Are 99% of Investors Avoiding the Taxman?

New research from crypto tax firm Divly has made some startling revelations about how many investors actually pay tax.

On April 5, Divly released its “Global Cryptocurrency Taxation Report 2022.” In it were some surprising statistics regarding crypto treasures around the world.

The research analyzed the percentage of cryptocurrency investors who declared their assets to their local tax authorities in 2022.

According to Divly, hardly anyone declared their crypto trading or investment activity to TX authorities last year.

“We estimate that globally only 0.53% of cryptocurrency investors declared their cryptocurrency activity to their local tax authorities in 2022.”

Everyone is avoiding crypto taxes?

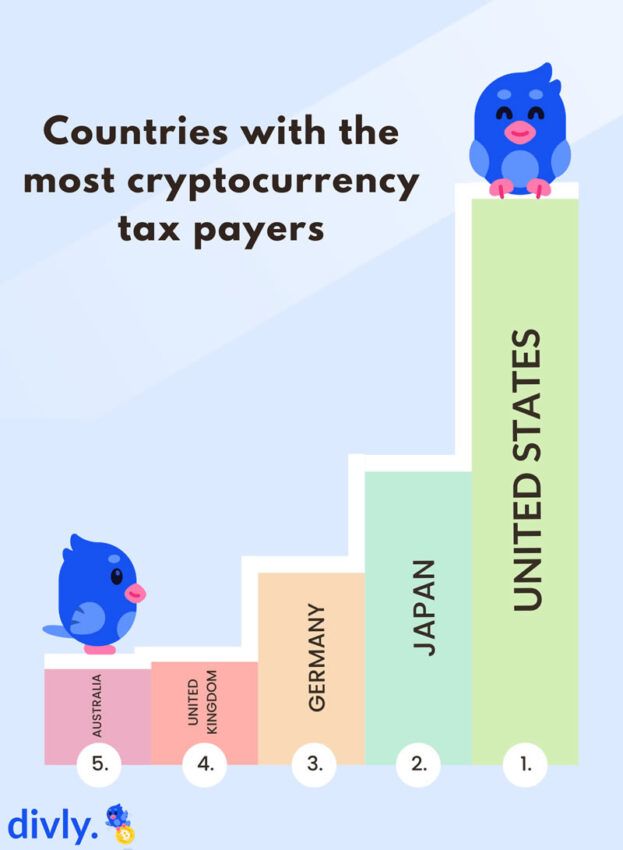

In terms of payment rates, Finland topped the list with 4.09%. This is the percentage of investors in the country who actually paid crypto tax in 2022.

Australians came in second, with 3.65% of investors paying some tax on their digital asset profits. Also, only 1.62% of Americans paid crypto taxes last year, according to the research. The Philippines had the lowest payment rate at just 0.03%.

The US has the tenth highest crypto tax payment rate of the 24 countries analyzed, it revealed.

Even with its low rate, the US came out as the country with the most crypto taxpayers. This is likely due to the excessive control the Internal Revenue Service (IRS) has over Americans’ lives. The report also said that US tax compliance rates had doubled since 2018.

In terms of continents, Asia came out lowest with a payout rate of just 0.20%.

Questionable methods

Divly’s methods for calculating these numbers were a bit questionable.

The survey used a combination of “official government figures and search volume data” to estimate the number of investors who have declared their business to the tax authorities. Governments are likely to underestimate the number of people who pay taxes.

It also analyzed the relationship between the number of people who declared their crypto holdings in their tax returns and the search volume for tax-related cryptocurrency keywords in a country.

This is a very vague method of determining data, so these numbers should be taken with a large grain of salt.

Earlier this month, US President Joe Biden proposed a budget that included a provision to close the tax loss loophole on crypto transactions.

Investors have used this method of selling an asset and repurchasing it to reduce any taxes imposed on the profit.

In late March, BeInCrypto reported that the IRS announced that it is considering taxation of non-fungible tokens (NFTs).

Disclaimer

In accordance with the guidelines of the Trust Project, BeInCrypto is committed to objective, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify the facts independently and consult with a professional before making any decisions based on this content.