Applied Blockchain (APLD): Catalysts and Improving Valuation

piranha

When I last covered Applied Blockchain (NASDAQ: APLD) for Seeking Alpha, my main argument for calling it a hold was how overvalued it was compared to both data center peers and Bitcoin (BTC-USD) mining companies. Since it article, the price of the stock has doubled and the valuation has actually improved. In this follow-up, we’ll go over some things that have changed in the three months since the last article, look at some of the valuations that we explored in mid-June, and try to assess the health of Bitcoin miners in general. .

What is new?

Since June, the company has made some significant non-earnings related announcements. The first was that the company has entered into an agreement with Marathon Digital (MARA) for hosting services. While the deal will see Marathon rely on Applied Blockchain for 90 megawatts of hosting capacity at APLD’s Texas facility and 110 megawatts out of North Dakota, hosting capacity could eventually reach a total of 270 megawatts by mid-2023. Since the rollout of Marathon’s hosting will not begin before Q422, this will be increased revenue for APLD in future quarterly filings. The Marathon news no doubt immediately helped APLD’s share price.

Something else that has affected share price dynamics is the cancellation of approximately 5% of outstanding APLD shares. The shares were held by Sparkpool. Sparkpool, one of the anchor customers from Applied Digital’s May Investor Card, has ceased operations. From page 56 of APLD’s annual report:

SparkPool stopped providing the agreed services for the company, and agreed to forfeit shares to compensate for future services that will not be performed. As a result of this agreement, 4,965,432 shares were forfeited and canceled by the company, reducing the number of outstanding shares.

It’s never good to see a customer go out of business, and we’ll explore the possibility of this continuing later in the article. First, another pretty big piece of news the company recently announced is a proposed name change from “Applied Blockchain” to “Applied Digital” to be voted on by shareholders in November. From the company:

Although Applied Blockchain continues to be a leading provider of digital infrastructure for many cryptocurrency mining operations, it is important for the company to distinguish that its next-generation data centers support many other high-performance computing applications

I share this view. If approved, the name change is not a move that will immediately affect the company’s bottom line. But I see it as a smart decision. In an ESG environment like the one we see from many corporate initiatives, I believe that subtle changes like this can ultimately help the company diversify its customer base in the long term. It’s a good step towards eliminating the notion that Applied is just a crypto company and opening the door a bit more to HPC services. Finally, the company beat revenue expectations last quarter with $7.5 million in top-line revenue versus guidance of $7 million.

Valuations

In June, I selected Hut 8 Mining (HUT), Marathon Digital (MARA), and Riot Blockchain (RIOT) as Bitcoin mining companies for Applied Blockchain. At the time, APLD traded at 37 times Price/Sales TTM and 19 times EV/Sales FWD. These numbers were generally between 10 and 20 times higher than the multiples of the selected Bitcoin mining competitors. While APLD remains overvalued compared to those companies after twelve months, APLD’s valuation has declined significantly while its peers have largely seen more expansions:

| APLD | COTTAGE | MARA | RIOT | |

| Price/Sales TTM | 14.03 | – | 6.13 | 2.53 |

| EV/Sales FWD | 1.03 | 2.58 | 11.03 | 2.51 |

| EV/Sales TTM | 21.68 | 2.16 | 10.49 | 35.29 |

Source: Seeking Alpha

Compared to the other three, APLD is now cheaper based on forward EV/Sales. But again, pure miners are not a perfect comp because Applied acts more like a data center for the miners. From that perspective, the data center REITs that I used in the last article for several comparisons were Digital Realty Trust (DLR), Equinix (EQIX), and Innovative Industrial Properties (IIPR).

| APLD | DLR | EQIX | IIPR | |

| Price/Sales TTM | 14.03 | 7.52 | 8.72 | 9.03 |

| EV/Sales FWD | 1.30 | 10.84 | 9.88 | 10.02 |

| EV/Sales TTM | 21.68 | 11.29 | 10.97 | 11.07 |

Source: Seeking Alpha

Here we can see that APLD is still overvalued on the subsequent calculations, but much cheaper on forward EV/Sales. I think it’s important to remember that while Applied Blockchain’s business model may be closer to that of data centers, the company will still depend on a healthy Bitcoin mining industry for revenue. Miners are currently facing a very difficult macro situation and I think it is important for APLD shareholders to keep that in mind.

Miner Upwind

We now know that APLD will have a business relationship with Marathon Digital. It’s going to help alleviate the customer concentration problem that I cited in my June article. The company has provided insight into who currently makes up this customer base:

We have significant customer concentration in our co-hosting business as of May 31, 2022. We have entered into contracts with JointHash Holding Limited (a subsidiary of GMR), Spring Mud, LLC (a subsidiary of GMR) Bitmain Technologies Limited, F2Pool Mining , Inc .and Hashing LLC (a subsidiary of GMR) to use our first co-hosting facility.

One thing to be aware of is that F2Pool Mining has an Ethereum (ETH-USD) mining footprint, although I don’t think we know how much of the mining it does with Applied Digital is Ethereum based. Ethereum miners are facing severe disruption after the merger from Proof-of-Work to Proof-of-Stake. I’ve detailed why they can’t just switch all their GPU machines to Ethereum Classic (ETC-USD) mining here. ETH or no ETH, we know that APLD has exposure to BTC miners and these entities may face solvency issues very soon.

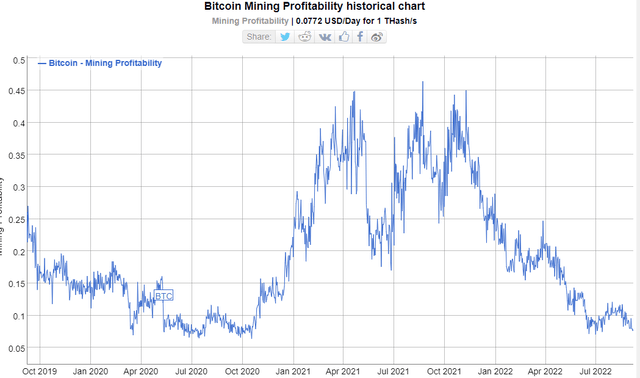

As the hash rate for Bitcoin continues to increase, miners need the price of Bitcoin to rise to offset the increased difficulty of obtaining the block reward. With Bitcoin not increasing in price, we are currently seeing some of the tightest wide miner margins in the last two years.

BitInfoCharts

This mining pressure can eventually lead to rigs being shut down and mining operators defaulting on their obligations. While hashrate and miner profits do not directly hurt Applied Blockchain’s revenue, if APLD’s customers cannot continue to operate at lower Bitcoin prices, it has the potential to affect long-term receivables and create customer churn.

Summary

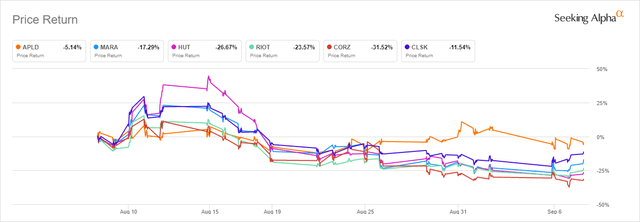

I still think Applied Blockchain is a very interesting equity for crypto business investors to consider. While the rest of the public mining companies have seen a bit more pressure on their share prices over the past month, APLD has held up quite well, taking just a 5% haircut.

Seeking Alpha

With improved valuations and a new industry-leading customer generating incremental revenue later this year, there’s a lot to like about Applied Blockchain. I currently do not own shares because I still believe we are in a riskier environment at the moment. But APLD is one I would consider going long in 2023. I want to see what, if any, impact the Ethereum merger has on APLD’s clients. And I would like to see Bitcoin mining become more profitable than it currently is to take the pressure off the industry more broadly. While I wouldn’t sell if I was long APLD, I think it’s still a hold for now.