Argo Blockchain: Down But Not Out (Excluded From My Portfolio) (NASDAQ:ARBK)

piranha

UK-based crypto miner Argo Blockchain (NASDAQ:ARBK) has seen a strong price movement in its shares in recent weeks. But I’m still bearish and actually took advantage of a recent sharp price rally to sell my existing position (at a huge loss).

In about a year and a half after covering the name, I have gone between positive, neutral and negative positions in the company. (That in itself should perhaps have made me think harder about my analytical framework). For now, I’m still bearish.

Good news

At the end of last year, the company announced some important news. It sold its large mining facility in Texas for $65m (£54m), refinanced its asset-backed loans and entered into a hosting agreement to maintain its mining machinery at the Texas facility. Full details of the transaction can be found here.

The company described these as “transformational strategic transactions,” and I think that’s fair. I also see that as good news. I have previously had doubts about Argo’s ability to maintain a going concern if it did not improve its finances. In October, it announced a series of “strategic actions to strengthen the company’s balance sheet”, including shareholder dilution and the sale of thousands of mining machines (“new in box”). These transactions were expected to ensure that Argo had sufficient working capital for a year.

This smells like a fire sale to me. I think the latest transaction is good news for Argo because it strengthens liquidity and helps raise the company’s working capital. But I also see it as a bad signal. It’s been less than a year since the Texas facility opened (or “activated” in company jargon, which in itself should have been a warning to me). This was the centerpiece of the company’s strategy, but it has now been sold along with thousands of machines the company bought but never took out of their boxes. Either the strategy is deeply flawed, the management is incompetent or both (which is my opinion).

Risk and potential reward

Argo has been hit like its peers by falling crypto prices, with Bitcoin (BTC-USD) down around three-fifths in the past year. If prices rebound, it could help the firm’s profitability.

At a half-year level, the company reported a loss after tax of £30.5m, compared with a profit after tax of £7.2m at the same stage a year earlier. Rising crypto prices can help boost profitability while further falls can hurt it.

Its current market value is around $67 million. The latest transactions “will reduce total debt by $41 million,” though it’s unclear to me what the company’s current net debt is. But could the shares be a bargain if Argo survives as a going concern (which the latest transactions make more likely, in my view) and takes advantage of the next rally in crypto prices? I certainly think it can.

However, the risk here is far too high for my tolerance. Crypto pricing is central to Argo’s valuation, and it has no control over it. I have serious doubts about the company’s management and strategy. Further shareholder dilution to increase liquidity is a clear risk, and I also continue to see eventual bankruptcy as a risk, although for now at least the latest transactions have strengthened the balance sheet.

My mistakes in analyzing Argo

Given how I now feel about the Argo, how did I decide to buy it?

My stake was small at just a few hundred dollars which I bought in part to have some skin in the game analytically, a motivation I now question.

Normally when I invest, I look for a company that has already proven that it can be consistently profitable, even if at the time I buy it may be loss making. Two of my biggest investment mistakes over the past couple of years, judged by percentage loss, clearly failed to meet this criteria (in addition to Argo, the other being kidney diagnostic firm Renalytix (RNLX)). In the case of Argo, however, it came close: it recorded profits after tax in both 2020 and 2021. While the 2020 profit was quite small (£1.4m), 2021 came in at £30.8m. I saw that as a sign of rapid growth rather than a lack of long-term consistent profitability. In the future, I think I will look for more than just a couple of years of profits as evidence of consistent profitability.

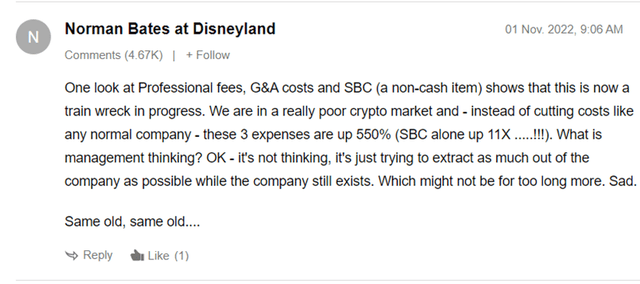

But I also missed or ignored other red flags. Take this insightful comment from November on an article I wrote in May, by SA user Norman Bates at Disneyland:

comment on the article (Seeking Alpha)

In 2021, legal, professional and regulatory fees rose by 1,344% on the previous year to £1.5m. Total administrative costs that year almost quadrupled. Granted, this was during a period of company expansion, but in retrospect that kind of jump now looks like a red flag.

More information about fees in the October and December transactions is missing, but will hopefully come at the full-year level. However, Norman Bates at Disneyland’s attention to such metrics seems valuable, and I should have followed up more closely myself.

I deluded myself a bit by thinking that one could separate the risk of investing in crypto (which I see as a Ponzi scheme) from investing in a company with a business model heavily tied to crypto pricing, which I did for example by considering other areas of use. as Argos data centers can be used.

Valuing Argo Blockchain Shares

Big money has been possible on Argo in recent weeks, with shares doubling in a single day’s trading at one point and other big moves. However, I see it as akin to speculation rather than investment.

The link to crypto pricing remains, the company’s strategy now looks questionable (and at a tactical level it seems to be survival) and I have no confidence in the management. On that basis, while a change in fortunes could conceivably lead to a large share price jump, I do not attribute any value to the shares.

Editor’s Note: This article covers one or more microcap stocks. Be aware of the risks associated with these stocks.