Are US investors buying the Asian dump?

Crypto prices have been swinging in both directions since the beginning of the week. No decisive trend has managed to establish itself strongly. Nevertheless, the cumulative valuation of all coins has hovered below $1 trillion recently, highlighting macro weakness. In the midst of the ongoing ebb and flow, funds have been shuffled around in the ecosystem itself. Most of the flows to Bitcoin have come via the Tether route in the last 24 hours.

On the contrary, injections via the fiat route have been relatively lean. On the other hand, market participants have also made diversions from Bitcoin to Ethereum and other stablecoins such as Binance’s native BUSD.

In the midst of the fund shuffling, fuel is added to one particular speculation: Asians are dumping crypto, while participants from the West have bought the same dump in eastern trading hours. But is the same HODL right?

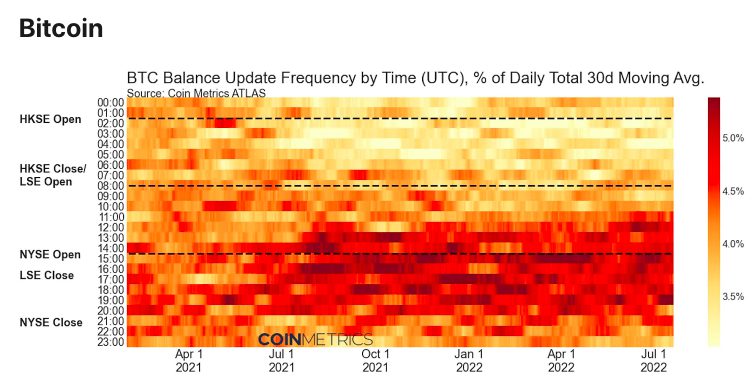

Bitcoin

A recent CoinMetrics report depicted time-based patterns and brought to light some interesting trends. The activity levels of some cryptoassets have depicted high amounts of clustering at certain times of the day, while being weak at other times.

The East has been quite strict about crypto-embrace compared to the West. China, for example, issued crackdowns on Bitcoin mining last spring and summer. Investors, for their part, are also rather less concentrated on the eastern side of the sphere compared to the western. The same has had a direct impact on trading activity. Per CoinMetrics,

“Most activity for Bitcoin is now concentrated in European/US working hours with a noticeable downward shift in the percentage of activity in Asia/Pacific hours…”

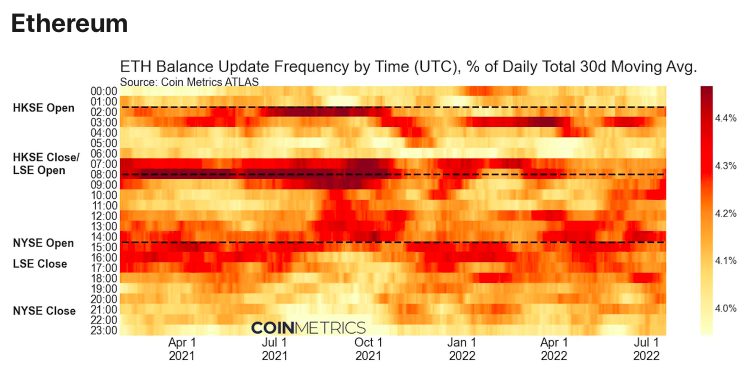

Ethereum

Unlike Bitcoin, Ethereum has not necessarily shown any strong daily pattern. As shown below, balance updates are somewhat scattered.

In terms of price, however, ETH’s movements have had more drive and power lately compared to Bitcoin. From the end of June 24 to the middle of June 26, Ethereum fell by nearly 19%, while Bitcoin lost only 10% of its value. In the aforementioned period, but no particular Asian market dump, American market buying pattern took some concrete form. Nevertheless, it should be noted that a couple of exceptional green lights were recorded by Ethereum and Bitcoin on July 25th, and the same happened roughly during the late EST hours.

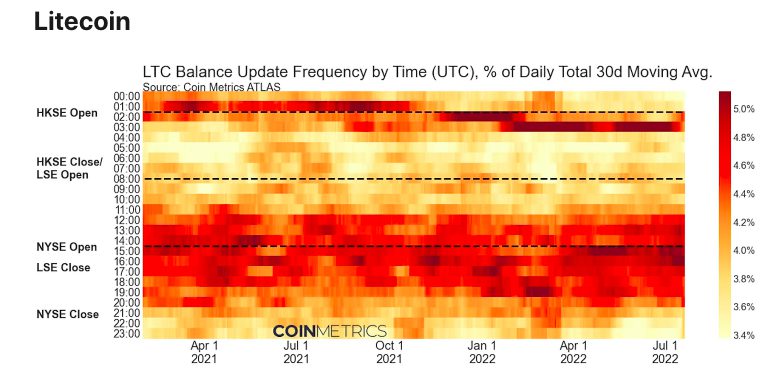

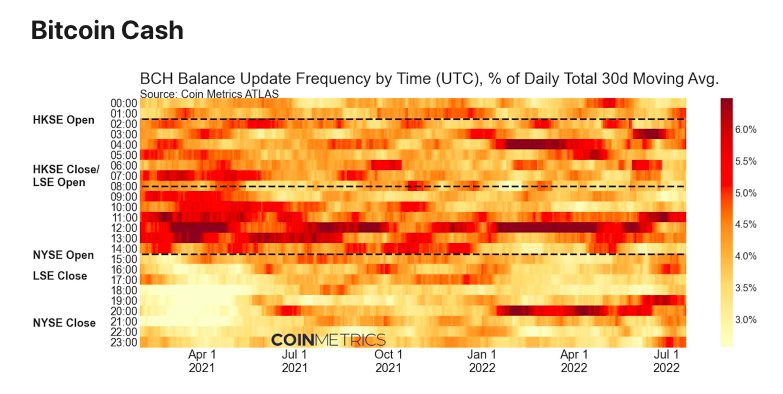

Alts: Litecoin, Bitcoin Cash

Alts has not necessarily followed the same path. Take Litecoin for example. Per CoinMetrics,

“Litecoin is showing some interesting behavior clustering roughly between 1:00-3:00 UTC, which is in line with the Asia/Pacific market open, clustering tightly around a single hour bin.”

That being said, it does not mean that Western participants have completely washed their hands of this Altcoin. A reasonable increase in Litecoin has also been noted during the LSE and NYSE sessions.

Bitcoin Cash, on the other hand, has three clusters at 3:00, 12:00 and 20:00 UTC. The same suggests that activity is most concentrated in the Asia/Pacific and London sessions. However, compared to last year, their activity seems to be quite suppressed.

So now, although a few clustering trend patterns and an increase in activity have been noted recently, there is no clear evidence that one set of participants is buying the other’s dump. As highlighted in the price chart above, an increase in activity has not always corresponded to an increase in price.

And lately, color bars have been more dominant on the price charts, indicating that positive/negative market sentiment has carried over from one trade to another. With the latest moves in mind, the current speculation is not necessarily HODL true at the moment.