Argo Blockchain stock price forecast

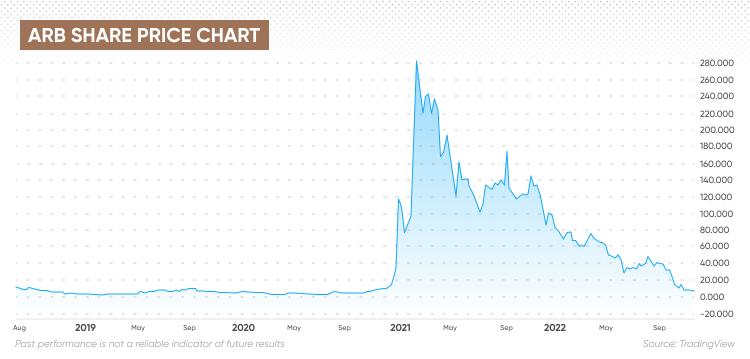

UK-based cryptocurrency miner Argo Blockchain (ARB) has seen its share price plunge 91.67% so far this year, as cryptocurrency prices have fallen, reducing the company’s revenue. A £24m funding deal went through at the end of October.

Will the company survive the turmoil in the crypto market? Is there potential to make money buying the dip in ARB stock?

Let’s look at the stock’s recent performance and potential long-term prospects.

What is Argo Blockchain?

Argo Blockchain is an enterprise-scale provider of cryptocurrency mining and smart contract services. The company aims to provide “accessible” cryptocurrency mining through a subscription service. To limit the environmental impact of mining, Argo focuses on using renewable electricity to support the growth of blockchain technologies.

The company was founded in 2017 by technology entrepreneur Peter Wall, who serves as CEO, and Mike Edwards, who was executive chairman until January 2020, when he stepped down to focus on his role as CEO of Pioneer Media Holdings.

Argo was listed on the London Stock Exchange in a £25 million initial public offering (IPO) in August 2018, in the first public listing of a cryptocurrency firm on the exchange. The stock was priced at £0.16 per share, valuing the company at £47m.

In September 2021, Argo listed 75 million American Depositary Shares (ADS) on the Nasdaq Global Market priced at $15 under the ticker ‘ARBK’, raising $112.5 million.

What is your sentiment on ARBgb?

Vote to see traders’ feelings!

ARB share price plunges in bearish crypto environment

Argo shares have fallen from their peak of £2.82 in February 2021, as the rally in the crypto market took off. But while the stock followed the pattern of crypto volatility, it did not keep pace with the magnitude of the bitcoin (BTC) market’s gains, with the stock trading up to £1.73 in September and £1.44 on November 12, after bitcoin traded at a all-time high above $68,000 on November 11.

Argo announced in July 2021 that it started construction of a bitcoin mining facility in Texas. However, the share price came under pressure as investors became concerned about the costs of the plant. In August 2021, short seller Boatman Capital warned investors: “We believe that Argo Blockchain purchased land in Texas apparently for up to 100 times more than the acreage is worth, raising serious questions about the governance of why this deal was made and who benefited.

“We are particularly concerned that nine of the beneficiaries of this deal appear to be Argo shareholders. We are also concerned that an apparently unreported multi-million dollar legal dispute between Argo and Celsius Network could threaten future bitcoin mining capacity and revenues . Argo leases around 40% of its mining fleet from Celsius.”

An insider revealed that the facility could cost $1.5 billion to $2 billion, which the company later confirmed in a statement on November 5.

The stock ended the year at £0.98 and has since been in decline amid turmoil in the cryptocurrency market. The share price was halved by May 2022 to £0.50, when Argo started bitcoin mining on the Texas site, as a strong US dollar and the collapse of the terra luna cryptocurrency caused turmoil in the markets.

Argo shares fell to £0.30 in mid-June before turning higher to reach £0.50 in mid-August as the company reported higher BTC mining revenues and the completion of a machine swap with Core Scientific. There was also a more favorable risk environment across the wider financial markets.

But the share price fell after Argo announced a 14% drop in first-half 2021 revenue to £26.7m, “driven primarily by a decline in the Bitcoin price and an increase in the global hashrate and associated network difficulty.”

In addition, the company revised its guidance for hash rate capacity to 3.2 EH/s by the end of 2022 and 4.1 EH/si during the first quarter of 2023, noting:

“We have worked closely with ePIC and Intel to modify the machine design to increase overall mining efficiency, which has delayed our expected rollout schedule. Furthermore, we are preserving our options by reducing our overall capital expenditure on these machines as market conditions remain volatile. We remain confident on the performance of the customized machines and are excited to deploy them from the first quarter of 2023.”

The share price continued to fall during September and on October 11, Argo reported a decrease in BTC mined in September to 215 bitcoin or bitcoin equivalents, from 235 BTC in August. The decline was primarily due to a 12% increase in the Bitcoin blockchain’s average network difficulty during September, and the company continued to curtail operations at the Texas facility during periods when electricity prices were high.

The ARB share price fell from £0.36 at the start of October to £0.14 on 13 October. While the price bounced from £0.11 on 21 October to £0.21 on 26 October, it failed to hold on to its gains and fell to a fresh low of £0.07 on 2 November. The stock has since fluctuated between £0.07 and £0.08 per share. Cryptocurrency prices have come under renewed pressure in November from the rapid collapse of the FTX exchange.

On 7 October, Argo had announced plans to sell 3,400 mining machines for £6m cash and to raise £24m via a proposed share offering with a strategic investor. But on October 31, the company stated that the deal had fallen through and that it was “continuing to explore other financing options”. The company added that it had sold 3,843 new mining machines for £4.8m in cash.

On November 8, Argo announced that October mining revenue totaled £3.55 million. That was down 51% from £7.24 million in October 2021. Argo mined 204 BTC in October, down from 215 BTC in September, as the difficulty of the Bitcoin network continued to increase.

The lack of funding and declining cash flow have raised questions about Argo’s long-term future.

“While Argo is exploring other financing opportunities, there can be no assurance that any definitive agreements will be signed or that any transactions will be completed. Should Argo not be successful in completing additional financing, Argo will be cash flow negative in the short term and will have to limit or stop operations, says the statement from 31 October.

“The Company endeavors to complete such financing transactions to provide the Company with working capital sufficient for its current needs, i.e. for at least the next twelve months from the date of this announcement.”

Where do analysts see stock trading in the future? What do some of the latest Argo Blockchain stock predictions indicate?

Argo Blockchain Share Price Forecast: Will the Company Survive in the Long Term?

At the time of writing (November 21), the average 12-month ARB share price forecast from two analysts was £0.0730 per share, with one rating the stock a ‘buy’ and the other giving it a ‘neutral’ rating, according to Investing.com. It will see the share price little changed from today’s £0.075 level.

Argo Blockchain stock price forecast from algorithm based forecaster Wallet investor at the time of writing estimated that the stock could fall from £0.08939 to £0.0559 in December and then fall further from £0.01 to £0.0000212 in May 2023. Wallet Investor’s Argo Blockchain share price forecast for 2023 indicated that the stock effectively could fall to zero by the middle of the year.

However, the Argo Blockchain stock price forecast for 2025 is from AI pickup saw the stock return to an average of £6.806, from £0.7553 in 2023.

Meanwhile, according to data compiled by MarketBeat, Nasdaq-listed ARBK stock forecast targets have ranged from $8 from HC Wainwright on Aug 26 to $3 from Barclays on Oct 10. On November 1, analysts at Jefferies Financial and Canaccord Genuity downgraded the stock from buy to hold, while analysts at Stifel Nicolaus downgraded their rating from hold to sell. The ADS price closed at $0.82 on November 18.

Argo Blockchain stock price forecast from Gov Capital for the company’s ADS share estimated that the price could fall to zero as soon as December 2022.

If you are looking for an Argo Blockchain stock price forecast to inform your trading strategy, it is important to remember that the high volatility of the cryptocurrency and stock markets makes it difficult for analysts and algorithmic forecasters to make accurate predictions about the future of the stock price.

We recommend that you always do your own research. View the latest market trends, news, technical and fundamental analysis and expert opinions before making any investment decision. Remember that past performance is no guarantee of future returns. And never invest money you can’t afford to lose.

Common questions

Is Argo Blockchain a good stock to buy?

Whether ARB is a suitable stock for your portfolio depends on your risk tolerance, trading strategy and how much you intend to invest, among other factors. Always be sure to do your own research.

Will the Argo Blockchain share price go up or down?

The direction of ARB’s share price will likely depend on the bitcoin price, as well as whether the company can generate sufficient liquidity to continue operations, among other factors. Remember that past results are not a guarantee of future results.

Should I invest in Argo Blockchain shares?

The decision to invest in ARB is one that only you can make. You should do your own research to take an informed view of the market.

Related reading

https://www.youtube.com/watch?v=

Please rate this article

![Ripple [XRP]: Before becoming a part of the exit liquidity, read this Ripple [XRP]: Before becoming a part of the exit liquidity, read this](https://www.cryptoproductivity.org/wp-content/uploads/2022/10/david-paschke-dzq6iTasEjk-unsplash-1-1000x600.jpg)

Comments

There are currently no responses to this story.

Be the first to answer.