Around 80% of Bitcoin investors have lost money, says a study

The Glassnode report showed that as of November 9, 2022, 35.4 percent of the total supply of Bitcoin was held by long-term holders (LTH), equivalent to more than 5.9 million BTC.

Around 80 percent of global investors are likely to have lost money on their cryptocurrency investments, a study says, as the market reels under pressure amid the collapse of a major crypto exchange.

A recent study conducted by the Bank for International Settlements (BIS) in collaboration with IntoTheBlock and CryptoCompare revealed that more than 73 percent of users who downloaded crypto apps did so while Bitcoin prices hovered above $20,000 – above the price of Bitcoin in October 2022.

If these users invested in Bitcoin the same day they downloaded a crypto exchange app, they would have incurred a loss on this initial investment, it said.

This led to an average estimate of investors experiencing unrealized losses in the long term. Bitcoin prices took a steep dive after the FTX meltdown, reaching support at $16,000.

Analysis of blockchain data shows that as prices rose and smaller users bought Bitcoin, the largest holders (also called “whales” or “humpbacks”) sold – making a return at the expense of the smaller users.

The study also highlighted the trends of Bitcoin prices and the factors driving their use across different age groups and demographics in 95 countries around the world over seven years, from 2015-2022.

“Overall, back-end calculations suggest that around three-quarters of users have lost money on their bitcoin investments,” the study said.

During the period under review, the price of bitcoin rose to a peak of nearly $69,000 in November 2021 from $250 in August 2015.

Also, the number of people using smartphone apps to buy and sell cryptocurrency increased to 32.5 million from 119,000 in the same period.

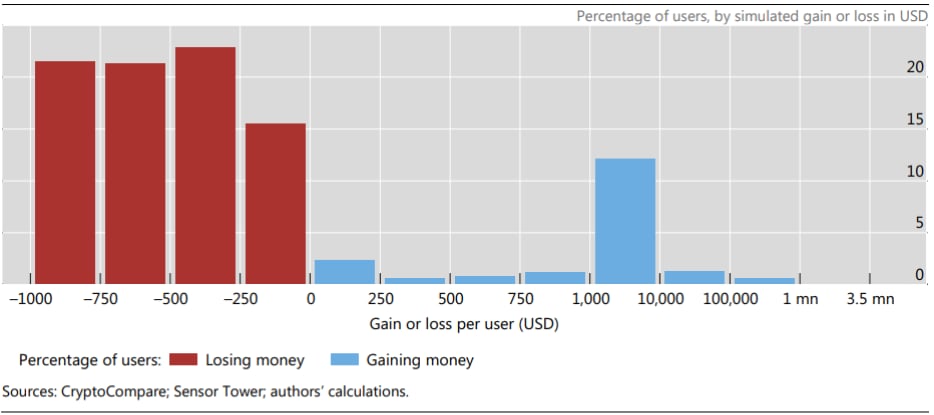

The study assumes that each new user purchased $100 Bitcoin a month for the first app download and in each subsequent month, 81 percent of users would have lost money, as shown in the graph above. The median investor would have lost $431, or 48 percent of their total $900 in invested funds.

Most of the wallets estimate increasing losses

Recent studies by Glassnode, another prominent Blockchain analytics firm, showed that a third of the total supply of Bitcoins held by investors was lost.

The Glassnode report showed that as of November 9, 2022, 35.4 percent of the total supply of Bitcoin was held by long-term holders (LTH), equivalent to more than 5.9 million BTC. All these LTHs held their BTC at a loss.

On the other hand, short-term holders (STHs) accounted for another 17 percent of the total BTC supply and held their holdings at a loss. Only 0.06 percent of the STHs were in profit.

This shows how most Bitcoin investors have been sitting on unrealized losses over the years. Most of these are long-term holders who have not seen any profits as Bitcoin prices do not show strong signs of recovery to previous levels.

Meanwhile, the latest study conducted by CoinDesk in collaboration with IntoTheBlock shows that more than 51 percent of the total 47.9 million Bitcoin wallet addresses were holding their coins at a value below the value at which they bought the coins, thus putting them at a loss. While the other 45 percent of investors were betting on unrealized gains.

To conclude

It is a fact that we have previously seen bear markets end with most wallets spilling red onto the ledger. During previous bear markets in 2015 and 2019, the proportion of wallets that lost was 62 per cent and 55 per cent respectively.

Although one can check past data to predict future outcomes, in the case of cryptocurrencies, market volatility makes it difficult to do so. Many factors, such as utility, project relevance, geopolitical issues and others, deeply affect the crypto space. Moreover, the FTX meltdown will have obvious consequences for the regulatory area. As a result, it is challenging to make sure BTC predictions now.