded per inflow was on 17 November when it was 253,000. This meant that CEXs had not regained a vote of confidence from investors, despite low selling pressure.

Source: Sentiment

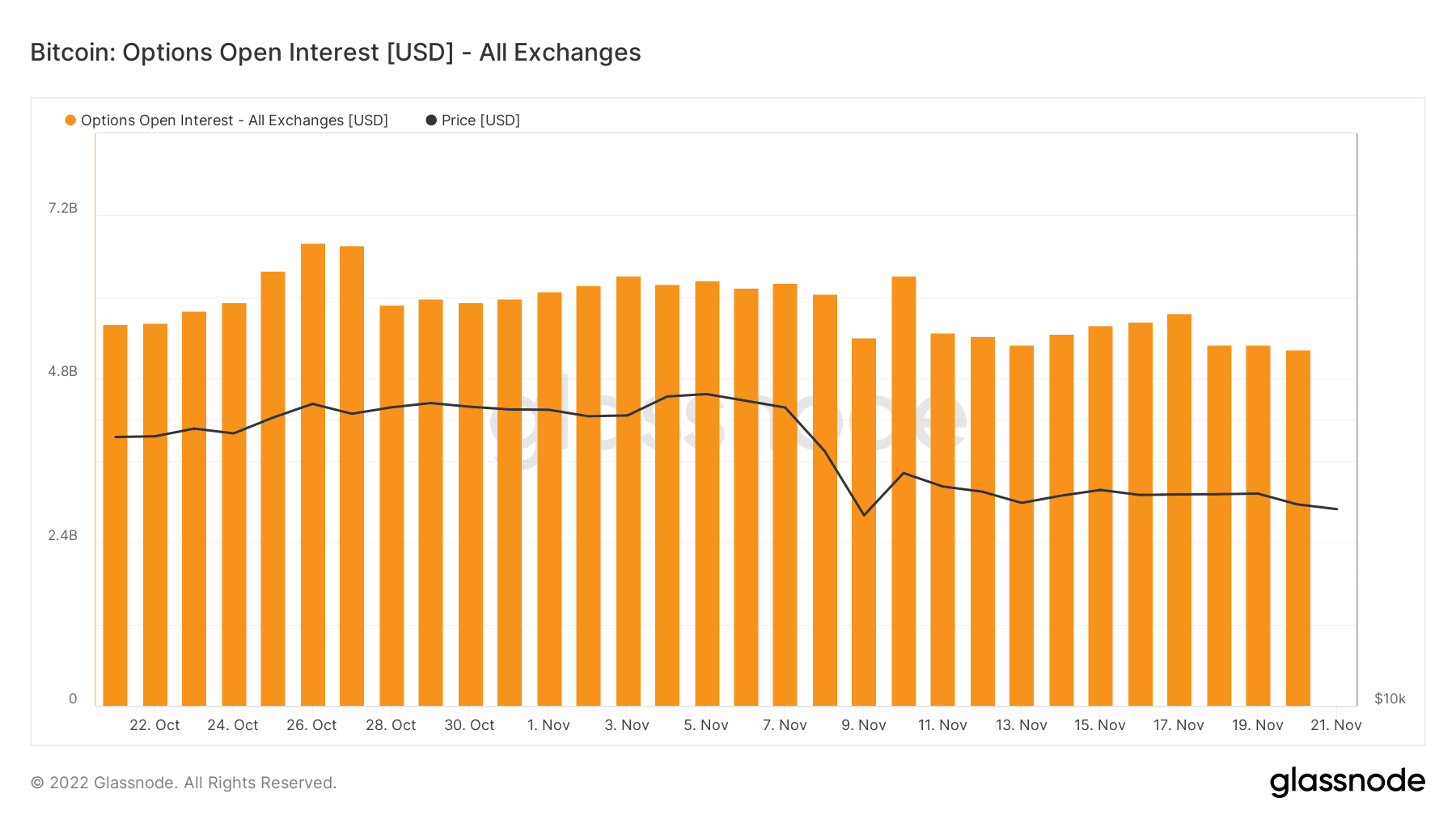

On other fronts, traders seemed to avoid pairs with BTC. This was because the Bitcoin options open interest had decreased, based on Glassnode data.

This further proved the point that the scare surrounding deposit switching was still alive. In addition, the decline meant that options contracts were starved of volume, indicating less interest in the coin.

Source: Glassnode

Dangerous times are here for BTC

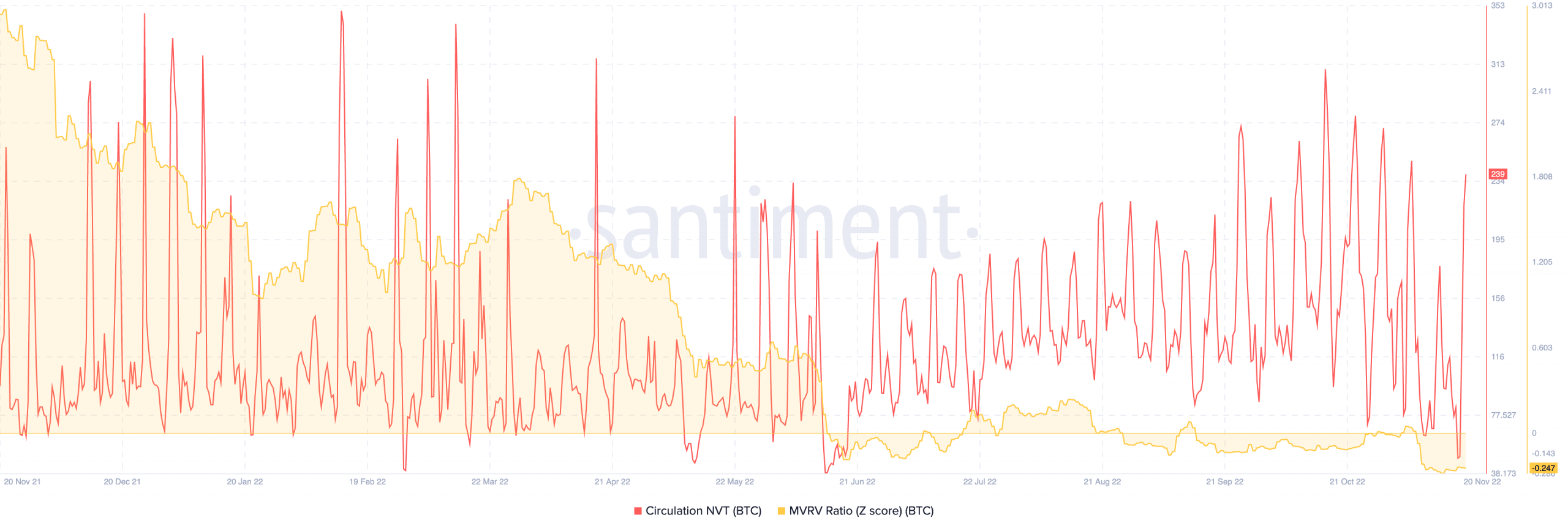

In addition to the factors mentioned above, investors may need to watch their actions on accumulation. This was because the circulation network to value (NVT) had a high value. At press time, NVT’s circulation had increased to a value of 239.

It suggested that the net value outperformed the circulation using the 90-day moving average. For this reason, it may be possible for BTC to lose its grip on $16,100. However, it was possible that the drop was not very significant due to revelation of market value to realized value (MVRV) z-score.

According to Santiment, the MVRV z-score was at an extremely low value of -0.247. The implication of this position was that BTC was undervalued and a further downward path could be out of the question.

Source: Sentiment