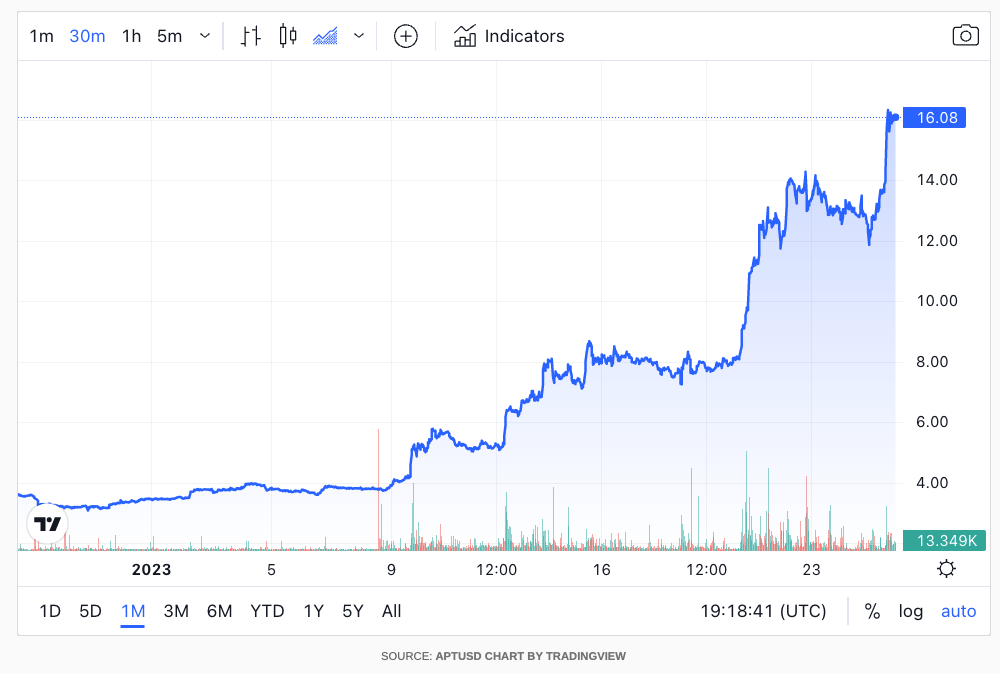

Aptos surges 343% to new all-time high amid renewed interest in L1 blockchains

Aptos (APT), the layer 1 proof-of-stake blockchain developed by former Meta employees that supports smart contracts and decentralized applications, has been one of the biggest winners in January, with the token increasing by more than 343.76% de last 30 days.

The v-shaped recovery for APT comes after a something tumultuous start, despite raising $350 million in two funding rounds in 2022 from a16z, Tiger Global and Multicoin Capital, among others. In July, the company was raised $150 million in a Series A funding round led by Sam Bankman-Fried’s FTX Ventures and Jump Crypto.

But after an initial launch resulted in some criticizing its tokenomics as a bit on the greedy side, the coin has now emerged as one of the hottest in a period that has seen a renewed interest in layer 1 (L1) blockchains.

L1 blockchains refer to the base-level chains that make up a given network, making it possible to build an ecosystem of other potential applications on top of it. What makes Aptos unique is that the project was carried by developers who had previously worked on Diem, Meta’s now shelved blockchain initiative.

Aptos blockchain uses a Rust-based programming language which according to its white paper, can process more than 130,000 transactions per second, using a process known as parallel execution engineering, or Block-STM. This is a significant upgrade to other blockchains like Bitcoin, which can only process seven transactions per second, or even Visa, which can only process around 1,700 transactions per second.

Therefore, Aptos aims to create an L1 that allows the blockchain to be used for other services and applications, so that apps can use the computing power.

According to on-chain analysis, not much is clear. The volume is low, even during the community section. Aptos still controls 80% of the community’s supply, which some say unfairly positions early adopters, developers and investors.

Aptos’ founding engineer Josh Lind, meanwhile, has been working to update the blockchain roadmap, doubling down on his promise to deliver a blockchain that can bring mainstream adoption to web3 applications, leveraging DeFi as a new potential source of downstream revenue from network participants which deploys Aptos blockchain for its own applications.

With a total market capitalization now firmly north of $2b ($2.55b), APT’s rise of over 18% over the past 24 hours has the token now sitting pretty at an all-time high of $16.04.