Argo Blockchain (LON:ARB) pulls back 11% this week, but still delivers shareholders solid 49% CAGR over 3 years

The Argo Blockchain plc (LON:ARB) share price has fallen by approx. 34% in the last month. But in three years the return has been great. The share price marched upwards over that time, and is now 233% higher than it was. So the latest drop in the share price should be seen in that context. Only time will tell if there is still too much optimism reflected in the share price.

In light of the stock falling 11% in the last week, we want to examine the long-term history, and see if fundamental factors have been the driver of the company’s positive three-year return.

See our latest analysis for Argo Blockchain

Because Argo Blockchain posted a loss over the past twelve months, we believe the market is likely more focused on revenue and revenue growth, at least for now. When a company is not making money, we generally expect good earnings growth. That’s because rapid revenue growth can easily be extrapolated to predict profits, often of significant size.

Argo Blockchain’s revenue increased by 77% every year over three years. That’s well above most pre-profit companies. Along the way, the share price rose 49% per year, a solid pop by our standards. This suggests that the market has recognized the progress the business has made, at least to a significant extent. This is not to say that we think the share price is too high. In fact, it might be worth keeping an eye on this one.

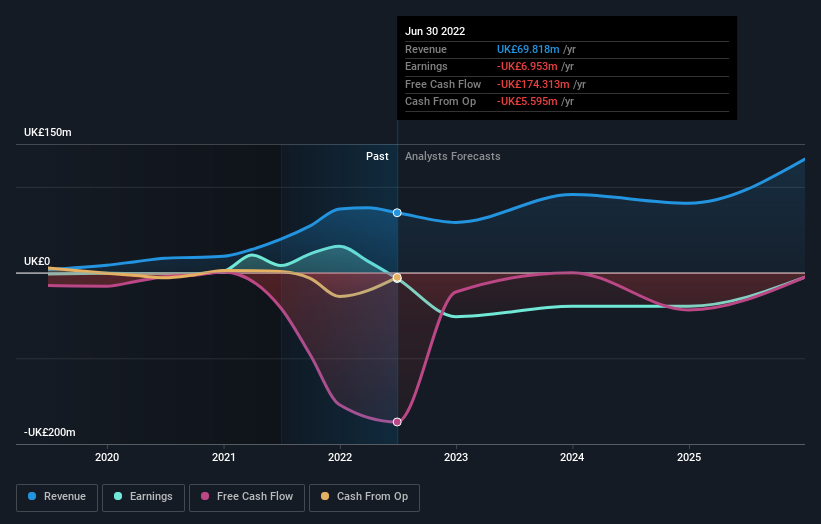

You can see below how income and earnings have changed over time (find the exact values by clicking on the image).

Balance strength is crucial. It might be worth taking a look at ours free report on how its financial position has changed over time.

Another perspective

Argo Blockchain shareholders are down 81% for the year, but the broader market is up 6.1%. But remember that even the best stocks will sometimes underperform the market over a twelve-month period. Fortunately, the long-term story is brighter, with total returns averaging around 49% per annum over three years. Sometimes when a good quality long-term winner has a weak period it turns out to be an opportunity, but you really have to be sure the quality is there. I think it is very interesting to look at the stock price over the long term as a proxy for business performance. But to really gain insight, we also need to consider other information. To that end, you should learn about 4 warning signs we’ve seen with Argo Blockchain (including 2 that are a bit uncomfortable).

Of course Argo Blockchain may not be the best stock to buy. So you might want to see this free collection of growth stocks.

Please note that the market returns given in this article reflect the market weighted average returns of stocks currently trading on GB exchanges.

Do you have feedback on this article? Worried about the content? Contact with us directly. Alternatively, you can email the editors (at) simplywallst.com.

This article by Simply Wall St is general. We provide commentary based on historical data and analyst forecasts only using an objective methodology, and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell shares, and does not take into account your goals or your financial situation. We aim to provide you with long-term focused analysis driven by fundamental data. Please note that our analysis may not take into account the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any of the stocks mentioned.

Join a paid user research session

You will receive one $30 Amazon Gift Card for 1 hour of your time while helping us build better investment tools for individual investors like yourself. sign up here