Applied Blockchain: Exciting model but overrated (NASDAQ: APLD)

NiseriN / iStock via Getty Images

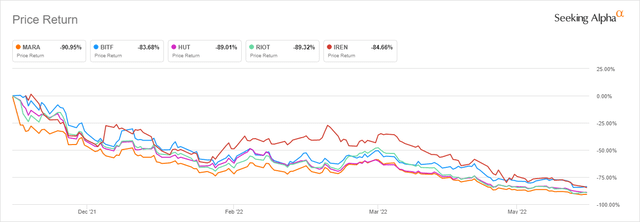

As Bitcoin (BTC-USD) has fallen from $ 69k down to $ 20k over the last 7 months, Bitcoin miners have been hit hard. Many of them are down between 80 and 90 percent since the peaks in November 2021.

Performance since 11/12/21 (Searching for alpha)

What has damaged the business models for the entire crypto mining sector has been the increase in energy costs combined with the decline in Bitcoin’s price. For a little more insight on that, check out my article covering Iris Energy Limited (IREN) from about a month ago. Despite the rotten investment climate for crypto-mining companies, Applied Blockchain (NASDAQ: APLD) has recently completed a Nasdaq listing. The organization has undergone a name change and a business change in the last year or so.

Previously, it was called Applied Science Products and operated an internal Ethereum (ETH-USD) mining operation. Assuming Ethereum implements the transition to a PoS (proof of stake) consensus mechanism, this pivot from mining is probably a good idea. The company has sold out these mining funds and changed course. Unlike other mining companies, Applied Blockchain now has a completely different revenue generation model.

Business model

Instead of owning a large number of ASICs and extracting as many coins as possible, the company chooses location leasing for customers who use the company’s mining facilities for a service fee. Applied Blockchain describes the business model as follows:

The company has a colocation business model where customers place hardware they own in the company’s facilities and the company offers full operation and maintenance services for a fixed fee. The company usually enters into long-term fixed interest rate contracts with our customers.

In my opinion, this makes Applied Blockchain more like a company like Compass Mining than most other listed mining organizations do. There is an argument for this type of approach to mining. The true mining business has a good deal of pre-cap ex, and the rigs need to be maintained from purchase to their eventual obsolescence. With Applied’s co-location model, revenues are fixed and more stable than they would be from owning the actual mining operations. While this means that the revenue upside is limited to location capacity, it also means that revenue should have a reasonable floor as long as Applied’s prices remain competitive and the company’s customers maintain solvency even when the crypto market is struggling.

Next generation data centers

As a host site, Applied Blockchain is primarily a data center provider. Both in its investor deck in May and during the quarterly earnings call, the company pointed out that there is a significant advantage in the “Next-Gen” data centers that the company builds compared to traditional data centers. At the last interview, CEO Wes Cummins said this:

The next generation data centers we develop are optimized for large data power and require more power than traditional data centers that are optimized for data storage and retrieval. The next generation data centers have very different layouts, requirements for internet connection and cooling design to meet different power needs and customer requirements. So we think we have developed a core competency with our team that will be difficult to replicate, especially for traditional data center operators.

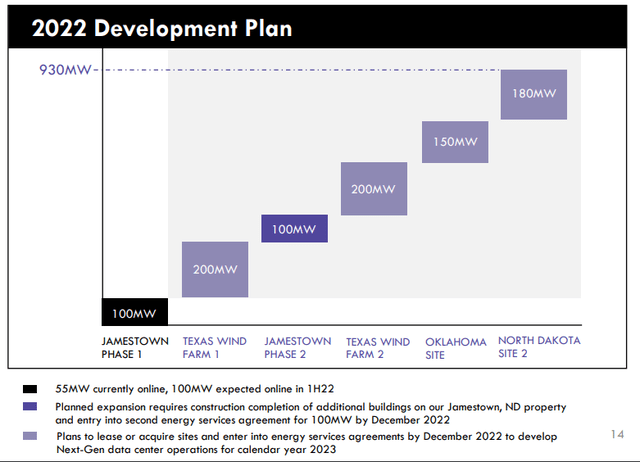

The large differences in design and in energy costs mean that traditional data centers will have a very difficult time adapting to accommodate the mining business if they wish to do so. It also means that jurisdiction is important because mining depends on very competitive electricity costs. The company currently operates in North Dakota (Jamestown) and plans to expand hosting in Texas and Oklahoma.

Development plan (Blockchain used)

From a growth perspective, the company envisages 1.8 GW capacity over the next 2 years and 5 GW capacity over the next five years. This capacity growth comes with a focus on geographical diversity that takes into account political jurisdictional risk and that allows for an emphasis on renewable energy use. With a capacity of 5 GW, the company estimates an EBITDA margin of 40%. In the interview, Cummins stated that Applied Blockchain estimates that the demand for their services will grow faster than what they will be able to deliver to the market:

Our internal estimate is that between 5,000 and 6,000 megawatts of hosting capacity will need to come online within the next 12 months to meet the publicly stated goal of the listed mining companies in North America

If these estimates come true, Applied Blockchain should be able to sell mining capacity and generate more stable revenue for the company without major problems.

Valuation

Both in the last conversation and in the investor deck in May, Applied Blockchain mentions the transition to the company to a more REIT structure. In the deck, the company cites REIT’s Digital Realty Trust (DLR), Equinix (EQIX) and Innovative Industrial Properties (IIPR) which have similar models that they hope they can become. Based on these peers, Applied is a very expensive base on sales multiples:

| APLD | DLR | EQIX | IIPR | |

| Price / Sale TTM | 37.69 | 8.03 | 9.03 | 12.55 |

| EV / Sales FWD | 18.87 | 11.06 | 9.53 | 12.30 |

| EV / Sales TTM | 135.86 | 11.53 | 10.89 | 15.65 |

Source: Seeking Alpha

If we look at the Applied Blockchain more through the lens of a mining business, it’s even more expensive:

| APLD | COTTAGE | MARA | RIOT | |

| Price / Sale TTM | 37.69 | 2.05 | 3.61 | 1.84 |

| EV / Sales FWD | 18.87 | 1.55 | 3.26 | 1.46 |

| EV / Sales TTM | 135.86 | 1.72 | 5.82 | 2.08 |

Source: Seeking Alpha

Based on company value for sale from both a subsequent and forward multiple, Applied Blockchain’s valuation is a bit rich compared to both REIT and mining model colleagues.

Danger

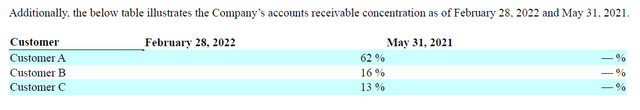

In the last quarterly submission, Applied Blockchain listed its hosting contract customers. These entities are JointHash Holding Limited, Bitmain Technologies Limited, F2Pool Mining, Inc. and Hashing LLC. In addition, the company broke the claims for 3 of the customers while keeping the names confidential.

Customer concentration (Blockchain used)

In my view, the customer concentration is high with the peak demand of 62% of the total. Beyond that, the mining business faces serious problems with margins being squeezed. As I mentioned in my Iris Energy article from last month, higher hash rates and lower cryptocurrencies are the exact opposite of what mining operators want. If it continues, some miners may face solvency problems.

Summary

In my opinion, Applied Blockchain is an interesting spin on the typical listed crypto mining companies. I think in a diversified stock portfolio with an emphasis on crypto and blockchain technology, Applied Blockchain is probably one to consider in the end. For me personally, I do not like it with this valuation. I think there is a fairly large customer concentration risk at the moment, and I would like to see Applied Blockchain’s receivables become a little less dependent on the success of one device. I can not recommend it here. But I think it’s one to keep an eye on.