Arkham Intelligence tracks transactions on the blockchain

Join the most important conversation in crypto and web3! Secure your place today

The problem

Blockchains are transparent, as long as you know who is behind 0xb794f5ea0ba39494ce839613fffba74279579268 or 0xCd73f4E8F50C48267E26348DF60e6d27C5DBf168.

Privacy on the blockchain relies on the ability to hide behind long, crazy addresses – pseudonymity is the natural state of a blockchain. Tens of billions of dollars move through Ethereum’s virtual pipes every day relatively unnoticed, simply because people don’t know where the money came from or where it’s going.

Often it is very problematic. Blockchain’s blend of pseudonymity with an immutable record of transactions enables peers to transact online without trust, but it also empowers bad actors to cheat, steal and exploit.

For example, if stakeholders knew where to look, they could find data showing that client and exchange-traded funds are being mixed.

Or that Sam Bankman-Fried’s hedge fund, Alameda Research, once an industry giant, had a significant portion of its balance sheet backed by FTT, the FTX exchange.

Regulators are doing what they can to ensure that entrances to the crypto economy, such as crypto exchanges, identify users when they come on board. But know-your-customer (KYC) rules can only do so much when new addresses are easy to spin up and cryptomixers allow people to protect their transaction history.

Read profiles for all the projects you will see in 2023: Reclaiming purpose in crypto

The idea: Arkham Intelligence

Critics of cryptocurrency often accuse the sector of being biased against early adopters. The faster you are to a crypto project, the more likely it is that you can collect a small fortune in tokens while the price is low. Sometimes project insiders can benefit the most from collecting tokens in secret. At other times, seemingly unrelated addresses appear to work together to influence governance decisions.

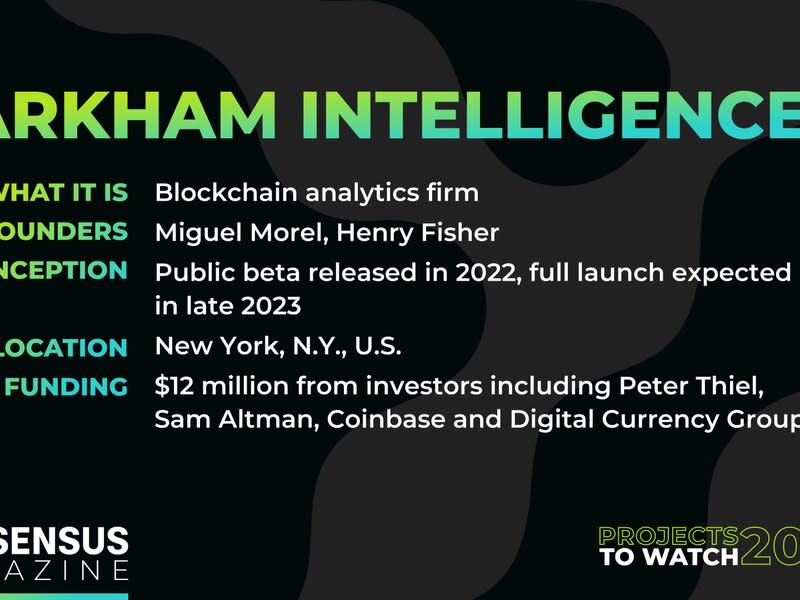

Without naming an address, it is difficult to understand what is being sent around. While some say that privacy is a fundamental part of crypto, there is also another school of thought that says that market fairness and equality can only be found in markets that are transparent. There are legitimate needs for privacy, say the founders of blockchain analytics firm Arkham Intelligence, but the market as a whole is better off if the public knows who is making the biggest trades in the ecosystem.

Arkham Intelligence hosts a relatively new platform that enables users to scrutinize blockchain addresses, inspect both sides of a transaction, track fund movements and investigate counterparty connections. The user interface sorts data by entity and tracks money flow that way as opposed to sorting things by token, which is how most of the competition organizes data.

The company has closed $12 million in funding, and plans to exit beta and launch publicly by the end of 2023. With its current runway, the firm plans to expand its feature set, including multi-chain support, and build more tools that will be familiar to traditional finance users ( TradFi).

“It’s very difficult to actually find out, despite its transparency, who the people behind these transactions are, what they’re doing with their money,” said Miguel Morel, founder of Arkham.

Arkham users can see the relationship between units in real-time and track relationships between the two.

Let’s say a large fund makes a move on a token, either adding to the position or liquidating it. Users will be able to see what is happening and where the money is flowing.

“As a cryptocurrency user, you need to manage your exposure at all times,” Morel says. “And you have to understand what it is you’re investing in, what it is you’re trading and what it is you’re speculating on.”

Arkham’s dashboards allow granular filtering and tracking of the relationships between addresses, so users can see where the coins are going.

For example, via Arkham, it is possible to see how the device that exploited the Euler Finance protocol moves around the funds, including deposits in wallets controlled by North Korea’s Lazarus Group.

Sure, it is possible to do this with a regular block explorer that is free, but it would be a much more difficult task.

“The good thing about blockchain is that it is not a black box. You don’t need a subpoena. You don’t have to wait for a judge to release information,” Morel said. “You don’t have to wait for the company to release information about what is happening internally. You can only look in the books.”

Arkham Intelligence is currently in private beta. Already it has media (including CoinDesk), crypto exchanges, hedge funds and other financial institutions as users. It received a significant amount of buzz around the time of the FTX collapse, shortly before/after it launched, due to the company’s Twitter threads that outlined and helped explain the strange flow of funds at the defunct exchange.

Transparency versus anonymity

Morel said he was motivated to build Arkham to remove pseudonymity from blockchains.

While some believe this forced unveiling is antithetical to crypto, Morel disagrees.

Morel says that even before he started Arkham, he saw that there were two narratives within the crypto industry: one that emphasizes the openness and decentralization of the blockchain, and another that emphasizes its privacy and pseudonymity.

“And they’re both true, or at least they were both true. Mostly because blockchains are completely transparent, verifiable and public with their information, it’s incredibly difficult to actually use that data,” he said. “With Arkham, that’s actually what I wanted … I wanted to marry that as an idea.”

All the data necessary to tell who is who on the chain is public and transparent, but unless you know the entity behind an address, this amount of data is useless to the average user.

“People are publicly broadcasting their activity to everyone on a minute-by-minute basis, every time they make a transaction,” he said. “We basically just create software that matches that information to the relevant person and then shows it to the end user.”

After all, why should the right to anonymity of a large investor trump the right of a private user who wants to know what they are investing in?

Morel points out that traditional finance also has a similar problem of opacity, but there are solutions for this, such as the 13F form that the US Securities and Exchange Commission (SEC) requires people or funds to file when they manage over $100 million in assets and take positions in listed companies.

“What we’re building is 10 times, 100 times, 100 times more detailed than that,” Morel said.