Arbitrum dominates blockchain activity in Q1 2023 with over 125% growth, says latest DappRadar report – BitcoinKE

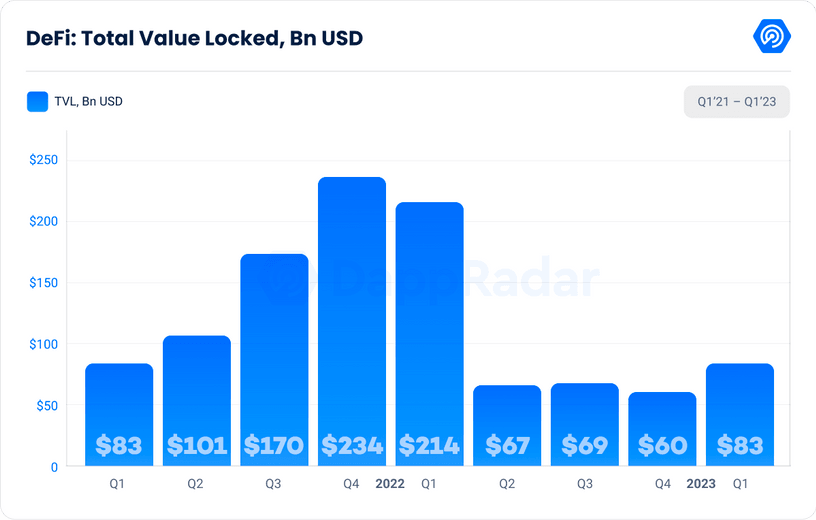

The DeFi sector has been a major focus in Q1 2023 with Total Value Locked (TVL) in DeFi reaching $83.3 billion at the end of the quarter.

According to the Q1 2023 DappRadar report, this represents a significant increase of 37.44% from the previous quarter and reflects a growing interest in decentralized finance.

The growing popularity of scaling solutions such as Arbitrum, Fantom and Optimism have played a significant role in the growing interest in DeFi.

[WATCH 🇰🇪]

“How many people have used a Layer 2?” – @VitalikButerin pic.twitter.com/PN4dKIPWKi

— BitKE (@BitcoinKE) 21 February 2023

In addition, the 48% increase in Ethereum’s price to over $1,800 in Q1 2023 was also a contributing factor in raising TVL.

In terms of blockchain activity:

- BNB Chain remains the most active in Q1 2023 with an average of 449,543 daily unique active wallets (dUAW) despite a 28.62% decrease from the previous quarter

- Wax follows close behind, up 9% over the past three months to reach an average of 397,273 dUAW

- Meanwhile, Polygon had a strong quarter and witnessed a 25.93% increase in its daily Unique Active Wallets reaching 197,343 unique wallets per day

- Arbitrum emerged as the top performer with a remarkable increase of 125.83%, reaching an average of 46,071 daily unique active wallets (dUAW). This growth can be attributed to the Arbitrum airdrop that took place in March 2023

The Rise of Social Dapps

The social dapps vertical has emerged as one of the most favored sectors in the industry. This category includes all Web3 platforms for social networking, messaging, and content creation, and recorded an average of 210,644 daily unique active wallets (dUAW) in Q1 2023.

While this figure indicates a 4.9% decline from the previous quarter, the vertical has expanded a remarkable 2,250% since Q3 2022.

Social dapps now account for 12% of DappRadar’s activity on the chain.

Social dapps use blockchain technology to provide users with privacy, security and transparency. They offer various features such as user profiles, messaging systems and content sharing features.

Top social dapps by Unique Active Wallets in Q1 2023 are as follows:

- Hooked – 120,584

- Glax – 39,953

- CyberConnect – 30,407

- Lens Protocol – 3.146

- Phi – 2405

The NFT market in the 1st quarter of 2023

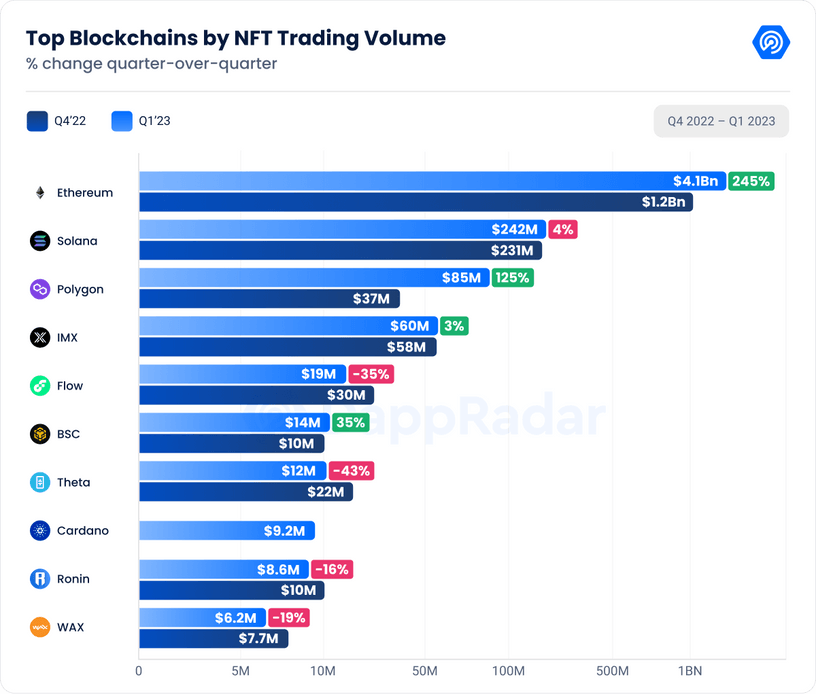

As for the non-fungible tokens (NFT) market, we see a strong start in Q1 2023 with the best performance since Q2 2022. Although there was a slight decrease in trading volume in March 2023, the overall trend was bullish.

During the quarter, the market experienced a significant increase in trading volume with a 137% increase compared to the previous quarter, totaling $4.7 billion. However, March 2023 saw a 15.65% drop in trading volume due to the inflated February 2023 period caused by Blur token farming. Despite this, the number of NFTs sold only fell by 4.63% in March 2023 with a total of 2.7 million NFTs sold.

All in all, Q1 2023 had a total of 19.4 million NFT sales which marks an increase of 8.56% from the last quarter of 2022.

The Ethereum blockchain continues to hold the largest share of the NFT market by trading volume with 89.50% market share by March 2023, with total trading volume during the quarter growing by 245.43% to reach $4.1 billion compared to Q4 2022. CryptoPunk’s NFT collection was the most traded on Ethereum with a trading volume of $241 million, a significant increase of 1,214% from the previous month.

In March 2023, NFT collections from Yuga Labs overtook Ethereum volume, accounting for 38.61% of NFT volume on Ethereum and 34.55% of the entire NFT industry.

According to DappRadar, the NFT market is experiencing rapid development, with new players appearing and changing the dynamics.

Based on this analysis, Blur dominated the NFT market and experienced a significant increase in trading volume and market dominance during the quarter. The NFT market witnessed a remarkable increase in trading volume, amounting to $2.7 billion, which marked a significant increase of 783.89% from the previous quarter and accounted for 57.44% of the NFT market in Q1 2023.

See also

In March 2023, although the trading volume for Blur fell by 6.56% to $1.2 billion, it still had a market dominance of 70.5%.

At the same time, OpenSea, one of the largest NFT marketplaces, saw a 68.41% increase in trading volume, reaching $1.4 billion with a market dominance of 31.10% during this period. OpenSea’s trading volume fell 35% to $381 million in March 2023, and its market dominance fell to 22%, its lowest market share since February 2021.

A more notable factor in Q1 2023 was the growing dominance of blockchain gaming, which now accounts for 45.60% of all activity on the chain. according to DappRadar. Platforms such as ImmutableX and Polygon are said to be leaders in the gaming space, with their partnerships and innovations paving the way for the future of Web3 gaming.

Despite the impressive resilience still demonstrated by the crypto space, the sector still experienced significant challenges.

In Q1 2023, there were still cases of hacks and exploits resulting in the loss of funds, with a total of $373 million lost. However, this was a significant improvement from the previous quarter, which posted a loss of $5 billion. The decline in losses demonstrates the resilience and adaptability of the blockchain ecosystem and the efforts of industry players to improve security measures.

Another issue that has emerged is the collapse of Silicon Valley Bank which has highlighted the need for stable coin regulations. With more traditional financial institutions moving into the crypto space, it has become increasingly crucial to establish clear guidelines and regulations to ensure market stability and security.

________________________________

Follow us on Twitter for the latest posts and updates

Join and interact with our Telegram community

________________________________

________________________________