Anthony Hopkins NFT sells out in 7 minutes – here’s everything you need to know

Anthony Hopkins, a Welsh actor, director and producer, has seen his first NFT collection sell out in less than 10 minutes despite the general market conditions and declining user interest in digital collectibles.

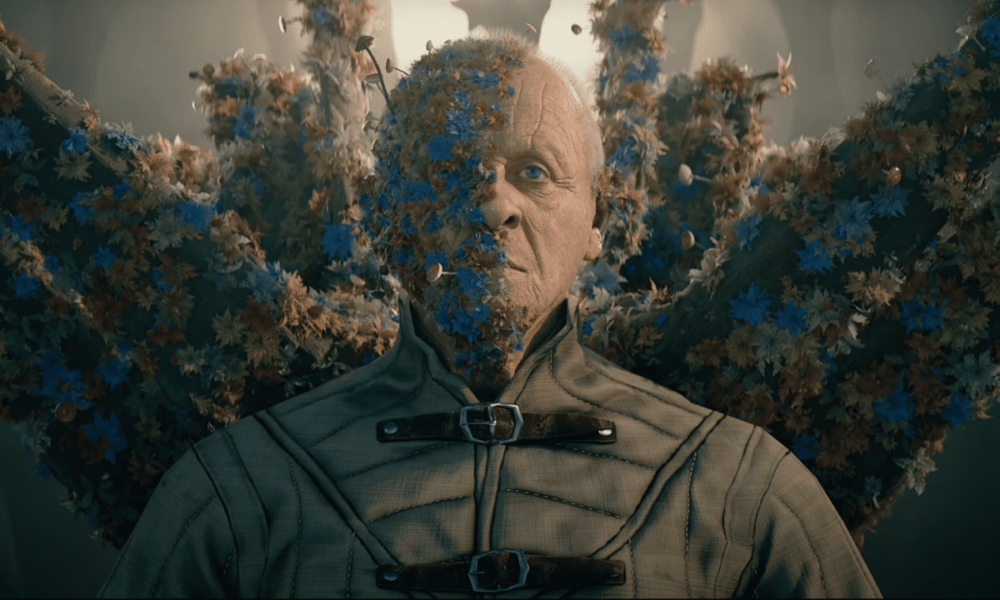

Called ‘The Eternal Collection’, the project was launched in collaboration with NFT design agency Orange Comet, and featured 1,000 pieces of original film artwork inspired by various appearances by the actor over his film version.

The work “conceptualizes an interpretation of the vast character archetypes Sir Anthony Hopkins has portrayed throughout his illustrious film career, deriving its strong energy from his stimulating art,” according to the collection’s description on OpenSea.

The archetype names include “The Jester”, “The Lover”, “The Ruler”, “The Rebel”, “The Giver” and “The Eternal”, each representing the different archetypal characters the actor has played throughout his prosperous time. career.

The memorial price for each NFT was 0.25 ETH (around $325), although the floor price for the collection is currently 0.69 ETH ($885). In particular, NFT holders have a chance to win personalized NFTs from Hopkins, an autographed art book and a Zoom call with him.

“Thanks to everyone who helped make this a huge success! Oscar winner Anthony Hopkins’ first NFT collection sold out in minutes at OpenSea” so Dave Broome, CEO of Orange Comet.

Hopkins has shown an interest in Web3 and NFTs for some time now, and recently added an ENS domain to his Twitter profile. He also starred in the sci-fi film Zero Contact, which was released via the NFT platform Vuee.

NFT market down with every calculation

What makes the success of “The Eternal Collection” even more impressive is that the project had a splashy debut despite the generally poor market conditions, especially for NFTs. As reported, NFT trading volume has taken a big dive, plunging nearly 100% from its all-time high in January of this year.

Trading volume for NFTs was $17 billion at the start of the year. However, that figure plunged to just $466 million in September, representing a 97% drop. The fall is in line with the broader market downturn and the global market downturn, caused by the war in Europe, rising inflation and poor central bank policy.

“The fading NFT mania is part of a broader $2 trillion wipeout in the crypto sector as rapid monetary policy tightening starves speculative assets of investment flows,” Bloomberg reported in late September.