Antiquities for antics: How good an investment tool is an NFT?

NFT stands for ‘non-fungible token’, which is a unique digital asset that has proof of ownership and verification of authenticity held in the blockchain. Bitcoin, the quintessential cryptocurrency, is fungible since it is also meant to be a medium of transactional settlement, but each NFT is unique, as each artwork is unique, making its non-fungible character absolutely essential.

An NFT can be digital art, real estate, collectibles, event tickets, website domains, or even tweets. It may not be an oversimplification to compare an NFT to dematerialized (dematized) shares that exist but in digital form, beyond the reach of counterfeiters and unable to be mutilated.

Personal Finance: A Simple 3-Step Approach to Building a Long-Term Investment Portfolio

Demat shares have changed the way people invest. They have made buying and selling in the stock market fast, preventing the loss of shares due to theft, damage, etc. For people investing in art, real estate, and so on, can NFTs offer similar benefits?

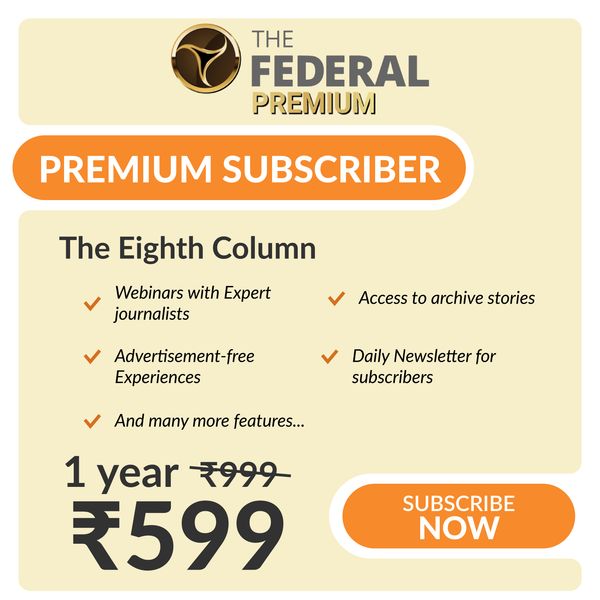

Advertisement

Art, and not art

On 11 March 2021, the BBC reported how auction house Christie’s sold a digital-only work of art for $69 million. Far from the usual sculpture or painting, the new owner of the artwork received a unique digital token, NFT whose underlying resource is of course the artwork.

While this is an example of art collectors diligently tending to the security of their collections to keep fraudsters and charlatans at bay, the trivialization of the NFT in the hands of megalomaniacs and narcissists began almost immediately.

“Just setting up twttr” — the first tweet from Twitter founder Jack Dorsey was published for sale as an NFT and earned him $2.9 million. However, it has hit a low of $132. Selling his baby to Elon Musk perhaps accelerated the downhill slide of his first tweet. More importantly, it may have dawned on the enraptured NFT enthusiasts that putting such a high value on a silly tweet was a colossal blunder.

Personal finance | GST on rent: Has Center allowed hotels to step on landlords’ toes?

Former POTUS Donald Trump joined the NFT bandwagon in superhero, astronaut and Nascar driver guises. He promoted the limited edition cards, saying they could “make a great Christmas present”. There were 45,000 of the cards, available for $99 each. Even Republicans were not amused by Trump’s antics.

Closer to home, our own Amitabh Bachchan, superstar of yore and celebrity forever, transformed his father Harivansh Rai Bachchan’s work Madhushala into NFT by recording the poems in his own voice which reportedly earned him an amazing $420,000 in November 2021.

Falling fortunes

The fortunes of cryptocurrencies have plummeted after the initial euphoria. So have the fortunes of the crypto NFTs. It is up to the legal experts to investigate whether blockchain technology underpinning NFTs can provide indisputable title and ownership of the underlying artwork to owners of the coin. In other words, there is currently no guarantee that the buyers of NFT will not be upset by a challenger under copyright law.

The time was when antiques, paintings, sculptures and other objects commanded staggering and staggering valuations in the art market. Cynics have always questioned such valuations and wondered if, at the end of the day, money was being laundered.

Personal finance: Here’s what the common man can do to fight high inflation

TMC leader Mamata Banerjee became the subject of such cynicism when she was paid 9 million pounds for 300 paintings of her. Similarly, ripples were caused when Yes Bank founder Rana Kapoor revealed that he was twisted into buying an MF Hussein painting by then oil minister Murli Deora for ₹2 crore and the amount was used for Sonia Gandhi’s treatment in the US. Even Bitcoin at the height of its staggering valuations was mocked as a handmaiden by crooks looking to launder their ill-gotten wealth.

Vulnerable to attack

The NFT, while arguably making ownership of art foolproof and tamper-proof and creating a vibrant market for their underlying assets—namely paintings, sculptures, and even insane tweets—has left its flanks vulnerable to attack. Dematerialization of shares has done wonders in the market, but dematerialization of antiques has unfortunately given rise to antics in the rarefied world of NFTs.

In light of this, an investor in NFTs must go for it with open eyes, and take a well-secured risk.