Argo Blockchain continues to build out as Bitcoin price falls below $20,000

NiseriN

A quick overview of Argo Blockchain

Argo Blockchain plc (NASDAQ:ARBK) went public in September 2021, raising approximately $113 million in gross proceeds from an IPO priced at $15.00 per ADS.

The firm operates cryptocurrency mining computers in locations in North America.

Argo appears to be effectively managed, so it’s worth putting on a watchlist at the current price of around $4.00, but for now I’m on hold for the stock.

Argo Blockchain Overview

London, UK-based Argo was founded to cost-effectively mine Bitcoin (BTC-USD) and other cryptocurrencies in North America using “predominantly renewable and affordable power.”

The management is led by managing director, Peter Wall, who has been with the firm since its inception and was previously a partner at The Art Department.

The firm currently has thousands of Bitcoin mining machines located in owned and hosted facilities in Canada and the United States.

Management also intends to invest in strategic initiatives beyond mining to diversify revenue streams via the Argo Labs division.

Argo Blockchain’s market and competition

The global Bitcoin mining market is currently undergoing significant change, with the recent bans on mining in China causing a large amount of the country’s hash power to leave the network as these operators look for a more suitable location.

The market value of mining depends on the price of Bitcoin, as the majority of the value that goes to the miner is a function of the current Bitcoin reward rate of 6.25 Bitcoin per successfully mined block.

At a price of $25,000 per Bitcoin, for example, the annual mining reward for the entire industry would be approximately $8.2 billion per year.

Major competing or other industry participants include:

-

Bit farms

-

DMG Blockchain

-

Hive Blockchain

-

Cabin 8 Mining

-

HashChain technology

-

DPW Holdings

-

Layer1 technologies

-

Riot Blockchain

-

Marathon Patent Corp.

-

Second

Argo Blockchain’s recent financial results

-

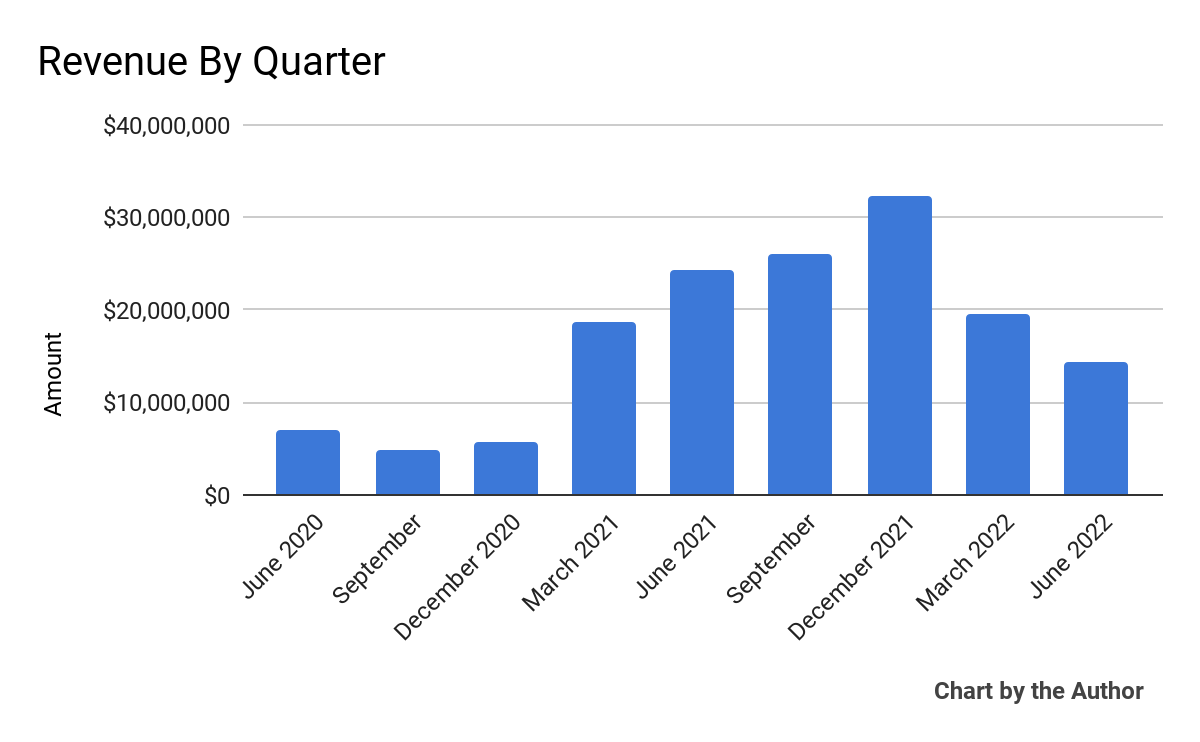

Total revenue per quarter has resulted in the following trajectory over the past 9 quarters:

9 quarter total revenue (seeking alpha)

-

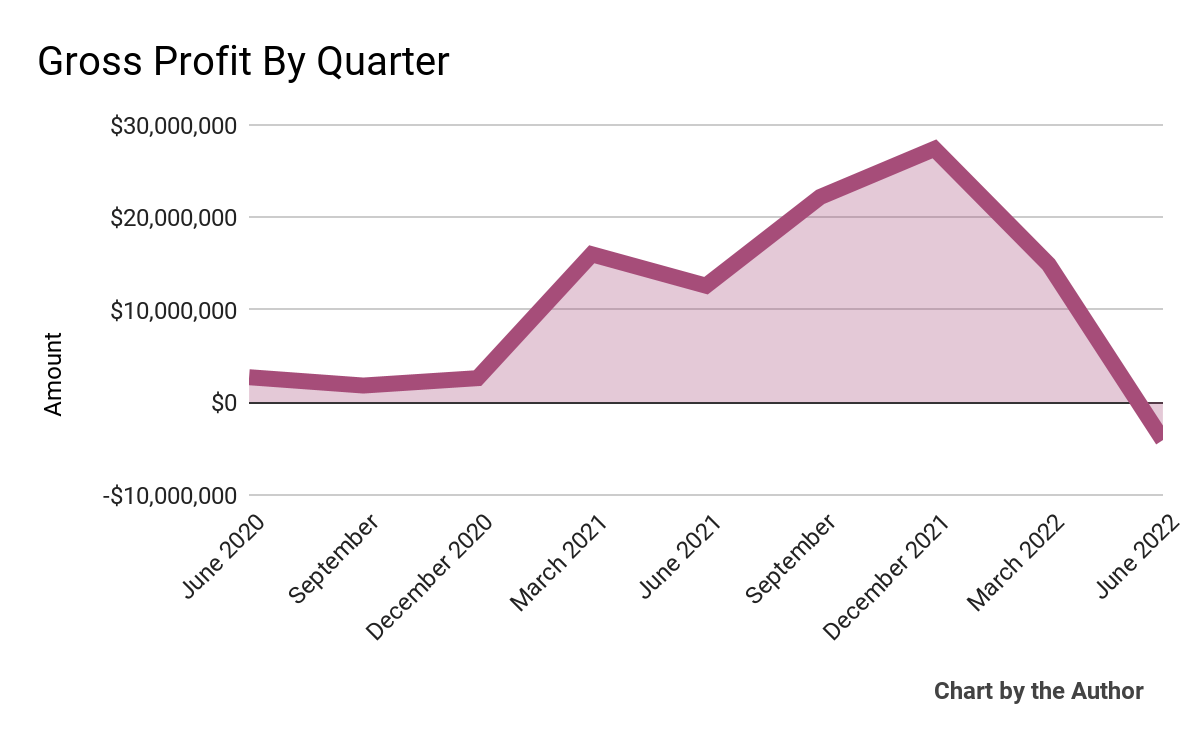

The gross profit per quarter has recently become negative:

9 quarter gross profit (seeking alpha)

-

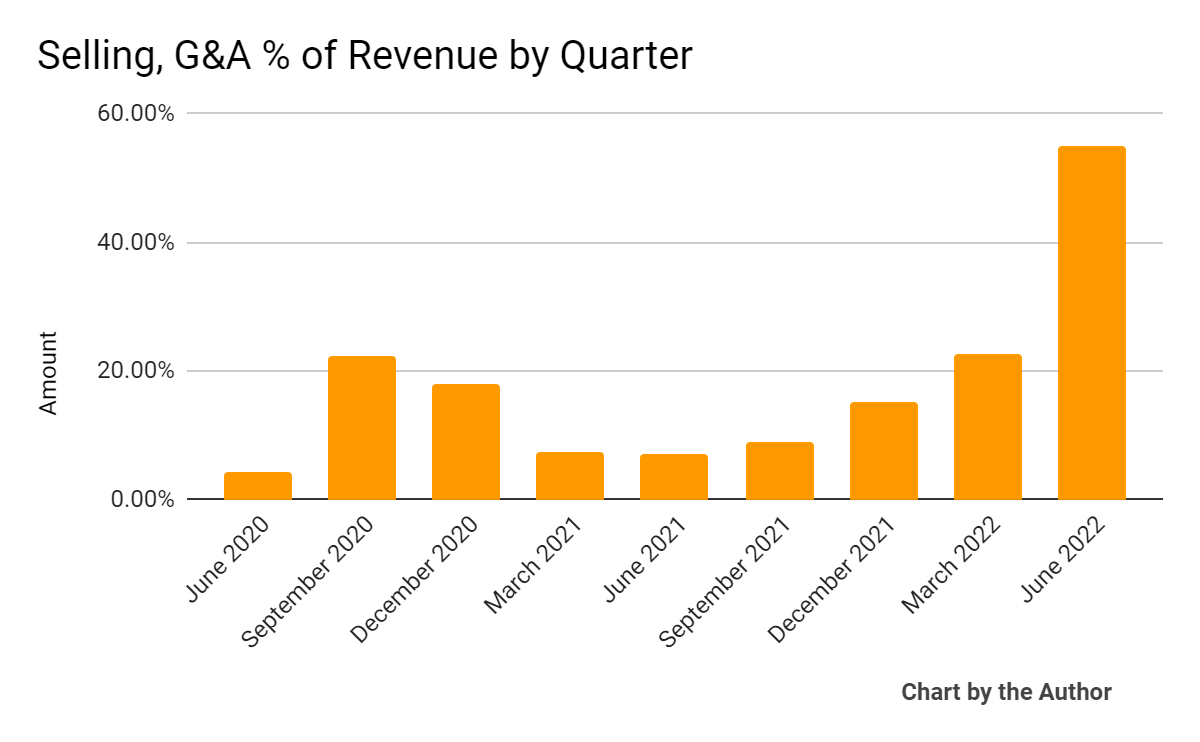

Sales, G&A expenses as a percentage of total revenue per quarter have increased sharply in recent quarters:

9 quarter sales, G&A % of revenue (seeking alpha)

-

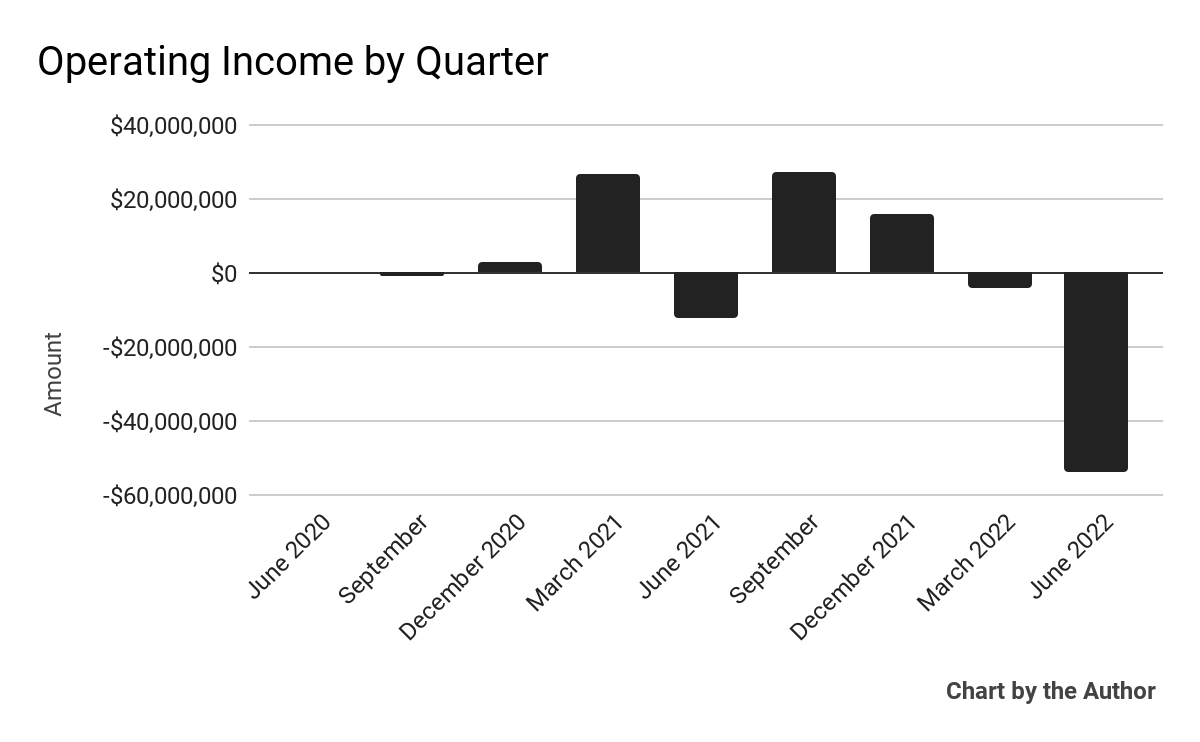

The operating income per quarter has become significantly negative in the 2nd quarter of 2022:

9 quarter operating income (Seeking Alpha)

-

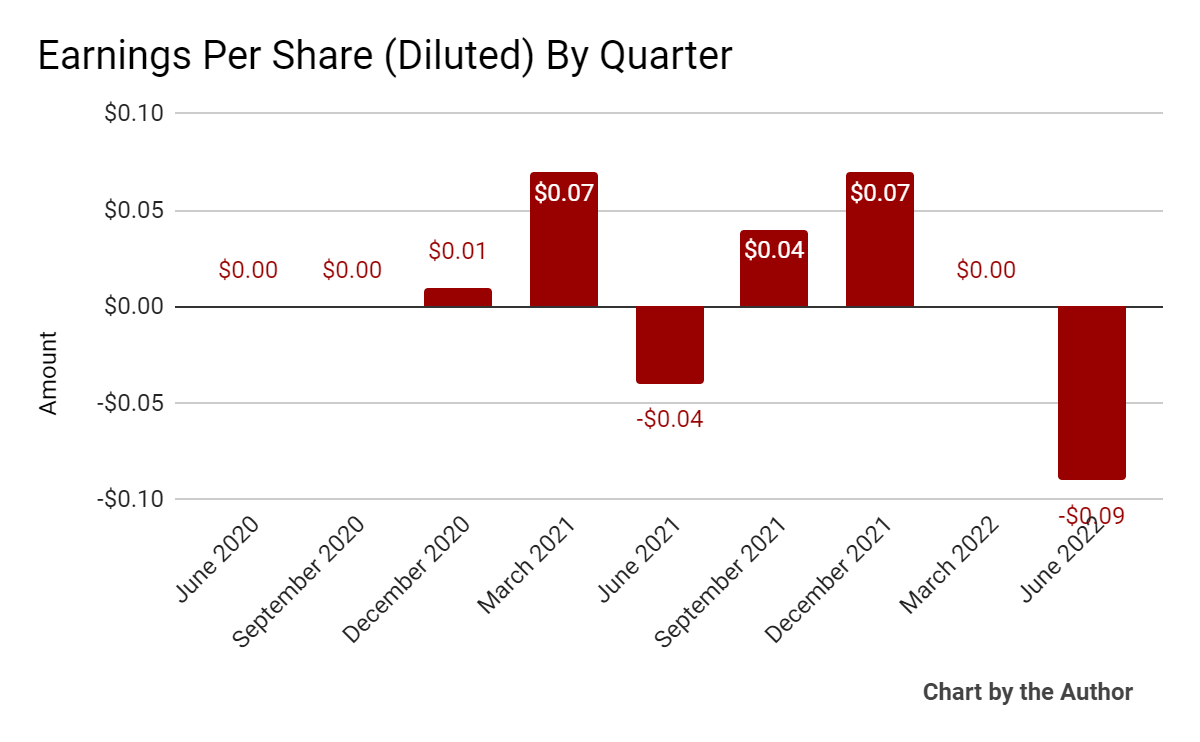

Earnings per share (diluted) have also turned into negative territory in Q2 2022:

9 quarterly earnings per share (Seeking Alpha)

(All data in the charts above are IFRS)

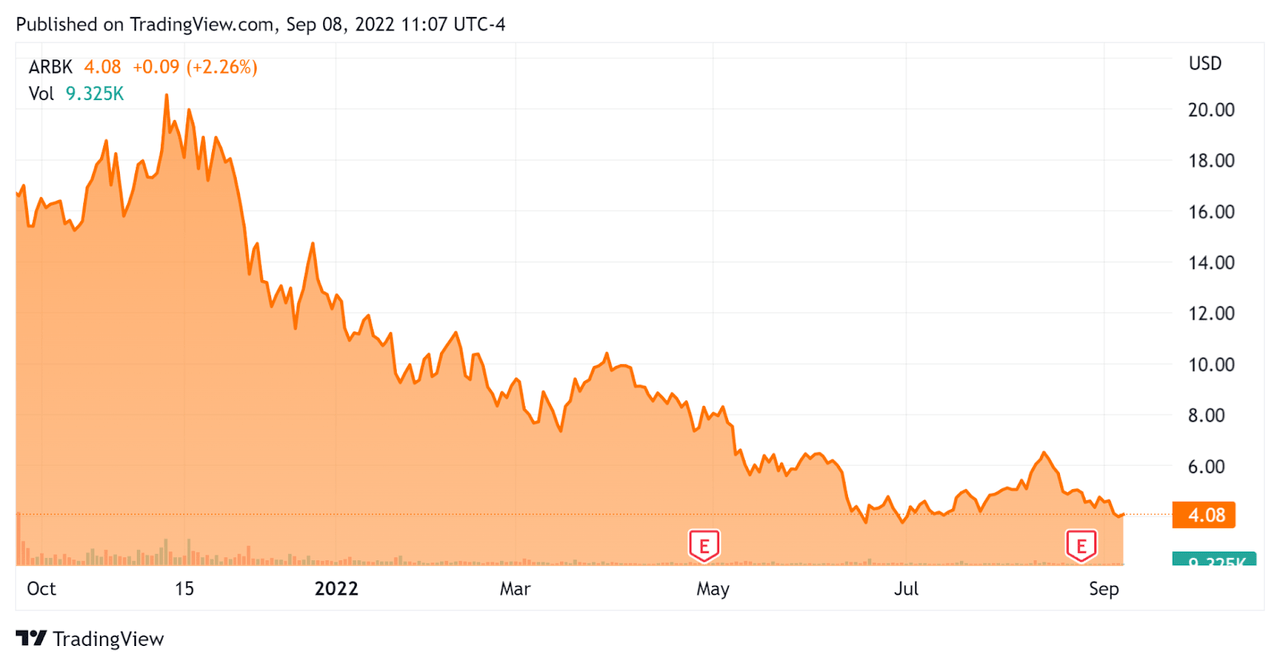

Since its IPO, ARBK’s share price has fallen 76% compared to the US S&P 500 index’s fall of around 11.2%, as the chart below indicates:

Share price since IPO (Seeking Alpha)

Valuation and other metrics for Argo Blockchain

Below is a table of relevant capitalization and valuation figures for the company:

|

Target (TTM) |

Amount |

|

Enterprise value/sales |

3.65 |

|

Income growth |

79.4% |

|

Net income margin |

-10.0% |

|

IFRS EBITDA % |

0.4% |

|

Market value |

$184,580,000 |

|

Group value |

$310,020,000 |

|

Cash flow from operations |

-$6,810,000 |

|

Earnings per share (fully diluted) |

$0.02 |

(Source – Seeking Alpha)

For reference, a relevant partially public comparable would be the much larger firm Riot Blockchain (RIOT); shown below is a comparison of their primary valuations:

|

Metric |

Riot Blockchain |

Argo Blockchain |

Difference |

|

Enterprise value/sales |

2.39 |

3.65 |

52.7% |

|

Income growth |

372.4% |

79.4% |

-78.7% |

|

Net income margin |

-118.5% |

-10.0% |

-91.6% |

|

Cash flow from operations |

-$73,610,000 |

-$6,810,000 |

-90.7% |

(Source – Seeking Alpha)

A full comparison of the two companies’ performance measurements can be seen here.

Comment on Argo Blockchain

In its most recent investor presentation (Source – Argo Blockchain) and financial results announcement (Source – Seeking Alpha), published on August 25, 2022 and August 23, 2022, respectively, management disclosed revenue of $32.5 million and adjusted EBITDA of $20.9 million .

Adjusted figures often exclude share-based compensation.

The firm saw a drop in its mining margin in the first half of 2022, to 71% from 81% in the first half of 2021. Argo says this is superior to its peers’ (Marathon, Riot, Hut 8, Bitfarms) margin of 61%.

ARBK brought its Texas flagship online during the quarter, with total hash power expected to reach 4.1 exahashes per second by the end of 2022 and installation of miners at the facility to continue through Q1 2023.

Notably, the firm has reached a supply agreement with Intel to supply its Blockscale energy-efficient hashing ASIC chip as part of the firm’s mining rollout in late 2022 and early 2023.

Management also continues to seek diversification of revenue streams through the Argo Labs initiative driven by Chief Strategy Officer, Sebastien Chalus.

As for the financial results, the total revenue has fallen significantly from a high mark in Q4 2022 as the price of Bitcoin has fallen sharply.

The gross result has become negative, while SG&A expenses as a percentage of income have increased and the operating loss has increased significantly.

On balance, the company ended the quarter with cash and digital assets valued at $45.4 million and total debt of $143 million.

In terms of valuation, the market has hammered Argo’s stock as a proxy for the price of Bitcoin, which has fallen sharply in recent months.

The company’s significant capital requirements for the acquisition of mining computers and the construction of associated infrastructure have also placed it at a disadvantage in today’s environment of increasing capital costs due to interest rate increases.

The primary risk to the company’s outlook is a continued bear market for the price of Bitcoin, just as large investments in Bitcoin mining equipment have been made by the firm and others in the space.

A potential upside catalyst would obviously be a Bitcoin price rally, but also a pause in the increase in the cost of capital.

Bitcoin mining stocks have been hit hard lately, but represent potential value opportunities for those bullish on Bitcoin prices.

While I am in the bullish Bitcoin camp, it may take some time to see a meaningful price increase for the digital asset.

Argo appears to be effectively managed, so it’s worth putting on a watchlist at the current price of around $4.20, but for now I’m on hold for the stock.